What the Charles Payne TV commercial - Inflation is about.

Charles Payne is a well-known Fox Business Network contributor and frequent guest on Fox News Channel. In one of his recent TV spots titled 'Inflation,' he discusses the rising inflation rates in the United States.

In the spot, Payne explains in simple terms how inflation works and points out that it is currently affecting all Americans, whether they realize it or not. He states that the current inflation rate is the highest it has been in over a decade, and that the rise in prices is affecting the daily lives of many Americans.

Payne goes on to discuss the causes of inflation, citing government spending and the printing of money as key factors. He warns that this trend could lead to even higher inflation rates in the future and advises viewers to take steps to protect their finances.

Payne's delivery is straightforward and easy to understand, making his message accessible to a wide range of viewers. He also provides some practical advice on how to protect oneself against the effects of inflation, such as investing in assets that hold their value or hedging against inflation with gold or other commodities.

Overall, Payne's TV spot provides an informative and thought-provoking analysis of a pressing economic issue, making it a must-watch for anyone interested in finance and the economy.

Charles Payne TV commercial - Inflation produced for

Charles Payne

was first shown on television on September 16, 2022.

Frequently Asked Questions about charles payne tv spot, 'inflation'

Wall Street Strategies

Payne is the chief executive officer and principal financial analyst of Wall Street Strategies, a stock market research firm he founded in 1991.

Our approach to investment advice focuses on a balanced allocation of funds, industry exposure, and realistic expectations. 70% of your stock portfolio should be in core positions while 30% should try to generate cash actively. Learn more.

Charles V. Payne is the Chief Executive Officer and Principal Analyst of Wall Street Strategies, Inc. (WSSI), which he founded in 1991. With less than $10,000.00 in start up capital and working from his apartment, he launched WSSI to provide a unique brand of stock market advice.

A 3 fund portfolio is a diversification approach whereby the investors put their money in a certain ratio in three different asset classes, i.e., domestic stocks, domestic bonds, and international stocks. It is a simple, low-cost investing approach that ensures retirement savings at a minimal risk appetite.

At a high level, the most common strategies for investing are:

- Growth investing. Growth investing focuses on selecting companies which are expected to grow at an above-average rate in the long term, even if the share price appears high.

- Value investing.

- Quality investing.

- Index investing.

- Buy and hold investing.

MAIN STREET WISDOM

We believe investors should take an approach to the stock market based first and foremost on understanding the stocks in their portfolios beyond the chart formation. The key to long term success isn't picking winning stocks but knowing which stock picks to hold onto during adverse conditions.

United StatesCharles Payne / Place of birth

The 4-3-2-1 Approach

One simple rule of thumb I tend to adopt is going by the 4-3-2-1 ratios to budgeting. This ratio allocates 40% of your income towards expenses, 30% towards housing, 20% towards savings and investments and 10% towards insurance.

9 popular investment strategies

- Start with a new or existing retirement account. One way to begin investing is through a retirement account.

- Buy-and-hold investing.

- Active investing.

- Dollar-cost averaging.

- Index investing.

- Growth investing.

- Value investing.

- Income investing.

- Step 1: Assess your risk tolerance. Conservative?

- Step 2: Diversify your investment. Balancing risk and return is the key to long-term investment.

- Step 3: Have a plan for asset allocation. Hit your investment targets with the right approach.

- Step 4: Assess investment performance.

- Step 5: Rebalance your investment portfolio.

At a high level, the most common strategies for investing are:

- Growth investing. Growth investing focuses on selecting companies which are expected to grow at an above-average rate in the long term, even if the share price appears high.

- Value investing.

- Quality investing.

- Index investing.

- Buy and hold investing.

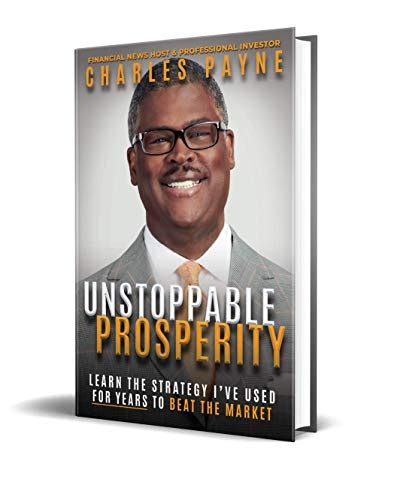

Be Smart, Act Fast, Get Rich: Your Game Plan for Getting It Right in the Stock MarketCharles Payne / BooksPraise for Be Smart, Act Fast, Get Rich "Charles Payne's book is blunt, provocative, and right on the money. This book is a lot like Charles himself: insightful and to the point. If you have time to read only one book on how to make money . . . this is the book." Google Books