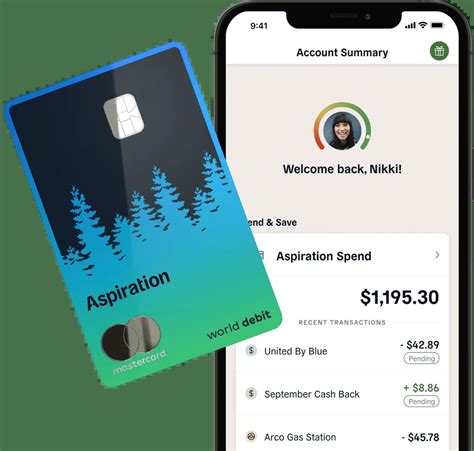

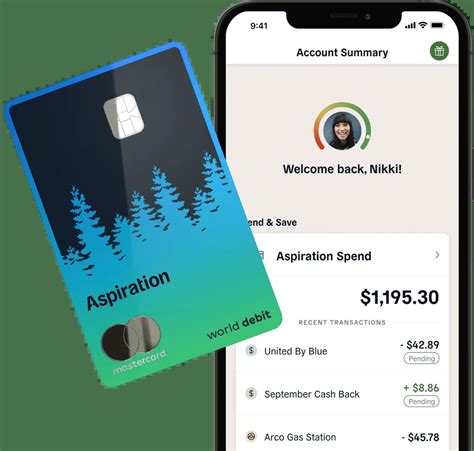

What is Aspiration Spend Account?

The Aspiration Spend Account is a financial account that offers consumers an opportunity to better manage their money while also doing good for the environment. This account is particularly focused on social and environmental responsibility, allowing customers to make a difference through their financial actions.

One of the key features of the Aspiration Spend Account is its commitment to sustainability. The account is backed by a zero-waste policy in which all packaging is biodegradable and all shipping materials are recyclable. Additionally, the account offers customers the option to plant a tree for each purchase made using their debit card, directly contributing to the fight against global deforestation.

Another important aspect of the Aspiration Spend Account is its fee structure. Unlike many traditional banking institutions that charge hidden or exorbitant fees, the account is set up with no monthly maintenance fees or minimum balance requirements. Even better, the account offers cashback incentives that are automatically deposited into the account. These incentives are based on environmentally-friendly purchases, such as using reusable bags or purchasing hybrid cars.

The Aspiration Spend Account is an innovative financial product that allows consumers to align their financial goals with their social and environmental values. With its commitment to sustainability, fee structure, and cashback incentives, this account is an excellent choice for anyone looking to manage their finances while also making a positive impact on the world.

Frequently Asked Questions about aspiration spend account

The Aspiration CMA offerings allow customers to use a single account for their checking account and savings account needs. Though Aspiration is not a bank, and CMAs are not the same as traditional bank accounts, customer deposits are still insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000.

Aspiration Spend is a non-interest bearing securities account with electronic transaction functionality. Aspiration Save is a securities account that, through the Insured Bank Deposit Program, permits you to earn interest on your available cash.

To be clear, Aspiration is not itself a chartered, federally insured bank. It's a financial firm offering a cash management account like Fidelity Investment's cash management account.

The minimum opening balance of the Aspiration Spend Account for all customers is $10.00. Aspiration Spend Accounts have transaction functionality, including debit card access to such funds as well as check writing capabilities. The minimum opening balance of the Aspiration Save Account for all customers is $10.00.

Aspiration happens when food, liquid, or other material enters a person's airway and eventually the lungs by accident. It can happen as a person swallows, or food can come back up from the stomach. Aspiration can lead to serious health issues such as pneumonia and chronic lung scarring.

What interest rates are offered for Aspiration Save?

| Aspiration | Aspiration Plus |

|---|

| $500+ Spend in a given month | 1.00% APY on balances up to $10,000.00 0.00% APY on balances greater than $10,000.00 | 3.00% on balances up to $10,000.00 0.25% on balances greater than $10,000.00 |

5 Types of accounts

- Assets.

- Expenses.

- Liabilities.

- Equity.

- Revenue (or income)

Coastal Community Bank

Aspiration Debit Cards are issued by Coastal Community Bank, Member FDIC, pursuant to a license by Mastercard International Incorporated.

Fintech Startup Aspiration Plans To Lay Off More Than Half Of Staff.

Aspiration is in the Business of Sustainability – Our mission is to empower people and businesses to Do Well and Do Good.

What interest rates are offered for Aspiration Save?

| Aspiration | Aspiration Plus |

|---|

| $500+ Spend in a given month | 1.00% APY on balances up to $10,000.00 0.00% APY on balances greater than $10,000.00 | 3.00% on balances up to $10,000.00 0.25% on balances greater than $10,000.00 |

Aspiration is a great fit for conscientious individuals who want to earn rewards and interest while also making a difference. Its cash back rewards and included high-yield savings account help make up for the lack of interest on its checking account.

There are three particular classifications of aspiration syndromes that are pathologically and clinically distinct: (1) Foreign body aspiration (FBA), (2) Aspiration pneumonitis, (3) Aspiration pneumonia (Paintal and Kuschner 2007).

Aspiration is a nonbank financial institution that offers the Spend and Save account, one that has both checking and savings features. Customers can opt for a basic account that has a “pay what is fair” monthly fee, which could be $0, making the account free.

Aspiration is a great fit for conscientious individuals who want to earn rewards and interest while also making a difference. Its cash back rewards and included high-yield savings account help make up for the lack of interest on its checking account.

Interest is essentially a charge to the borrower for the use of an asset. Assets borrowed can include cash, consumer goods, vehicles, and property. Because of this, an interest rate can be thought of as the "cost of money" - higher interest rates make borrowing the same amount of money more expensive.