Humana Medicare Advantage TV commercial - Dual-Eligible Special Needs Plan

Advertisers

Advertisers of the Humana Medicare Advantage TV Spot, 'Dual-Eligible Special Needs Plan'

Humana

Overview of HumanaHumana is a US-based health insurance company that provides a range of healthcare services and insurance plans to individuals, families, and businesses. The company is headquartered...

What the Humana Medicare Advantage TV commercial - Dual-Eligible Special Needs Plan is about.

Humana, a leading healthcare insurance company, recently released a TV spot promoting their Dual-Eligible Special Needs Plan as part of their Medicare Advantage program. The commercial features seniors who are enrolled in the plan and highlights the benefits they have received.

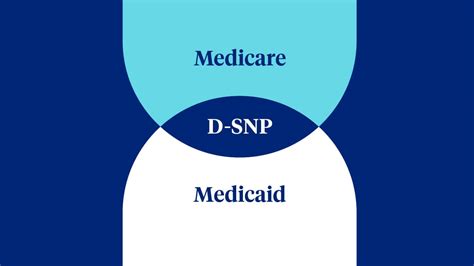

The spot opens with a group of seniors sitting in a doctor's office discussing their health concerns. The narrator then introduces the Dual-Eligible Special Needs Plan, which is specifically designed for seniors who are eligible for both Medicare and Medicaid. The plan offers enhanced benefits beyond traditional Medicare coverage, including prescription drug coverage, vision and hearing services, and personal care from a registered nurse.

The commercial then showcases the seniors utilizing these benefits, such as one woman receiving in-home care from a registered nurse and another gentleman getting his teeth checked by a dentist. The patients are shown to be very happy and satisfied.

The TV spot ends by emphasizing that Humana's Dual-Eligible Special Needs Plan is tailored to meet the unique healthcare needs of seniors with dual eligibility. The message is clear that Humana cares for their health and provides the necessary resources to help them live their best lives.

Overall, this TV spot is an effective way for Humana to showcase the benefits of their Medicare Advantage program for seniors with dual eligibility. It is a well-produced commercial that highlights the effectiveness of the program and the satisfaction of the patients. Seniors who are considering their healthcare options would likely find this spot helpful.

Humana Medicare Advantage TV commercial - Dual-Eligible Special Needs Plan produced for Humana was first shown on television on October 31, 2022.

Frequently Asked Questions about humana medicare advantage tv spot, 'dual-eligible special needs plan'

Videos

Watch Humana Medicare Advantage TV Commercial, 'Dual-Eligible Special Needs Plan'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Actors

Actors who starred in Humana Medicare Advantage TV Spot, 'Dual-Eligible Special Needs Plan'

Agenices

Agenices of the Humana Medicare Advantage TV Spot, 'Dual-Eligible Special Needs Plan'

Cronin

After conducting a search on Cronin, it appears that there are several companies and individuals with that name. The most prominent seems to be a full-service advertising agency called Cronin in Conne...

Products

Products Advertised

TV commercials

Similar commercials