Self Financial Inc. TV commercial - Low Credit Score

Advertisers

Advertisers of the Self Financial Inc. TV Spot, 'Low Credit Score'

Self Financial Inc.

Self Financial Inc. is a dynamic fintech company that specializes in empowering individuals to build their credit and achieve financial independence. With a mission to help consumers take control of t...

What the Self Financial Inc. TV commercial - Low Credit Score is about.

Title: Self Financial Inc. TV Spot - 'Low Credit Score'

Introduction:In the world of personal finance, having a low credit score can sometimes feel like an insurmountable obstacle. It can limit your options, impact your ability to secure loans, and even affect your chances of finding suitable housing. However, Self Financial Inc. understands the struggles faced by those with low credit scores and aims to be the helping hand they need to rebuild their financial standing. In their powerful and empowering TV spot, Self Financial Inc. sheds light on the possibilities that can emerge even with a low credit score, leaving viewers inspired and hopeful for a brighter financial future.

Scene 1:The TV spot opens with a dimly lit room, symbolizing the gloom that often surrounds those with low credit scores. A person with their head down slowly walks into the frame, embodying the weight of their financial burden. The narrator's voiceover begins, with a compassionate tone that speaks directly to the viewer's struggles.

Narrator: "Are you tired of feeling trapped by your low credit score? There is hope."

Scene 2:As the narrator speaks, the room begins to brighten, signifying the optimism that Self Financial Inc. offers. The camera pans to a television screen displaying vibrant imagery of individuals overcoming financial challenges, rebuilding their credit, and embracing a brighter future.

Narrator: "Introducing Self Financial Inc. - the company determined to help you break free from the shackles of a low credit score."

Scene 3:In a series of quick but impactful shots, the TV spot showcases individuals from diverse backgrounds, each with their own unique financial story. These individuals are shown checking their credit scores, accessing educational resources, and utilizing Self Financial Inc.'s tools and services.

Narrator: "With Self Financial Inc., you gain access to comprehensive credit-building tools and resources tailored to fit your needs."

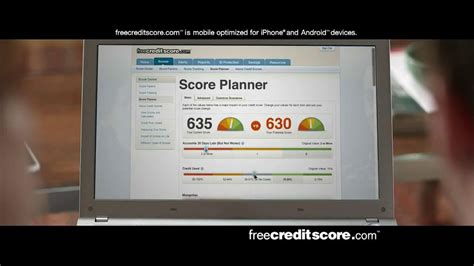

Scene 4:The camera zooms in on a person using Self Financial Inc.'s mobile app, where they explore various features such as credit monitoring, financial education courses, and personalized credit-building plans. The person's facial expression evolves from uncertainty to determination.

Narrator: "We believe in your potential, no matter your current credit score. Self Financial Inc. is here to guide you every step of the way toward a brighter financial future."

Scene 5:As the TV spot nears its end, the music's tempo picks up, creating an atmosphere of empowerment. The screen splits into multiple frames, showcasing success stories of individuals who have overcome

Self Financial Inc. TV commercial - Low Credit Score produced for Self Financial Inc. was first shown on television on February 4, 2020.

Frequently Asked Questions about self financial inc. tv spot, 'low credit score'

Videos

Watch Self Financial Inc. TV Commercial, 'Low Credit Score'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Products

Products Advertised

TV commercials

Similar commercials