Student Loan TV commercial

Advertisers

Advertisers of the Student Loan TV Spot

Student Loan

Student Loan Company is a financial institution that specializes in providing loans to students to help them finance their education. The company understands the importance of education and aims to su...

What the Student Loan TV commercial is about.

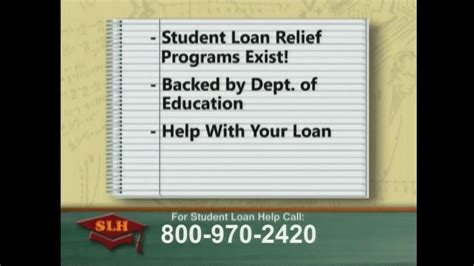

Student Loan TV spots are typically commercials that are targeted towards students and recent graduates who are seeking financial assistance to pay for their education. These commercials are designed to promote various loan programs and services that can help students secure funding for college or other educational pursuits.

In a typical Student Loan TV spot, you might see a happy and enthusiastic college student talking about the benefits of getting a loan to pay for their education. They may mention features like low interest rates, flexible repayment plans, and the ability to defer payments until after graduation.

The tone of the commercials is usually upbeat and positive, encouraging students to pursue their dreams and reminding them that a student loan is a proven way to invest in their future. The commercials may also highlight various success stories of students who have used student loans to achieve their goals and go on to successful careers.

Of course, there are also potential downsides to taking out student loans, and some commercials may address these concerns as well. For example, a TV spot might mention the importance of only borrowing what you need, or warn students about the potential risks of defaulting on their loans.

Overall, Student Loan TV spots are an important tool for financial institutions to reach out to current and prospective borrowers, as well as to educate the general public about the benefits and risks of taking out student loans. Whether you're a student looking for funding for your education or a concerned parent helping your child with their financing options, these commercials are a helpful resource for anyone interested in the world of student loans.

Student Loan TV commercial produced for Student Loan was first shown on television on March 18, 2013.

Frequently Asked Questions about student loan tv spot

Videos

Watch Student Loan TV Commercial

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

TV commercials

Similar commercials