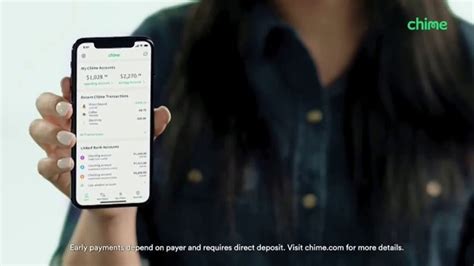

What the Go2 Bank TV commercial - Mobile Banking Like Never Before is about.

The Go2 Bank TV spot unveils an innovative approach to mobile banking like never before. The commercial aims to catch the attention of banking customers and non-customers by emphasizing the unique features of Go2 Bank. The story portrayed in the ad shows a young woman getting ready for her day when she receives a notification from Go2 Bank that someone has tried to access her account. With a few taps on her phone, she blocks the unauthorized request easily through the app, all while continuing to fulfill her daily routine.

The ad highlights the benefits of banking with Go2 Bank, such as the bank's advanced security measures, user-friendly mobile app, and convenience. The ad's narrative and its quick-paced direction demonstrate how Go2 Bank offers banking solutions in a problem-free way to its customers. The spot's upbeat electronic music and energizing visuals reflect the innovative spirit of Go2 Bank's mobile app while also making it clear that it is an excellent choice for those who want to manage their finances quickly and efficiently.

Overall, the Go2 Bank TV spot accomplishes its goal of demonstrating the unique advantages of mobile banking with Go2 Bank. It effectively presents a modernized approach to banking that is easy, convenient, and secure all in one place.

Go2 Bank TV commercial - Mobile Banking Like Never Before produced for

GO2bank

was first shown on television on January 5, 2021.

Frequently Asked Questions about go2 bank tv spot, 'mobile banking like never before'

Yes, GO2bank is a digital bank operated by Green Dot, an FDIC-insured bank.

Green Dot Bank

GO2bank is a brand of Green Dot Bank, Member FDIC. Green Dot Bank operates under the following registered trade names: GoBank, GO2bank, Green Dot Bank and Bonneville Bank.

GO2bank™ is the banking app built for everyday people. Keep more of your hard-earned money with no monthly fees¹ and our free nationwide ATM network⁷. Say no to monthly fees and hidden fees² and yes to keeping more of your money.

Your demand responsive bus service, that offers bus stop to bus stop transport upon request. The service hours are 06:00 to 19:00 Mondays to Saturdays. Phone bookings will only be available from 09:00 to 17:00 on Mondays to Saturdays. Requests for travel outside of these times MUST be made using the app.

You can use your secured credit card everywhere that Visa® is accepted in the U.S. We may restrict your ability to make foreign transactions for fraud or security purposes. If you are planning on using your Card in a foreign country (for example, if you are traveling abroad), please let us know in advance.

GoBank is a brand of Green Dot Bank, Member FDIC, which also operates under the brands Green Dot Bank and Bonneville Bank. Deposits under any of these trade names are deposits with a single FDIC-insured bank, Green Dot Bank, and are aggregated for deposit insurance coverage.

You can use your secured credit card everywhere that Visa® is accepted in the U.S. We may restrict your ability to make foreign transactions for fraud or security purposes. If you are planning on using your Card in a foreign country (for example, if you are traveling abroad), please let us know in advance.

You can open a GO2bank account at GO2bank.com or after you download the GO2bank app.

You can find your GO2bank virtual debit card in the GO2bank app. Your virtual debit card allows you to make purchases online or over the phone until you receive and activate your personalized debit card.

You can use your secured credit card everywhere that Visa® is accepted in the U.S. We may restrict your ability to make foreign transactions for fraud or security purposes. If you are planning on using your Card in a foreign country (for example, if you are traveling abroad), please let us know in advance.

GO2bank is the mobile bank account of Green Dot Corporation, where our decades of experience serving everyday people make us one of the most trusted names in banking. We are an FDIC-insured bank, meaning your money is always protected up to the maximum allowable limit and won't ever be held by a third party.

Yes, you can use the virtual debit card in the app to make purchases where your physical card is not required. You can use the virtual card until you activate your physical debit card or for 15 days after you open your account, whichever happens first.