What is Westminster Mint National Treasures Collection?

The Westminster Mint National Treasures Collection is a unique collection of precious metal coins that captures the beauty and history of America's most iconic landmarks and monuments. The collection is comprised of 50 coins, each crafted from.999 fine silver and beautifully colored to highlight the intricate details of each landmark.

From the Statue of Liberty to Mount Rushmore, the Westminster Mint National Treasures Collection celebrates the rich history and culture of the United States. Each coin in the collection features a detailed engraving of a different national treasure, bringing to life the majesty of each monument in stunning detail.

With its limited mintage and impeccable quality, the Westminster Mint National Treasures Collection is a must-have for coin collectors, history enthusiasts, and everyone who appreciates the beauty and significance of America's most iconic landmarks. These coins are not just a collector's item, but a tangible reminder of the wonders that our country has to offer and the remarkable people who made them possible.

Whether you display them in a beautiful coin album or pass them down as a cherished family heirloom, the Westminster Mint National Treasures Collection is a fitting tribute to the treasures that made America great.

Frequently Asked Questions about westminster mint national treasures collection

In addition to their intrinsic silver value, many silver coins carry numismatic value. This value stems from a coin's historical significance, rarity, condition, and demand among collectors. A rare silver coin in excellent condition can be worth much more than just its weight in silver.

Westminster Mint is an established company. It was founded in May 2001 and is registered with and licensed by the State of Minnesota as a coin and bullion dealer.

Best Silver Coins To Buy At A Glance

- Silver Britannia.

- Silver Tudor Beast.

- Silver Myths And Legends.

- Silver Krugerrands.

- Silver Maple Leaf Coin.

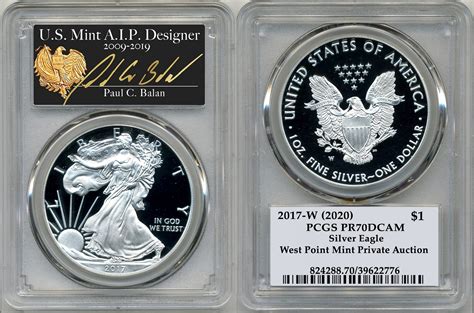

- American Silver Eagle Coin.

The Royal Mint has worked with precious metals for over a millennium and we are The Original Maker of trusted investment solutions in gold, silver and platinum.

Why are your prices higher than the market price for the metal? Bullion products from The Royal Mint incur a margin or 'premium' on top of the cost of the metal. This cost covers the design, craftsmanship, production and management of the products that we sell.

Silver is also a smart way to diversify your portfolio and offset your exposure to other, riskier assets, such as stocks. "It can be smart to invest in silver when you're seeking diversification or when you expect inflation or economic turmoil," says Nick Ganesh, manager at Endeavor Metals.

While no major economy uses gold or silver as the basis for its currency any longer, investors still see these two metals as active stores of value. Silver is more volatile, cheaper and more tightly linked with the industrial economy. Gold is more expensive and better for diversifying your portfolio overall.

Why are your prices higher than the market price for the metal? Bullion products from The Royal Mint incur a margin or 'premium' on top of the cost of the metal. This cost covers the design, craftsmanship, production and management of the products that we sell.

The Royal Mint is one of the world's leading mints, producing all the coins of the United Kingdom and is trusted with developing currency for more than 60 countries around the world, making it the world's leading export mint.

There are a few reputable manufacturers around the globe making the best gold bars suitable for investment. Engelhard, Johnson Matthey, The Royal Canadian Mint, The Perth Mint, and Credit Suisse are among the most well-known precious metal refiners for producing the best gold bar brands.

It is much cheaper

It is often said that silver is the 'common man's gold' and looking at their respective prices it is little surprise. Even though gold is exempt from VAT while silver is not, the huge difference in price allows investors to get more metal for their money when buying silver.

Market Volatility

One of the primary risks of investing in physical silver bullion, silver futures contracts, silver mining stocks, and other silver assets is high volatility compared to stocks, bonds, and other investment classes.

Silver, just like gold, can protect your wealth against inflation because its value is not dependent on the value of fiat currencies. In times of runaway inflation, local currencies can become completely worthless, forcing investors to seek safety in alternative currencies such as silver and gold.

Silver could be a good option if you're considering investing a small amount of money, as it has more upside potential due to its industrial uses. On the other hand, if you plan to invest a larger sum, gold might be a better choice due to its scarcity and potential for higher gains.

Coin production

As the sole body responsible for minting legal tender coins in the United Kingdom under contract from HM Treasury, the mint produces all of the country's physical currency apart from banknotes which are printed by the Bank of England.

Key Takeaways. Mints are facilities that produce coins for use as currency or as collector's items. National mints produce coins that are legally recognized as legal tender. The U.S. Mint produces tens of billions of coins each year.