MassMutual Guaranteed Acceptance Life Insurance TV commercial - Protection

Advertisers

Advertisers of the MassMutual Guaranteed Acceptance Life Insurance TV Spot, 'Protection'

MassMutual

Introduction to MassMutualMassMutual is a financial services company that provides life insurance, retirement and investment services, pension risk transfer services, and financial education to indivi...

What the MassMutual Guaranteed Acceptance Life Insurance TV commercial - Protection is about.

The MassMutual Guaranteed Acceptance Life Insurance TV spot titled "Protection" is a heartwarming advertisement that showcases the love and care between a father and his daughter. The ad starts with an emotional scene where the father is holding his newborn baby girl in his arms and promising to protect her at all costs. As the girl grows up and faces different challenges in life, the father continues to keep his promise and be there for her every step of the way.

The advertisement then introduces the concept of MassMutual Guaranteed Acceptance Life Insurance as a way to provide financial protection to loved ones after death. The ad emphasizes the peace of mind that comes with knowing that your family will be taken care of even when you're not around.

Throughout the ad, the message is clear - life can be unpredictable, but with MassMutual Guaranteed Acceptance Life Insurance, you can safeguard your family's financial future. The ad ends with a heartwarming scene where the father is still there for his grown-up daughter, sharing a moment of joy and gratitude for the life they have built together.

Overall, the MassMutual Guaranteed Acceptance Life Insurance TV spot is a touching reminder of the importance of protecting our loved ones and providing financial security even after we're gone. The ad does an excellent job of tapping into the emotional aspect of life insurance and portrays it as a way to show your ultimate act of love towards your family.

MassMutual Guaranteed Acceptance Life Insurance TV commercial - Protection produced for MassMutual was first shown on television on October 7, 2015.

Frequently Asked Questions about massmutual guaranteed acceptance life insurance tv spot, 'protection'

Videos

Watch MassMutual Guaranteed Acceptance Life Insurance TV Commercial, 'Protection'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

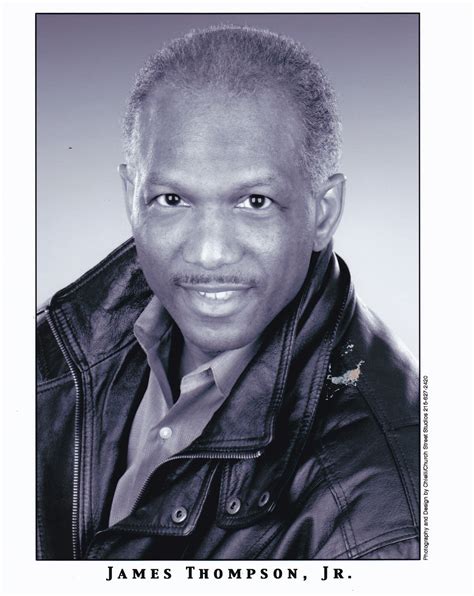

Actors

Actors who starred in MassMutual Guaranteed Acceptance Life Insurance TV Spot, 'Protection'

Agenices

Agenices of the MassMutual Guaranteed Acceptance Life Insurance TV Spot, 'Protection'

Martino Flynn, LLC

Martino Flynn, LLC is a marketing communications agency based in Rochester, New York. The company offers a range of services, including advertising, public relations, digital marketing, and market res...

Products

Products Advertised

TV commercials

Similar commercials