What is J.P. Morgan Asset Management Core Plus Bond ETF?

J.P. Morgan Asset Management offers a Core Plus Bond ETF as part of its investment offerings. The J.P. Morgan Core Plus Bond ETF (ticker symbol : JCPB) is designed to provide investors with exposure to a diversified portfolio of fixed income securities. This ETF aims to generate attractive risk-adjusted returns by actively managing various fixed income sectors.

The Core Plus investment strategy allows portfolio managers to go beyond the traditional core bond holdings and invest in a wider range of fixed income securities. This flexibility allows managers to add value by actively allocating assets across sectors, taking advantage of potential opportunities in the market.

Investment Approach:The J.P. Morgan Core Plus Bond ETF employs an active investment approach , which means that the fund managers actively select and manage the portfolio securities in order to generate returns. The fund aims to outperform its benchmark index by actively managing duration, yield curve positioning, sector allocation, and security selection.

Key Features:Some key features of the J.P. Morgan Core Plus Bond ETF include:- Diversification : The fund provides exposure to a wide range of fixed income sectors , including investment-grade corporate bonds, U.S. government bonds, mortgage-backed securities, and other fixed income instruments.- Active Management: Experienced portfolio managers actively manage the fund to identify potential opportunities and risks in the fixed income market.- Risk Management: The fund's managers aim to manage risk by carefully monitoring interest rate movements, credit quality, and yield curve positioning.- Liquidity: The ETF offers investors the ability to buy or sell shares on a stock exchange, providing liquidity and flexibility.

Performance and Fees:It is important for investors to consider the performance and fees associated with any investment product. The J.P. Morgan Core Plus Bond ETF's performance can be evaluated by looking at historical returns and comparing them to its benchmark index. Additionally, investors should review the fund's expense ratio, which represents the annual operating expenses as a percentage of assets under management.

Conclusion:Overall, the J.P. Morgan Asset Management Core Plus Bond ETF (JCPB) provides investors with an actively managed approach to fixed income investing. It aims to generate attractive risk-adjusted returns by actively allocating assets across sectors and actively managing the portfolio. Investors interested in this ETF should carefully review its investment objectives, performance, fees, and associated risks before making an investment decision.

Frequently Asked Questions about j.p. morgan asset management core plus bond etf

Western Asset Core Plus Bond Strategy seeks to maximize total return from a high-quality, US domestic core fixed-income portfolio that can be enhanced by allocations to sectors such as high-yield, non-US and emerging market debt.

Our goal is to create value for our clients.

Our approach to sustainable investing spans an ESG-integrated investment platform, ESG-enhanced stewardship to help companies manage the financially material ESG risks that they face, and a range of ESG-focused strategies.

317 ETFs

| Ticker/Name | Segment | % Allocation |

|---|

| XLFFinancial Select Sector SPDR Fund | Equity: U.S. Financials | 9.19% |

| IYFiShares U.S. Financials ETF | Equity: U.S. Financials | 9.13% |

| KBWBInvesco KBW Bank ETF | Equity: U.S. Banks | 8.50% |

| FTXOFirst Trust Nasdaq Bank ETF | Equity: U.S. Banks | 8.43% |

Investment expertise

Our clients face an infinite set of portfolio building challenges. We meet them with a singular focus: to offer investment solutions designed to achieve their long-term goals in the way that's best for them.

Core Bond Fund invests in high-quality, intermediate-term U.S. bonds, while Core Plus Bond Fund – anchored in high-quality core bonds – has the flexibility to invest in extended sectors, including high yield and emerging markets debt.

A 15-year-old apartment building that is well-occupied but in need of light upgrades is an example of a core plus investment opportunity.

We invest for sustainable return in a sustainable world. Our goal is to create sustainable value for our clients. Our research-led approach is continually evolving to consider everything material to our clients' investments over the long term – including environmental, social and governance factors.

J.P. Morgan Alternative Asset Management (JPMAAM) is a dedicated, global provider of niche hedge fund strategies. Since its inception in 1995, JPMAAM has focused on developing customized solutions across the liquidity spectrum to help investors achieve their strategic investment objectives.

The largest JPMorgan Chase ETF is the JPMorgan Equity Premium Income ETF JEPI with $29.32B in assets. In the last trailing year, the best-performing JPMorgan Chase ETF was AMJ at 32.49%. The most recent ETF launched in the JPMorgan Chase space was the JPMorgan Hedged Equity Laddered Overlay ETF HELO on 09/29/23.

Yieldstreet

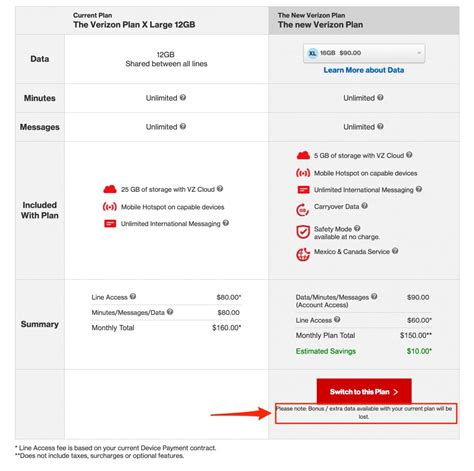

| ETF | Expense Ratio | Year-to-date Performance (as of Oct. 3) |

|---|

| WisdomTree Japan Hedged Equity Fund (DXJ) | 0.48% | 35.5% |

| iShares U.S. Technology ETF (IYW) | 0.40% | 40.3% |

| Global X Artificial Intelligence & Technology ETF (AIQ) | 0.68% | 32.3% |

| Vanguard S&P 500 ETF (VOO) | 0.03% | 11.6% |

We invest for sustainable return in a sustainable world. Our goal is to create sustainable value for our clients. Our research-led approach is continually evolving to consider everything material to our clients' investments over the long term – including environmental, social and governance factors.

J.P. Morgan was known for reorganizing businesses to make them more profitable and stable and gaining control of them. He reorganized several major railroads and became a powerful railroad magnate. He also financed industrial consolidations that formed General Electric, U.S. Steel, and International Harvester.

When you buy into one, you're buying multiple bonds at a time. This minimizes risk for the lender (aka you), so if one of those bond holders (aka a corporation) goes into default, then you don't lose all of your money. It's less risky than the stock market, but riskier than a certificate of deposit (CD).

Top 5 Core Bond Funds for Long-Term Investors

- Fidelity Total Bond Fund (FTBFX)

- Vanguard Total Bond Market ETF (BND)

- Dodge & Cox Income Fund (DODIX)

- Metropolitan West Total Return Bond Fund (MWTRX)

- Loomis Sayles Core Plus Bond Fund (NEFRX)

Shaykevich: Both Core and Core-Plus can be foundational pieces for a diversified fixed income portfolio. The funds offer two different approaches for building a fixed income portfolio. You can go for our Core-Plus Bond Fund, which invests in a broader range of sub-asset classes than our Core Bond Fund.

Another important component of JPMorgan's competitive advantage is its diversified business model. The company operates in a wide range of business segments, including investment banking, commercial banking, asset management, and retail banking.