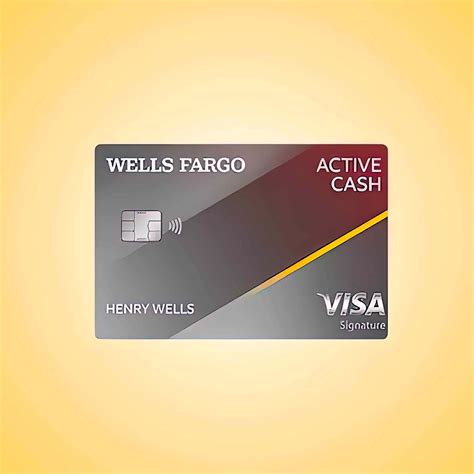

What is Wells Fargo Active Cash Visa Card?

The Wells Fargo Active Cash Visa Card is a credit card offered by Wells Fargo Bank , N.A. It is designed to provide consistent cash rewards to cardholders for all their purchases. The card offers 2% back on all purchases with no category restrictions or earning limits, making it an attractive option for those who want a simple and straightforward rewards program.

The card also comes with a number of additional benefits, including cell phone protection, which provides coverage for damage or theft of up to $600 per claim, with a maximum of two claims per year. The card has an introductory 0% APR on purchases and balance transfers for the first 15 months, after which a variable APR of 16.49% to 24.49% will apply.

There are no annual fees associated with the Wells Fargo Active Cash Visa Card. Cardholders can also access a range of tools and resources through Wells Fargo's online and mobile banking platforms, including the ability to view account activity, make payments, and track their rewards.

Overall, the Wells Fargo Active Cash Visa Card is a solid choice for those who want a simple and reliable cash-back credit card. With its flat 2% rewards rate, no annual fee, and extra benefits such as cell phone protection, it's a good option for everyday use and can help cardholders earn cash rewards on all their purchases.

Frequently Asked Questions about wells fargo active cash visa card

The Wells Fargo Active Cash® Card pairs a highly competitive flat cash back rate with generous welcome and introductory APR offers for no annual fee. The card is more well-rounded and streamlined than rivals, making it a solid standalone or partner rewards card.

No, the Wells Fargo Active Cash card isn't made out of metal. It's a simple plastic credit card. If you're interested in applying for a card that's heavier and more sophisticated than plastic, check out our list for the best metal credit cards on the market right now.

Wells Fargo Platinum Visa® Card Guide to Benefits

- Emergency Cash Disbursement and Card Replacement.

- Travel and Emergency Assistance Services.

- Auto Rental Collision Damage Waiver.

- Roadside Dispatch®

- $150,000 Worldwide Automatic Common Carrier Travel Accident Insurance.

- Additional Terms.

Wells Fargo Visa® Credit Cards and Mastercard® | Wells Fargo.

Does the Wells Fargo Active Cash Card have a foreign transaction fee? We call this a Foreign Currency Conversion fee. There is a 3% fee for each foreign transaction amount converted to U.S. dollars. Please refer to the Important Credit Terms for the most current rate and fee information.

The credit limit for the Wells Fargo Active Cash® Card typically ranges from $1,000 to $20,000 or more, based on user reports we reviewed. Credit limits vary by cardholder and depend on several factors, including annual income and credit history. Is the Wells Fargo Active Cash® Card hard to get?

July 2021

Wells Fargo launched the Wells Fargo Active Cash® Card in July 2021, which has no-annual fee and earns a flat 2% cash rewards across the board.

No, you cannot apply for Wells Fargo Active Cash as a business, because this is a personal credit card. However, you can use the Wells Fargo Active Cash card for your business expenses. Keep in mind, though, that personal credit cards usually have lower credit limits.

The Wells Fargo Active Cash earns an unlimited 2% cash rewards on purchases and charges no annual fee. This puts it in competition with the best flat-rate cash-back cards on the market.

If you're in the habit of keeping an ongoing balance on your credit cards, a rewards credit card like the Wells Fargo Active Cash® Card isn't right for you. The high ongoing interest rate will cancel out the value of any rewards earned.

NerdWallet's Best Wells Fargo Credit Cards of October 2023

- Wells Fargo Autograph℠ Card: Best for Travel.

- Wells Fargo Active Cash® Card: Best for Cash back.

- Wells Fargo Reflect® Card: Best for 0% intro APR.

The credit limit for the Wells Fargo Active Cash® Card typically ranges from $1,000 to $20,000 or more, based on user reports we reviewed. Credit limits vary by cardholder and depend on several factors, including annual income and credit history. Is the Wells Fargo Active Cash® Card hard to get?

The Wells Fargo Active Cash® Card runs on the Visa payment network, so it's widely accepted around the world. However, the card charges a foreign transaction fee, adding an extra cost every time you use it when traveling abroad.

The Cash Card is a Visa debit card that can be used to pay for goods and services from your Cash App balance, both online and in stores. You may have access to your card details as soon as you order it to add it to Apple Pay or Google Pay and make purchases online.

Cash Back Credit Card - Active Cash Visa® Card | Wells Fargo.

Overview. Wells Fargo may be a good fit for those who want access to a large network of branches and ATMs as well as a full-featured mobile banking app. Those seeking out high savings rates may want to consider other options.