What is Capital One (Banking) App?

Capital One's mobile banking app is a convenient way for customers to access their accounts on the go. The app is available for both iOS and Android devices, and it can be downloaded for free from the App Store and Google Play.

With the Capital One banking app, customers can securely and easily check their balance, view transaction history, transfer funds, pay bills, and even deposit checks straight from their mobile device. The app is designed to be user-friendly and intuitive, making it easy for customers to navigate and find the information they need.

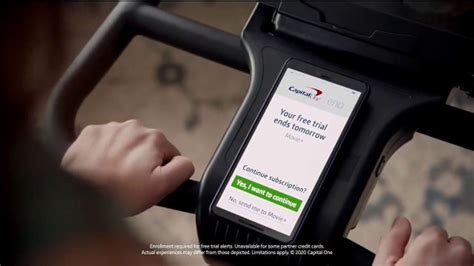

One of the standout features of the Capital One banking app is the ability to personalize alerts. Customers can choose to receive notifications for things like low account balances, unusual charges, or when a payment is due. This feature can help customers stay on top of their finances and avoid any surprises.

In addition to banking features, the Capital One app also offers tools for budgeting and tracking expenses. Customers can set spending limits, track their expenses by category, and even receive insights and tips to help them save money.

Overall, the Capital One mobile banking app is a great way for customers to manage their money on the go. It's convenient, secure, and packed with useful tools and features to help customers stay on top of their finances.

Frequently Asked Questions about capital one (banking) app

Capital One Financial Corporation is an American bank holding company specializing in credit cards, auto loans, banking, and savings accounts, headquartered in McLean, Virginia with operations primarily in the United States.

You can access your account online or through the Capital One Mobile app. With built-in security and 24/7 access, your money is always at your fingertips. Web access is needed to use mobile banking, and mobile deposits are available only in the U.S. and U.S. territories.

Capital One is a full-service bank offering competitive rates and no-fee accounts to fit most banking needs.

The obvious benefit: rewards

- A rewards credit card for travel.

- A cash back rewards credit card for dining and entertainment.

- A cash back rewards credit card for everyday purchases.

- Capital One Mobile app.

- Insider access and experiences.

- Travel perks through Capital One Travel.

- No foreign transaction fees.

Capital One Financial Corp (Capital One) is a diversified financial holding company that offers a range of commercial and retail banking, and credit card solutions through its subsidiaries.

Where Capital One is really different is because they are primarily a credit card lender, that is not the case for most other banks.

And confirm your account. Then you're all set to access Capital One. Including in the app. Once you're logged in just follow a few simple prompts to set up and personalize your experience.

Capital One is best for consumers in search of accounts with competitive yields and no fees. It offers a large network of fee-free ATMs. Capital One maintains branches in a handful of states, so those who live outside its branch footprint and prefer in-person banking should look elsewhere.

Consolidated assets: $464.9 billion

Capital One Bank may have fewer traditional banking branches than most other members of this list, but they have a massive network of 70,000 ATMs, a mobile banking app, Capital One Cafes in select cities and competitive rates on deposit accounts.

Capitol Bank is a community bank and we have locations only in Dane County, Wisconsin (Madison and Verona). Capital One has locations both in the US and abroad. Our websites and branding look drastically different. At Capitol Bank, we utilize gold, blue, white and charcoal gray in our color scheme.

Capital One is best for consumers in search of accounts with competitive yields and no fees. It offers a large network of fee-free ATMs.

As a World Elite Mastercard® cardholder, you have access to Mastercard® Travel & Lifestyle Services, a suite of benefits, amenities and upgrades, preferential treatment and premium travel offers from best-in-class travel companies across hotels, air travel, tours, cruises, car rentals and more*.

About Capital First

Capital First (BSE: 532938) provides debt financing services. It offers personal, business, home, and two-wheeler loans, as well as financing, asset management, foreign exchange, and equity brokerage services.

Software solutions, APIs & open source projects to enhance your business. We build in-house tech platforms, tools and solutions ranging from cloud and data management to machine learning and analytics. Now, we're making them available to everyone. We build tech that goes beyond banking.

More than 25 years ago, Capital One revolutionized the credit card industry with data and technology. Today, we are one of the largest retail banks in the United States, serving more than 100 million customers across a diverse set of businesses.

Its primary differentiating factor has been its reliance on analytics, as well as its emphasis on innovation and acquisitions. The largely saturated card lending market has led banks to seek ways to differentiate themselves, vying for the attention of consumers through an ever-growing list of card offerings.