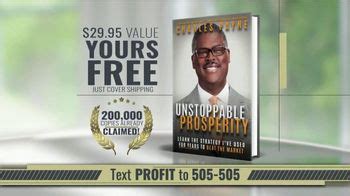

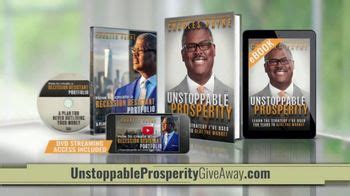

What is Charles Payne "How to Create a Recession Resistant Portfolio" DVD?

Charles Payne's "How to Create a Recession Resistant Portfolio" DVD

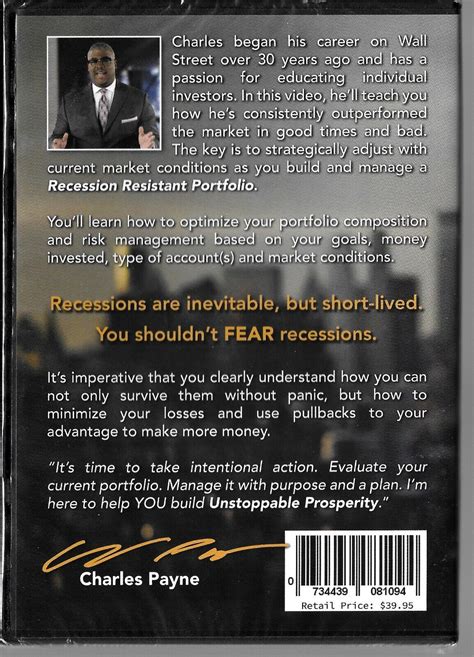

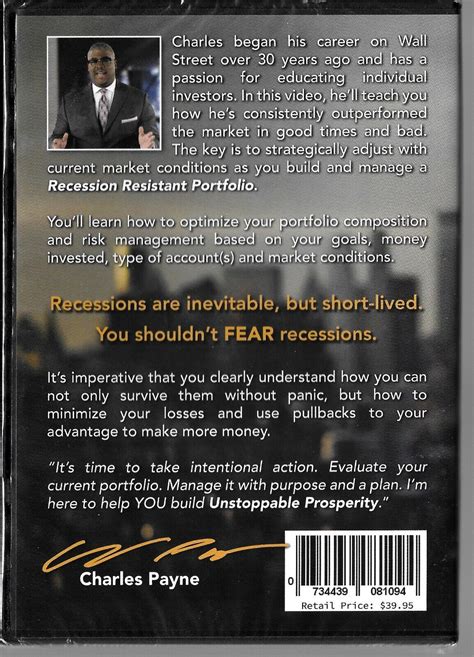

Charles Payne is a well-known financial analyst , television personality, and author who has written and spoken extensively about investment strategies and financial education. One of his popular works is the DVD titled "How to Create a Recession Resistant Portfolio."

The DVD offers valuable insights and guidance on how to build and manage a portfolio that can withstand economic downturns and volatility. Payne shares his expertise and provides practical advice on how to navigate market fluctuations and secure financial stability, even during challenging times.

The content of the DVD focuses on several key areas related to creating a recession-resistant portfolio. These include:

1. Investment Strategies: Payne discusses various investment strategies and techniques that can help you protect and grow your wealth during recessionary periods. He provides actionable steps and highlights specific investment opportunities to consider.

2. Diversification: Diversification is a crucial aspect of building a recession-resistant portfolio. Payne emphasizes the importance of spreading investments across different asset classes, sectors, and regions to minimize risk and optimize returns.

3. Risk Management: Managing risk is vital in turbulent market environments. Payne shares practical tips and techniques for assessing and mitigating risk in your investment portfolio. He explores different risk management tools and approaches to help investors protect their capital.

4. Resilience and Adaptability: The DVD underscores the importance of resilience and adaptability in the face of economic challenges. Payne encourages investors to adopt a proactive mindset and adjust their investment strategies as market conditions evolve.

"How to Create a Recession Resistant Portfolio" DVD serves as a comprehensive guide for individuals looking to build a robust investment portfolio that can weather economic downturns. Charles Payne's expertise and engaging teaching style make this DVD a valuable resource for both novice and experienced investors seeking to navigate the complexities of the financial markets.

Please note that specific details and examples mentioned in the DVD may vary. To obtain a more comprehensive understanding, it is recommended to watch or purchase the DVD directly.

Frequently Asked Questions about charles payne "how to create a recession resistant portfolio" dvd

One of the best things you can do to recession-proof your portfolio is to diversify your investment. Including stocks that historically perform better during a recession is a good start. Keep in mind that there are pros and cons to a recession-proof portfolio.

Investors typically flock to fixed-income investments (such as bonds) or dividend-yielding investments (such as dividend stocks) during recessions because they offer routine cash payments.

The best recession stocks include consumer staples, utilities and healthcare companies, all of which produce goods and services that consumers can't do without, no matter how bad the economy gets.

Cash, large-cap stocks and gold can be good investments during a recession. Stocks that tend to fluctuate with the economy and cryptocurrencies can be unstable during a recession.

Here are seven ways to prepare for a recession:

- Focus on building a budget.

- Limit spending.

- Build an emergency fund.

- Pay off debt.

- Diversify investments.

- Add multiple streams of income.

- Secure a recession-proof career.

What industries are recession-proof? Consumer staples, vices, healthcare, education, defense, utilities, budget travel, and premium luxuries are seen as recession-proof.

Food and grocery items

Food is always in demand, so it's a good bet for a recession-proof business. While many consumers stated they will cut back spending in this category, they still need to buy groceries.

Necessity items

Products that are essential for daily life, such as food, cleaning supplies, and personal hygiene products, may be in high demand during a recession as consumers try to cut costs by limiting non-essential purchases.

Examples of businesses and industries that historically have been recession proof include:

- Financial advisors and accountants.

- Child services.

- Health care.

- Auto repair.

- Property management.

- Home repair/contractor.

- Cleaning services.

- Grocery store.

9 high-dividend stocks

| Ticker | Company | Dividend Yield |

|---|

| DX | Dynex Capital, Inc. | 13.49% |

| PDM | Piedmont Office Realty Trust Inc | 13.33% |

| CFFN | Capitol Federal Financial | 13.26% |

| RGR | Sturm, Ruger & Co., Inc. | 12.39% |

What industries are recession-proof? Consumer staples, vices, healthcare, education, defense, utilities, budget travel, and premium luxuries are seen as recession-proof.

Ten recession-proof business ideas (with real examples)

- Pharmaceuticals.

- Care work.

- Accounting.

- Financial planning.

- Beauty products.

- Beauty salons When times are tough, we still want to look good.

Build up your emergency fund, pay off your high interest debt, do what you can to live within your means, diversify your investments, invest for the long term, be honest with yourself about your risk tolerance, and keep an eye on your credit score.

What is a “Recession”? Here Are the 5 Key Indicators

- Decline in Real GDP.

- Decline in real income or income after inflation is taken into consideration.

- Rise in unemployment.

- Stagnation of industrial production and retail sales and finally.

- Decline in consumer spending.

Here are seven ways to prepare for a recession:

- Focus on building a budget.

- Limit spending.

- Build an emergency fund.

- Pay off debt.

- Diversify investments.

- Add multiple streams of income.

- Secure a recession-proof career.

So if you want to insulate yourself during a recession partly with stocks, consider investing in the healthcare, utilities and consumer goods sectors. People are still going to spend money on medical care, household items, electricity and food, regardless of the state of the economy.