Capital One (Banking) 360 Performance Savings tv commercials

TV spots

TV commercials Capital One (Banking) 360 Performance Savings

Advertisers

Advertisers of commercials featuring Capital One (Banking) 360 Performance Savings

Capital One (Banking)

Capital One is a well-known banking company that operates primarily in the United States and has its headquarters in Virginia. The company was founded in 1988 and has since then grown to become one of...

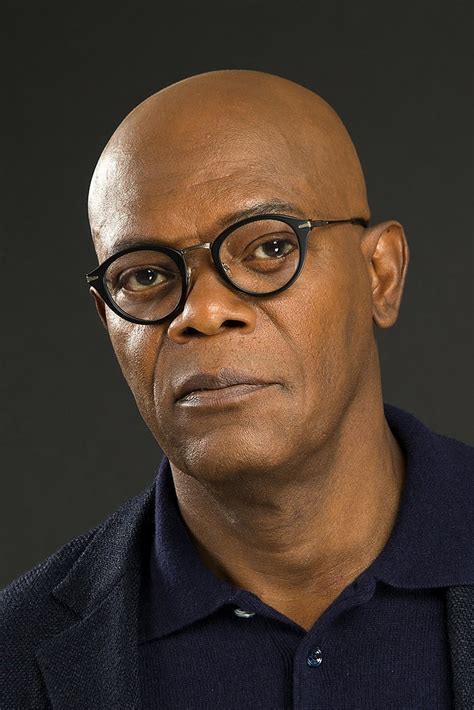

Actors

Actors who starred in Capital One (Banking) 360 Performance Savings commercials

Agenices

Agencies worked with Capital One (Banking) 360 Performance Savings

DDB

GSD&M

Horizon Media, Inc.

What is Capital One (Banking) 360 Performance Savings?

Capital One's 360 Performance Savings is a remarkable banking product that offers customers an exceptional way to save and grow their money. With its innovative features and competitive interest rates, it has established itself as a leading option in the world of online savings accounts.

One of the key advantages of the Capital One 360 Performance Savings account is its simplicity. Opening an account is quick and hassle-free, allowing customers to start saving right away. Additionally, the account is completely fee-free, meaning there are no maintenance or monthly fees to worry about. This makes it an attractive option for those wanting to maximize their savings without the burden of unnecessary charges.

Furthermore, Capital One's 360 Performance Savings takes advantage of cutting-edge technology to provide customers with a seamless and user-friendly experience. The online platform allows users to easily manage their savings, transfer funds, and track their progress towards their financial goals. Coupled with a mobile app that provides instant access on the go, Capital One ensures that customers have full control over their savings at all times.

One of the most appealing aspects of the 360 Performance Savings account is its impressive interest rates. Capital One offers highly competitive rates that help customers maximize their savings potential. Unlike many traditional banks, which often have lower rates, Capital One ensures that their customers' money is working hard for them, providing a solid return on investment.

Capital One also understands the importance of security and peace of mind. With robust security measures in place, including encryption technology and fraud monitoring, customers can rest assured that their funds and personal information are protected. This focus on security is one of the reasons why Capital One has gained the trust and loyalty of millions of customers worldwide.

In addition to these outstanding features, Capital One's 360 Performance Savings account also includes features such as automatic savings plans and the ability to set savings goals. These tools empower customers to build healthy financial habits and work towards their desired financial milestones.

Whether you're saving for a dream vacation, a down payment on a house, or simply want to grow your nest egg, Capital One's 360 Performance Savings account provides a solid foundation for achieving your financial goals. With its user-friendly interface, competitive interest rates, and commitment to security, it's no wonder that Capital One has become a trusted name in the realm of online banking.

So, if you're looking for a banking product that offers convenience, security, and the opportunity for significant savings growth, look no further than Capital One's 360 Performance Savings. Take control of your financial future and start saving with confidence today.