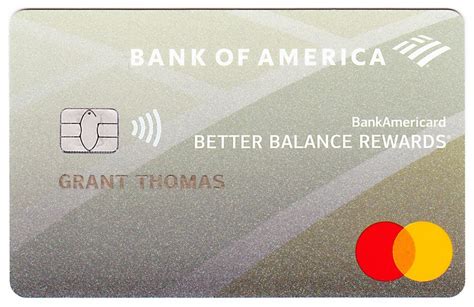

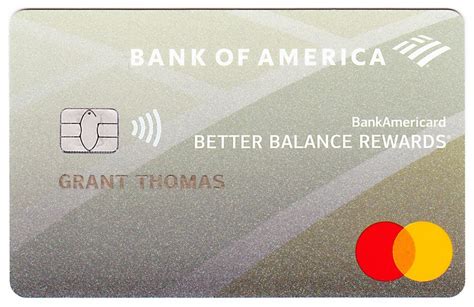

What is Bank of America (Credit Card) Better Balance Rewards Credit Card?

The Bank of America Better Balance Rewards Credit Card is an excellent choice for those looking to earn rewards while also keeping their finances in check. This credit card comes with a unique feature that offers rewards for paying your bills on time and keeping your balances low.

One of the standout features of the Better Balance Rewards card is its automatic $25 quarterly cash rewards bonus. To receive this bonus, cardholders must make their minimum monthly payments on time and keep their account balance low. This is a great incentive for customers who want to stay on top of their bills and earn rewards at the same time.

In addition to the quarterly rewards bonus, the Better Balance Rewards card also comes with a number of other benefits. Cardholders can earn 1% cashback on all purchases, and there is no annual fee for the card. Additionally, the card has a low-interest rate, making it a great option for those who may need to carry a balance from time to time.

Another benefit of the Better Balance Rewards card is its fraud protection. Bank of America monitors accounts for suspicious activity and will alert customers if any unusual transactions are detected. This gives cardholders peace of mind knowing that their accounts are safe and secure.

Overall, the Bank of America Better Balance Rewards Credit Card is an excellent choice for those looking for a credit card that offers rewards while also helping them maintain good financial habits. With its automatic rewards bonus, low-interest rate, and fraud protection, this card is a great option for anyone looking to manage their finances responsibly and earn rewards while doing so.

Frequently Asked Questions about bank of america (credit card) better balance rewards credit card

(Update) Bank of America Better Balance Rewards Cards Being Converted. Bank of America has announced that the Better Balance Rewards Card is being discontinued and will be forcibly converted to Bank of America Unlimited Cash Rewards World Mastercard credit card on May 16, 2023.

How does the Bank of America® Cash Rewards credit card work? earns 3% back on a category of your choice and 2% back on grocery store and wholesale club spending, on up to $2,500 per quarter in combined spending in those categories. All other purchases earn 1% back.

Bank of America offers credit cards featuring benefits from travel and cash back to an exceptional suite of services and experiences, all curated to complement your lifestyle. As a Private Bank client, you will earn 75% more points on every purchase, if you're enrolled in Bank of America's Preferred Rewards program.

Redeem your cash rewards for any amount, anytime for statement credits, deposits made directly into a Bank of America® checking or savings account, or for credit to an eligible account with Merrill. Redemptions for a contribution to a qualifying 529 account with Merrill or for a check start at $25.

On your mobile device

Log in to the Mobile Banking app and select your credit card account, or you can set up the My Balance™ feature to view account balances without signing in to the app.

To check your credit card rewards balance and cash in or redeem your rewards points online, log in to Online Banking and select your credit card then select the Rewards tab. To redeem your credit card rewards by phone, call 800.434. 8313 and select option 2 (Mon-Fri 9 a.m.-9 p.m. ET).

NerdWallet's Best Bank of America Credit Cards of October 2023

- Bank of America® Customized Cash Rewards credit card: Best for Bonus category cash back.

- Bank of America® Unlimited Cash Rewards credit card: Best for Simple cash back.

- Bank of America® Travel Rewards credit card: Best for Travel.

The Bank of America® Unlimited Cash Rewards credit card is an excellent choice for earning rewards beyond the Customized Cash card's spending limit. It will also be great for purchases at retailers that typical bonus categories don't cover - including Walmart, Target and other superstores.

The Bank of America credit card annual fee ranges from $0 to $95, depending on the card. Most Bank of America consumer credit cards have $0 annual fees. The same goes for their business and student credit cards.

Forbes Advisor Ratings

| Company | Forbes Advisor India Rating | Welcome Benefits |

|---|

| SBI SimplySAVE Credit Card | 4.5 | Bonus reward points |

| SimplyCLICK SBI Credit Card | 4.5 | Amazon Gift Card |

| BPCL SBI Credit Card (RuPay Version) | 4.0 | 2,000 reward points worth INR 500 on payment of joining fee |

| RBL Bank ShopRite Credit Card | 3.5 | Cashback |

Full Review of Bank of America Balance Assist

Bank of America's small-dollar loan, Balance Assist, allows customers to borrow up to $500 in $100 increments, for a flat $5 fee. Then, the loan is repaid over a 90-day period in three equal monthly installments.

Bank of America Advantage SafeBalance Banking is a “checkless” checking account, which means users cannot write personal paper checks.

Credit card cash back rewards are bonuses provided to credit card customers when they use their cards to make purchases. Cash back rewards can take the form of dollars or points - with points typically redeemable on an online marketplace operated by the card issuer. Cash back rewards operate on a percentage basis.

The Cash Rewards cash value will be deposited within five business days via electronic transfer into the Bank of America checking or savings account or qualifying Cash Management Account® with Merrill that you selected as long as your account is open and has active charging privileges.

Bank of America® Unlimited Cash Rewards credit card. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that, a Variable APR that's currently 18.24% to 28.24% will apply. A 3% fee applies to all balance transfers.

A cash back or cash rewards credit card gives you cash rewards for spending. The reward is usually a percentage of the amount you spend. Therefore, if a card offers 1 percent cash back, spending $4,500 over the course of a year would give you a reward of $45.