Monex Precious Metals TV commercial - Silver American Eagles: Investors

Advertisers

Advertisers of the Monex Precious Metals TV Spot, 'Silver American Eagles: Investors'

Monex Precious Metals

Monex Precious Metals is a company that specializes in the purchase and sale of precious metals such as gold, silver, platinum and palladium. The company was founded in 1967 by Louis Carabini, a forme...

What the Monex Precious Metals TV commercial - Silver American Eagles: Investors is about.

Monex Precious Metals TV Spot titled 'Silver American Eagles: Investors' is all about showcasing the benefits of investing in Silver American Eagles and how Monex Precious Metals can help investors make the most out of their investment.

You may have seen TV spots from Monex before, but this one is specifically focused on Silver American Eagles. The commercial features a spokesperson who explains the benefits of investing in precious metals, particularly silver.

The commercial starts with the spokesperson explaining that when it comes to investing in precious metals, one cannot go wrong with Silver American Eagles. Then, the spokesperson goes on to explain how Silver American Eagles have been valued by collectors and investors alike for decades.

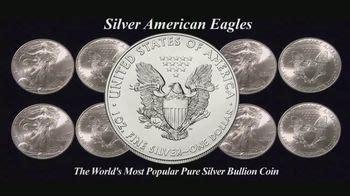

The commercial features visuals of the Silver American Eagles and their unique design, as well as shots of the Monex Precious Metals headquarters and staff. The spokesperson also emphasizes that Monex has been a trusted name in precious metals investment for over 50 years and is committed to helping investors make informed decisions.

The commercial concludes with a call to action, urging viewers to contact Monex for more information on how to start investing in Silver American Eagles.

Overall, Monex Precious Metals TV Spot, 'Silver American Eagles: Investors' highlights the benefits of investing in silver and how Monex can help investors make the most out of their investment. The commercial is informative, visually appealing, and leaves a lasting impression on viewers.

Monex Precious Metals TV commercial - Silver American Eagles: Investors produced for Monex Precious Metals was first shown on television on January 15, 2020.

Frequently Asked Questions about monex precious metals tv spot, 'silver american eagles: investors'

Videos

Watch Monex Precious Metals TV Commercial, 'Silver American Eagles: Investors'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Products

Products Advertised

TV commercials

Similar commercials