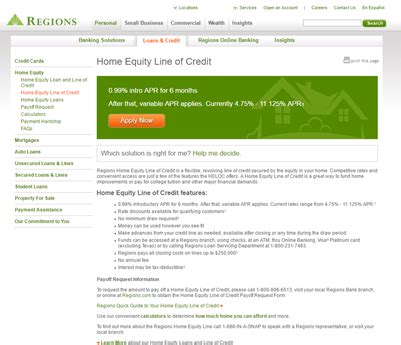

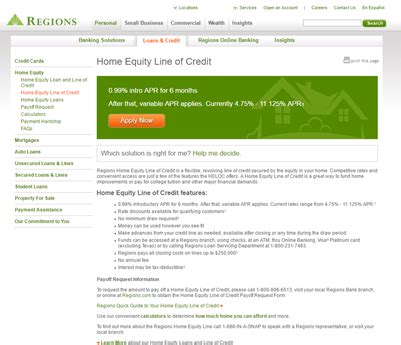

What is Regions Bank Home Equity Line of Credit?

Regions Bank is a well-respected financial institution that offers a range of financial products and services for its customers. One such product is the Regions Bank Home Equity Line of Credit, which is a flexible financial solution that enables homeowners to access the equity in their homes and use it to finance various financial needs.

A Regions Bank Home Equity Line of Credit (HELOC) is essentially a line of credit that is secured by the equity in your home. The equity in your home is the difference between the current market value of the property and the outstanding balance on your mortgage. With a Regions Bank HELOC, you can borrow up to a certain percentage of that equity, which can be used to finance a variety of expenses.

One of the most significant advantages of a Regions Bank HELOC is its flexibility. The line of credit can be used for anything, from home renovations and repairs to debt consolidation or college tuition. The interest rate on the loan is variable, meaning that it can fluctuate over time, and you only pay interest on the amount that you borrow.

Another advantage of a Regions Bank HELOC is that it can be accessed at any time, which means that you have a source of funds available to you whenever you need it. Whenever you need to make a payment, you simply make a withdrawal from the line of credit, and the funds will be transferred to your bank account.

Overall, if you are a homeowner looking for a flexible financial solution that can provide you with access to quick and easy cash, a Regions Bank Home Equity Line of Credit could be an excellent option for you. With its competitive interest rates, flexible terms, and quick and convenient access to funds, this product could be the perfect solution for a range of financial needs.

Frequently Asked Questions about regions bank home equity line of credit

Access your home's equity through a HELOC, a revolving credit line with flexible payments. Borrow as much as you need up to your credit limit to pay for home improvements, major expenses or to consolidate debt.

A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loans such as credit cards.

What is the Regions Protection Line of Credit? It's a small, revolving line of credit that allows funds to be borrowed, repaid and then borrowed again for overdraft protection needs. The line of credit is made available to Regions customers by email or online invitation only.

Interest rates and fees

Interest rates range from: Prime + 5.00% to Prime + 18.00%. View Regions Preferred Line of Credit product details. Variable APR based on The Wall Street Journal prime rate, plus a margin. The margin is based on the amount of the approved line amount.

A home equity loan offers borrowers a lump sum with an interest rate that is fixed but tends to be higher. HELOCs, on the other hand, offer access to cash on an as-needed basis, but often come with an interest rate that can fluctuate.

With a home equity loan, you receive the money you are borrowing in a lump sum payment and you usually have a fixed interest rate. With a home equity line of credit (HELOC), you have the ability to borrow or draw money multiple times from an available maximum amount.

A home equity line of credit (HELOC) is a loan that allows you to borrow, spend, and repay as you go, using your home as collateral. Typically, you can borrow up to a specified percentage of your equity. Equity is the value of your home minus the amount you owe on your mortgage.

The three common types of credit - revolving, open-end and installment - can work differently when it comes to how you borrow and pay back the funds. And when you have a diverse portfolio of credit that you manage responsibly, you can improve your credit mix, which could boost your credit scores.

A line of credit is a flexible loan from a financial institution that consists of a defined amount of money that you can access as needed. You can repay what you borrow from a line of credit immediately or over time in regular minimum payments. Interest is charged on a line of credit as soon as money is borrowed.

9.01%

What are today's average HELOC rates?

| LOAN TYPE | AVERAGE RATE | AVERAGE RATE RANGE |

|---|

| HELOC | 9.01% | 8.34% – 9.71% |

A home equity loan allows you to borrow a lump sum of money against your home's existing equity. A HELOC also leverages a home's equity but allows homeowners to apply for an open line of credit. You then can borrow up to a fixed amount on an as-needed basis.

HELOCs come with both benefits and risks. They can provide you with funds at a lower interest rate than other kinds of loans, and obtaining one can be quicker than going through a traditional loan process. On the other hand, you're using your home as collateral.

Advantages Of Getting A HELOC

(A home equity loan charges interest on the full amount of the loan, whether you use it or not.) No Closing Costs: HELOCs don't require a closing, so there are no closing costs. No Fees For Cash Draws: There are no fees for using your line of credit.

HELOCs tend to have lower interest rates than other types of home loans. They can be a good option to finance a major expense like a home renovation, to consolidate debt or to cover an unexpected emergency. There are benefits to using a HELOC, particularly because you can borrow against your credit line at any time.

With a home equity loan, you receive the money you are borrowing in a lump sum payment and you usually have a fixed interest rate. With a home equity line of credit (HELOC), you have the ability to borrow or draw money multiple times from an available maximum amount.

What Is a Line of Credit? A line of credit is a flexible loan from a bank or financial institution. Similar to a credit card with a set credit limit, a line of credit is a defined amount of money that you can access as needed and use as you wish. Then, you can repay what you used immediately or over time.