GEICO Umbrella Insurance tv commercials

TV spots

TV commercials GEICO Umbrella Insurance

Advertisers

Advertisers of commercials featuring GEICO Umbrella Insurance

GEICO

What is GEICO?GEICO (Government Employees Insurance Company) is an American auto insurance company headquartered in Chevy Chase, Maryland. It was founded in 1936 by Leo Goodwin Sr. and his wife Lillia...

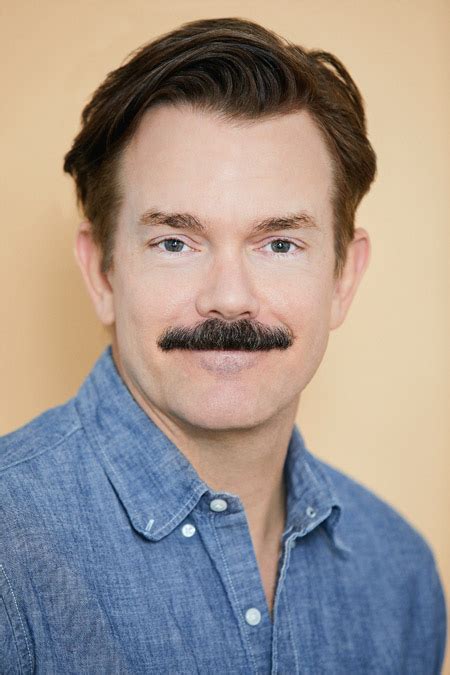

Actors

Actors who starred in GEICO Umbrella Insurance commercials

Agenices

Agencies worked with GEICO Umbrella Insurance

Mediabrands

The Martin Agency

What is GEICO Umbrella Insurance?

GEICO Umbrella Insurance: Protecting Every Aspect of Your Life

When it comes to safeguarding your financial future, insurance plays a crucial role. While traditional insurance policies cover a wide range of risks, it's essential to have extra protection in today's unpredictable world. This is where GEICO Umbrella Insurance steps in, offering an extra layer of coverage that goes above and beyond what traditional policies provide.

So, what exactly is GEICO Umbrella Insurance? Think of it as an additional shield against unexpected accidents, liabilities, and damages that exceed the limits of your existing insurance policies. With an umbrella policy, you gain peace of mind by extending your coverage and ensuring that you're protected even in the most unfortunate circumstances.

One of the primary benefits of GEICO Umbrella Insurance is its ability to provide coverage beyond your auto and property insurance limits. Picture this: you're involved in a severe car accident, and the damages and medical expenses far surpass what your auto insurance covers. In such instances, GEICO Umbrella Insurance steps in to cover the outstanding expenses, saving you from potentially devastating financial implications.

Moreover, GEICO Umbrella Insurance acts as a safety net, protecting your assets and preventing a significant loss in case of a liability claim against you. Whether it's a lawsuit stemming from an accident on your property or a liability claim arising from your activities, having an umbrella policy ensures that you don't have to bear the full brunt of these unfortunate incidents.

Another advantage of GEICO Umbrella Insurance is its affordability. Considering the level of protection it offers, the additional cost of an umbrella policy is often quite reasonable. GEICO offers competitive rates, allowing you to obtain comprehensive coverage without breaking the bank.

Moreover, GEICO prides itself on exceptional customer service and a seamless claims process. Should the need arise, their team of dedicated professionals is always ready to assist you, ensuring that your claims are handled promptly and efficiently.

It's important to note that GEICO Umbrella Insurance is not a standalone policy but instead complements your existing coverage. To be eligible, you will generally need to have certain minimum limits on your underlying auto and property insurance policies. GEICO's knowledgeable agents can guide you through the process, helping you determine the best coverage limits for your needs.

In conclusion, GEICO Umbrella Insurance is a valuable tool for protecting every aspect of your life. It offers an additional layer of coverage that goes beyond the limits of traditional policies, ensuring that you're safeguarded against unforeseen accidents, liabilities, and damages. With GEICO's competitive rates