What is Credit Sesame Sesame Cash Account?

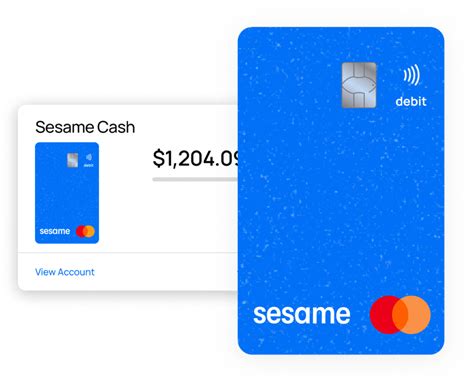

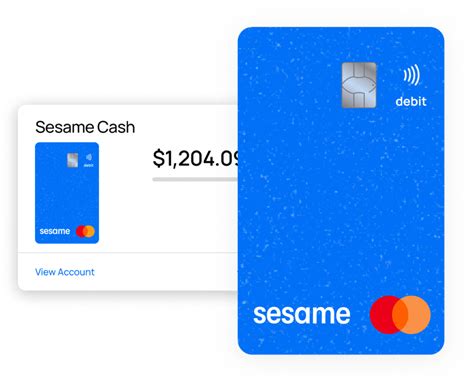

Credit Sesame is a financial services company that is known for its credit monitoring and financial wellness solutions. One of its latest offerings is the Sesame Cash account, which is a digital checking account that comes with a debit card and offers some unique features.

Firstly, one of the most significant advantages of Sesame Cash is the cashback rewards program. Account holders can earn up to 15% cashback at select merchants, which can add up to big savings over time. The cashback rewards are available to users who use their Sesame Cash debit card to make purchases at participating retailers.

Another great feature of Sesame Cash is the "Credit Boost" program. The program is designed to help customers build credit by reporting their positive payment history to major credit bureaus. This can help improve their credit score over time, which can make it easier for them to access financial products in the future.

Sesame Cash also offers some excellent mobile banking features, including online bill pay, mobile check deposit, and fee-free ATM access at over 55,000 Allpoint ATMs. These features make it easy for Sesame Cash account holders to manage their finances from anywhere.

Opening a Sesame Cash account is free and easy, and there are no monthly maintenance fees or minimum balance requirements. The account is FDIC-insured up to $250,000, which means that deposits are safe and protected.

Overall, Sesame Cash is an excellent option for anyone looking for a reliable, convenient, and rewarding digital checking account. With its unique cashback rewards program, Credit Boost program, and mobile banking features, Sesame Cash is a great choice for anyone looking to upgrade their banking experience.

Frequently Asked Questions about credit sesame sesame cash account

Credit Sesame is a free personal financial management tool that assists users with monetary liabilities. While other financial management tools incorporate bank accounts, retirement investments, and target savings goals, Credit Sesame stays on the debt side of the transaction.

Sesame Cash is a prepaid debit card issued by Community Federal Savings Bank (CFSB). To build credit with Sesame Cash, you must also open a virtual secured account with CFSB that is reported to the credit bureaus. There is no upfront security deposit required.

credit and loan company

Credit Sesame is a credit and loan company that makes consumer credit and loan management simple and automated.

VantageScore® 3.0 scoring

The credit score you see on Credit Sesame is based on the VantageScore® 3.0 scoring model. It's provided by TransUnion, but when you upgrade to our premium services, we show your score from all three credit bureaus. You'll also get access to many other resources to help protect your credit.

Credit Sesame is one of the first fintech companies to implement credit-building tools using consumers' cash and alternative data points to fast-track credit building.

Credit Sesame is the Program Manager for your Sesame Cash account, which is an account held by Community Federal Savings Bank. Credit Sesame provides administration and operational services to support your Sesame Cash account.

The Sesame Cash account helps you manage your money and build or improve your credit. You have your paycheck direct deposited into your Sesame Cash account up to two days early. Then, you use the debit Mastercard to pay your bills - to providers that are listed in the app - and make purchases.

The word “fintech” is simply a combination of the words “financial” and “technology”. It describes the use of technology to deliver financial services and products to consumers. This could be in the areas of banking, insurance, investing – anything that relates to finance.

Fintech lending works by using digital technology tools to help lenders issue loans online through websites or mobile apps. There are several business models within fintech lending, including peer-to-peer lending, mortgages, business loans, and investor loans.

Credit Sesame now offers a free prepaid debit card account to its customers that replaces a traditional bank account and that will provide additional financial wellness tools. The Card is not connected in any way to any other account, such as a checking or savings account. The Card is not a credit card.

The Cash Card is a Visa debit card that can be used to pay for goods and services from your Cash App balance, both online and in stores. You may have access to your card details as soon as you order it to add it to Apple Pay or Google Pay and make purchases online.

Sesame Cash is a prepaid debit card issued by Community Federal Savings Bank (CFSB). Building credit with Sesame Cash requires you to also open a secured line of credit with CFSB that is reported to the credit bureaus.

It refers to any app, software, or technology that allows people or businesses to digitally access, manage, or gain insights into their finances or make financial transactions.

10 Examples of Fintech Solutions

- Mobile Banking. Mobile banking is steadily growing in the fintech industry as more and more people use mobile devices to check their bank accounts, transfer money, and much more.

- Mobile Payment.

- Blockchain.

- Crowdfunding Platforms.

- Insurtech.

- Regtech.

- Stock Trading.

- Portfolio Management Platform.

Some examples include mobile banking, peer-to-peer payment services (e.g., Venmo, CashApp), automated portfolio managers (e.g., Wealthfront, Betterment), or trading platforms such as Robinhood. It can also apply to the development and trading of cryptocurrencies (e.g., Bitcoin, Dogecoin, Ether).

Examples of fintech applications include robo-advisors, payment apps, peer-to-peer (P2P) lending apps, investment apps, and crypto apps, among others.