What is Quicken Simplifi?

Quicken Simplifi is a personal finance management app that helps users track their spending, create a budget, and manage their finances more efficiently. It was developed by Quicken and was launched in 2020. The app is available on both the web and mobile devices.

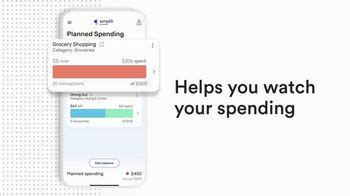

One of the standout features of Quicken Simplifi is its simplistic and user-friendly interface. It offers a clear and concise overview of the user's finances, making it easy to see where their money is going. Users can link all their financial accounts, including credit cards, bank accounts, and investment accounts, in one place. Quicken Simplifi also includes a search function, allowing users to find specific transactions or expenses quickly.

Quicken Simplifi offers a Spending Plan feature that helps users create a monthly budget based on their income and expenses. The app suggests a budget based on the user's spending habits and allows them to adjust their budget as necessary. The app also provides insights and recommendations to help users save money and reach their financial goals.

In addition, Quicken Simplifi allows users to set up bill reminders and alerts for upcoming bills, so they never miss a payment. It also sends alerts for unusual account activity, such as large purchases or abnormal spending patterns.

Overall, Quicken Simplifi is a useful tool to help individuals manage their personal finances effectively. Its user-friendly interface, bill reminder feature, and budgeting tools make it an excellent choice for those looking to take control of their finances.

Frequently Asked Questions about quicken simplifi

Simplifi provides a more comprehensive overview of your finances through charts and data. You'll get monthly reports that examine your spending, income, net income, savings, and shopping refunds.

The most notable difference between the two is that Quicken Simplifi is entirely web-based, meaning there isn't a desktop application that needs to be installed. Instead, you can access Quicken Simplifi through any supported web browser or download the Quicken Simplifi Mobile App to use on your mobile device.

Quicken on your mobile device (iPhone®, iPad®, Android™ phone or tablet) syncs with your desktop data and makes keeping track of your money easy when you're on the go. You can receive customizable alerts and notifications about your account balances, fees, and spending patterns.

Quicken Personal Finance and Money Management Software.

Based on the user experience and financial tools, Simplifi is best for people who want a clear overview of their money and to receive valuable tips to stay on target. It's best for people who don't mind paying a little bit for an ad-free experience.

Overall, Quicken is a powerful and robust tool for managing your finances. If you want to understand your money and plan for the future, Quicken might be the right fit for you. With that being said, our verdict is that Quicken is likely to be the best fit only for entrepreneurs, small businesses, and the self-employed.

Simply put, Simplifi takes a fresh and unique approach to personal finance management, earning it our Editors' Choice award. We recommend you take advantage of its 30-day free trial to see if you agree. Simplifi by Quicken takes a fresh, unique approach to personal finance.

Overall, Quicken is a powerful and robust tool for managing your finances. If you want to understand your money and plan for the future, Quicken might be the right fit for you. With that being said, our verdict is that Quicken is likely to be the best fit only for entrepreneurs, small businesses, and the self-employed.

For powerful, easy-to-use financial management, Quicken Simplifi is your go-to choice. It's a cloud-based app designed for web & mobile.

Quicken and QuickBooks are two popular accounting software programs. Quicken is designed for personal finance while QuickBooks is geared toward small businesses. Both programs can track income and expenses, create budgets and generate reports.

Cons. Subscription required: Unlike some competitors, there's no free version. You'll have to pay annually to use Simplifi after the free trial period. Room for improvement in some areas: Investment features are minimal.

First, head to the Simplifi home page and select “Start your free 30-day trial.” At this point, you'll need to choose which plan you want to work with. The choices are the annual plan, which comes with a monthly cost of $3.99 per month, or the month-to-month plan, which costs $5.99 per month.

Quicken vs Money in Excel - Final Thoughts

Both Money in Exel and Quicken are good alternatives for managing and tracking your personal or business finances. Both have great performance and few disadvantages. If you're looking for professional services, then Quicken is your choice.

Quicken has been a big name in the personal finance industry for many years. While many people continue to use the software, others are looking for Quicken alternatives. In some cases, people want to consider Quicken options that are free. Others want a more modern interface and a better app experience.

If you're looking for something that will do pretty much everything, Quicken can be a good choice. Quicken for Mac can also be a good choice, but you might pay a little more than you'd like for the value - especially since the Mac version is missing some features.

Quicken provides all the tools that many small businesses and most small nonprofits would need to track their expenses and to provide reporting to different departments. It's very user-friendly and easy to learn, but can get quite messed up if the data going in is not entered appropriately. Trust me on that one!