What is Simon and Schuster David M. Rubenstein "How to Invest"?

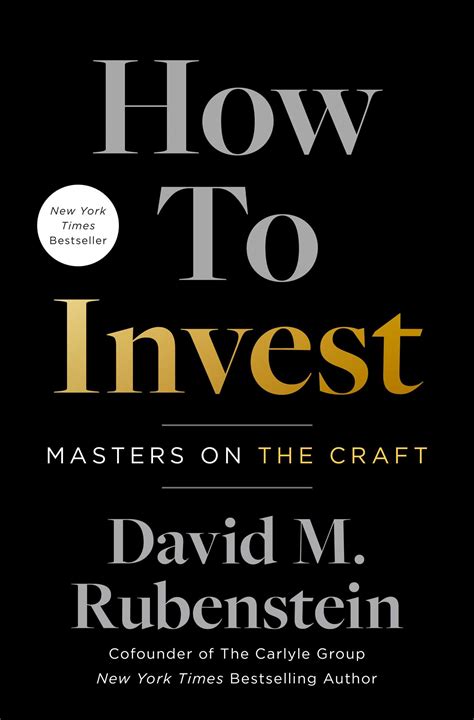

"How to Invest" by David M. Rubenstein"How to Invest" is a book written by David M. Rubenstein and published by Simon & Schuster. The book is a master class on investing and features conversations with some of the biggest names in finance. The book, which was published in September 2022, covers topics such as value investing, growth investing, and alternative investments, among others.

The Author: David M. RubensteinDavid M. Rubenstein is a New York Times bestselling author and co-founder of The Carlyle Group , one of the world's largest private equity firms. He is also a prominent philanthropist and has made major contributions to various cultural institutions and universities. Rubenstein has authored several books, including "How to Lead," "The American Experiment," and "The American Story."

The Book Content"How to Invest" features conversations with some of the best investors in the world, including Warren Buffett, Ray Dalio, and Peter Lynch, among others. The book provides valuable insights into their investment philosophies and strategies, as well as their views on the current economic landscape. Readers can learn from the experiences of these successful investors and apply their lessons to their own investment strategies.

ReviewsThe book has received positive reviews from various media outlets, including The Wall Street Journal, which described it as "an entertaining and informative read." The book offers actionable advice for investors of all levels, making it a valuable resource for anyone who wants to improve their investment skills.

In summary, "How to Invest" by David M. Rubenstein is a must-read for anyone looking to learn from some of the best minds in finance and improve their investment skills. The book is a master class on investing and covers a wide range of topics, making it a valuable resource for investors of all levels.

Frequently Asked Questions about simon and schuster david m. rubenstein "how to invest"

You only have one body, so it's important to invest in it and give yourself the best opportunity for a long and healthy life.

- Nourish your body. Your body needs fuel to run properly, so make sure you give it the nutrients it needs.

- Exercise regularly.

- Get good sleep.

- Practice self-care.

- Feed your brain.

Best investments for beginners

- High-yield savings accounts. This can be one of the simplest ways to boost the return on your money above what you're earning in a typical checking account.

- Certificates of deposit (CDs)

- 401(k) or another workplace retirement plan.

- Mutual funds.

- ETFs.

- Individual stocks.

8 Must Read Stock Trading Books For Beginners

- The Little Book of Common Sense Investing by Jack Bogle.

- A Random Walk Down Wall Street by Burton G. Malkiel.

- The Intelligent Investor by Benjamin Graham.

- One Up On Wall Street by Peter Lynch.

- The Warren Buffett Way by Robert G. Hagstrom.

It really has to do with values. Your greatest investment in life are people. First is your family; next are the other people in your circle of influence; and then the larger society.

Your money can make money to provide daily income from investments. Bank accounts, certificates of deposit, stocks, bonds, ETFs and real estate all offer opportunities to earn income without actively having to work for it. Each investment alternative offers a different mix of safety, liquidity and income potential.

10 options where you can invest money in India

- Stocks. Stocks are one of India's most popular investment options.

- Mutual funds. Mutual funds are a common pool of money invested in multiple assets like equities, bonds, etc.

- Fixed deposits.

- Gold.

- Real estate.

- Bonds.

- Saving schemes.

- SIP mutual funds.

How to build wealth with long-term investments

- Stock ETFs and mutual funds.

- Low-cost index funds.

- Real estate (or REITs)

- Money market funds.

- Online savings accounts.

- Treasury bills.

- Certificates of Deposit.

How To Begin Investing In 8 Steps

- Learn your investment options.

- Determine how much to invest.

- Start investing in a 401(k)

- Open an investment account.

- Choose your investment strategy.

- Start investing early.

- Work with a financial advisor.

- Build your investment portfolio.

If you want to invest in both the primary and secondary share market, you need a Demat Account. A DEMAT Account will carry the electronic copies of the shares you trade with. Along with a DEMAT Account, you also require a Trading Account, which allows you to buy and sell shares in the market.

Investing in the S&P 500

The S&P 500 is an index that tracks the 500 largest companies in the U.S. by market capitalization. You can't directly invest in the index itself, but you can buy individual stocks of S&P 500 companies, or buy a S&P 500 index fund through a mutual fund or ETF.

The U.S. stock market is considered to offer the highest investment returns over time. Higher returns, however, come with higher risk. Stock prices typically are more volatile than bond prices.

U.S. Government Treasury Bills

Given the U.S. Government's creditworthiness, T-Bills are typically considered the highest return investments of any “risk-free asset.” Although shorter maturity dates typically mean a smaller interest payment, they are the safest, lowest-risk, and most secure types of bonds to buy.

- 8 Passive Income Ideas To Make $1,000+ Online In a Month.

- Invest in Dividend Stocks.

- Rent Out Spare Rooms.

- Invest in High-Yield Savings Accounts.

- Launch an Informational Blog or YouTube Channel.

- Sell Photos Online.

- Invest in Peer-to-Peer Lending.

- Launch an Online Course.

Here's how to invest $1,000 and start growing your money today.

- Buy an S&P 500 index fund.

- Buy partial shares in 5 stocks.

- Put it in an IRA.

- Get a match in your 401(k)

- Have a robo-advisor invest for you.

- Pay down your credit card or other loan.

- Go super safe with a high-yield savings account.

- Build up a passive business.

The best way to invest 10K in individual stocks, ETFs, mutual and index funds, and stocks and shares ISAs. You can also use a robo-advisor to invest in stocks. How to invest 10k for the short term? You can invest the 100k in a high-interest savings account or a cash ISA for short-term goals.

Investing in the stock market is one of the best ways to generate wealth over many years and decades, and buying shares in stock ETFs is a good place to start. Much like a bond ETF, a stock ETF owns a basket of stocks with the aim of tracking a particular market index such as the S&P 500 (SNPINDEX:^GSPC).