What is JPMorgan Chase (Banking) Debit Card?

JPMorgan Chase is one of the largest banking institutions in the United States, and they offer a variety of financial products and services to their customers. One of these products is their debit card.

The JPMorgan Chase debit card is a convenient way for customers to access their funds and make purchases without carrying cash. The card can be used at any merchant that accepts debit cards, and it can also be used to withdraw cash from ATMs.

One of the benefits of the JPMorgan Chase debit card is that it is linked to the customer's checking account, which means that they can easily keep track of their spending and account balance. Additionally, the card comes with fraud protection, which means that customers won't be held liable for unauthorized purchases.

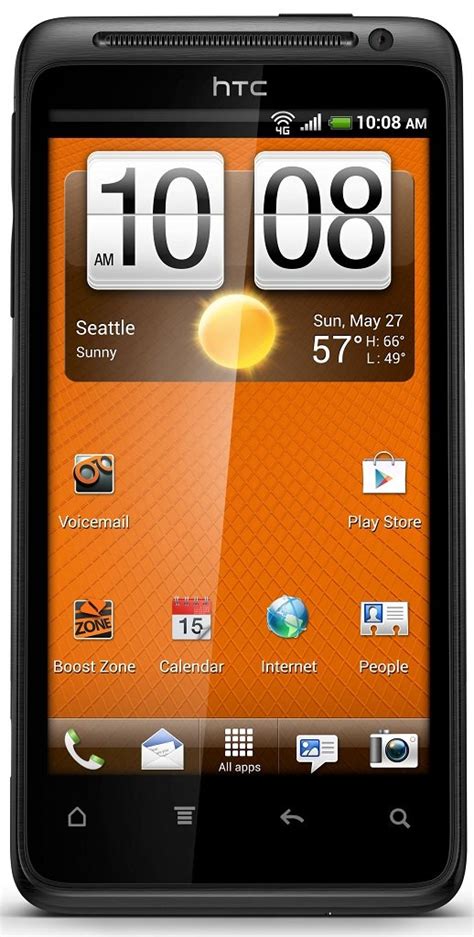

JPMorgan Chase also offers a mobile app, which allows customers to view their account balance, transaction history, and even lock or unlock their debit card in case of loss or theft. This makes it easy for customers to manage their finances on-the-go.

Overall, the JPMorgan Chase debit card is a convenient and secure way for customers to access their funds and make purchases. With features like fraud protection and a mobile app, it's no wonder why so many people choose JPMorgan Chase for their banking needs.

Frequently Asked Questions about jpmorgan chase (banking) debit card

Debit cards allow consumers to make convenient transactions with funds from their checking account. Debit cards are often provided when you open an account at a bank, credit union, or financial institution, but there might be some cases in which you have to request one yourself.

The Chase Privileges Debit card allows individuals you authorize to have controlled access to funds in your J.P. Morgan checking account, allowing them to make debit card purchases anywhere Visa cards are accepted or to withdraw cash at ATMs worldwide.

A debit card is a card linked to your checking account. It looks like a credit card, but it works differently. The amount of money you can spend on a debit card is determined by the amount of funds in your account, not by a credit limit such as credit cards carry.

Chase debit cards allow you to access money from a checking account by making purchases or ATM withdrawals. You can only use them to spend money you already have. For more options, you can compare checking accounts with debit cards on WalletHub.

Chase primarily uses Visa as a network, but also offers a couple of Mastercard credit cards. Not all merchants accept credit cards from all networks. Before starting your purchase, make sure to inquire if the card you are planning to use is accepted.

A debit card lets you spend money from your checking account without writing a check. You can use your debit card to buy things in a store. You can use it at an ATM to get cash.

JPMCB stands for JPMorgan Chase Bank, which offers a number of available credit cards. Both personal and business credit cards are available, and many of them offer rewards and access to Chase's lucrative Ultimate Rewards program.

Card Products means a Visa or MasterCard, general purpose credit card.

A Comprehensive Guide to Different Types of Debit Cards in India

- Visa Debit Cards. VISA Opulence Debit Card. Visa Signature Debit Card.

- Mastercard Debit Card. MasterCard Classic DI Debit Card.

- RuPay Debit Cards. RuPay Platinum DI Debit Card.

- bob World Yoddha Debit Card.

- Contactless Debit Cards.

- Virtual Debit Card.

JPMCB stands for JPMorgan Chase Bank, which offers a number of available credit cards. Both personal and business credit cards are available, and many of them offer rewards and access to Chase's lucrative Ultimate Rewards program.

Chase primarily uses Visa as a network, but also offers a couple of Mastercard credit cards. Not all merchants accept credit cards from all networks. Before starting your purchase, make sure to inquire if the card you are planning to use is accepted.

Although both kinds of cards can be used to pay for goods or services, there are key differences between credit cards and debit cards. Most notably is that credit cards are borrowed funds issued by a bank, and debit cards pull funds directly from your existing bank account.

Visa

Chase primarily uses Visa as a network, but also offers a couple of Mastercard credit cards. Not all merchants accept credit cards from all networks.

Let's explore a few key features of debit cards right here.

- Instant access to funds.

- ATM withdrawals.

- Contactless payments.

- Check debit card limit.

An ATM card is a PIN-based card, used to transact in ATMs only. While a Debit Card, on the other hand, is a much more multi-functional card. They are accepted for transacting at a lot of places like stores, restaurants, online in addition to ATM.

What are the 4 types of credit cards? The types of credit cards are categorised as per their used cases. Four types of credit cards include travel credit cards, business credit cards, reward credit cards, and shopping credit cards among others.