What is Capital One (Credit Card) Spark Cash?

Capital One Spark Cash is a business credit card that offers cashback rewards for purchases. It is designed to be a simple way for business owners to earn cashback on all their purchases without any bonus categories or rotating rewards.

The card offers unlimited 2% cashback on every purchase, which can add up to significant savings for business owners. There is also an initial bonus offer of $500 cash back when you spend $4,500 on purchases within the first three months of account opening.

Capital One offers several management tools to help business owners manage their cash flow, expenses, and employees' card transactions. These features include account alerts, automatic payments, and quickbooks integration.

The Spark Cash card also comes with a range of additional benefits, including purchase security and extended warranty coverage, travel and emergency assistance services, and roadside assistance.

Overall, Capital One Spark Cash is a competitive cashback credit card option for small business owners looking to earn rewards on their purchases. With unlimited 2% cashback and a range of management tools and benefits, it's worth considering for any business looking to maximize their rewards earning potential.

Frequently Asked Questions about capital one (credit card) spark cash

The Capital One Spark Cash for Business is the only major small-business card that offers an unlimited 2% cash back on all purchases, which makes it well worth its annual fee - $0 intro for the first year, then $95 - for small businesses that spend a lot.

The Spark Cash Plus is a charge card with no preset spending limit, so it's a flexible card that can adapt to your needs based on your spending behavior and your payment and credit history. Another aspect to note about charge cards is that there's no annual percentage rate since your balance is due in full every month.

The Capital One Spark Cash Plus is an easy-to-use business credit card that offers straightforward rewards - in this case, an unlimited 2 percent cash back on all purchases. It's also a charge card, which means cardholders have to pay their balance in full each month, and there's no APR or preset spending limit.

The Capital One Spark Cash Business credit cards are all Mastercards, not Visa cards. You can use any of the Capital One Spark Cash cards at nearly 11 million merchants that accept Mastercards nationwide, and you can use it abroad in more than 200 countries and territories.

The Capital One® Spark® Classic for Business doesn't offer much in the way of rewards, but it's one of the few business credit cards targeted toward people with fair credit.

Full Review

For small-business owners with fair credit (FICO scores from 630 to 689), the Capital One® Spark® Classic for Business is a good choice - and one of just a few options available. It offers a basic 1% cash back on every purchase, an annual fee of $0 and no foreign transaction fees.

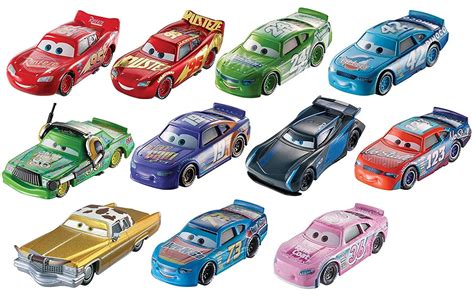

The Spark cards fall into two major buckets: travel rewards cards, which are blue, and cash-back cards, which are green or gold. Generally, travel cards tend to offer bigger sign-up bonuses than cash-back cards, but this isn't the case with the Spark cards.

Unlimited, flat rewards on all purchases

The card comes with a $150 annual fee, so you'll want to make sure you're earning enough in rewards to make up for that cost. Also, the Capital One Spark Cash Plus is a charge card rather than a credit card, which means you're required to settle your balance each month.

The limit on a Capital One Spark Classic business card is $500, but you may receive a higher limit depending on how high your credit score and income level are. on Capital One's Secured Site. Credit score is one of the many factors lenders review in considering your application.

This page includes information about the Capital One® Spark® Classic for Business and the Capital One® Spark® Miles Select for Business currently unavailable on NerdWallet. Among business credit cards, generous flat-rate rewards are hard to find, but the Capital One Spark business credit cards are a glowing exception.

Mastercard

Plus, get helpful perks such as no preset spending limit, free employee cards, no foreign transaction fees, and get your $150 fee refunded every year you spend at least $150,000. Is the Capital One Spark Cash Plus card a Visa or Mastercard? The Capital One Spark Cash Plus card is a Mastercard.

Spark 2% Cash Plus comes with no preset spending limit that adapts to your needs based on spending behavior, payment history and credit profile.