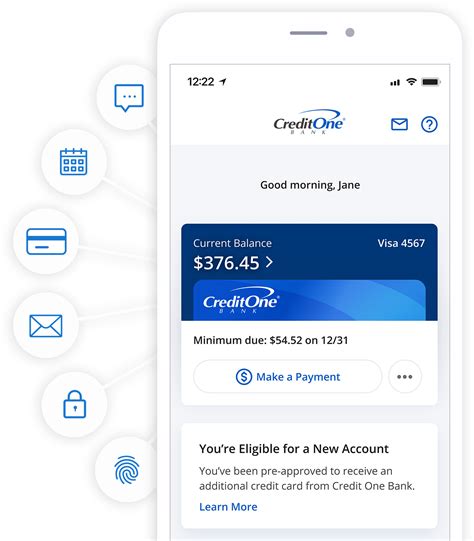

What is Credit One Bank Platinum Visa?

The Credit One Bank Platinum Visa is a credit card offered by Credit One Bank. This credit card comes with various features and benefits that cater to the needs of different customers. With the Platinum Visa card, customers can earn cashback rewards on everyday purchases and even rebuild their credit. The card is unsecured and is available to people with fair credit.

The Credit One Bank Platinum Visa offers decent benefits , including cashback rewards, credit protection, and fraud detection. Customers can earn cashback rewards for every dollar spent, and these rewards can be redeemed for statement credits or even cash back. Additionally, the card comes with credit protection features like zero fraud liability and account alerts, which help customers protect their credit and financial information.

One of the significant advantages of the Credit One Bank Platinum Visa card is that it is an unsecured card , meaning that customers do not need to provide collateral to be approved for the card. This feature makes it a great choice for people looking to improve their credit score or those who do not have any credit history.

However, the Credit One Bank Platinum Visa card has some drawbacks too. The card comes with an annual fee and high-interest rates, making it less appealing to customers who are looking for a low-cost credit card option. Also, the card has some transaction fees that may not be suitable for customers who travel frequently or make foreign transactions.

In conclusion, the Credit One Bank Platinum Visa is a decent credit card option for those seeking to build or rebuild their credit score , earn cashback rewards, and protect their credit and finances. It may not be the best option for customers looking for a low-cost credit card option.

Frequently Asked Questions about credit one bank platinum visa

The Credit One Bank® Platinum Visa® is a decent unsecured credit card for people with fair credit that offers 1% cash back on eligible purchases and charges an annual fee of $39. Although it does not require a security deposit, the Credit One Bank Credit Card is not cheap.

Additional Card Benefits

- Contactless. Payment.

- Zero. Fraud Liability.

- Free Online Access. to credit score†

- Easy-To-Use. Mobile App.

- Customizable. Notifications.

- Choose a New Payment. Due Date.

Visa Platinum card benefits

From golf to dining to shopping and more, Visa Platinum lets you enjoy a host of attractive lifestyle privileges and experiences. Extended Warranty adds real value to your Visa Platinum card.

Credit One Bank is an online-only bank that exclusively offers credit cards. It is a technology and data-driven financial services company that is based in Las Vegas. The bank offers American Express and Visa credit cards to millions of customers across the United States.

The Credit One Bank® Platinum Visa® can earn you cash back. But keep an eye on the expensive fees and high variable purchase APR of 29.24%* Variable - these can quickly eat into anything you might earn.

The main difference between Visa Signature and Visa Platinum is the rewards programs and minimum credit limits. However, if you're looking for a card with cash back 33, Visa Platinum is your best bet. If you prefer more travel benefits, then you'll love Visa Signature 43. Learn more about cash back vs.

'Platinum' is a category of debit card issued by Visa. Visa is a globally recognised payment platform that issues debit and credit cards.

The Credit One Bank® Platinum Visa® can earn you cash back. But keep an eye on the expensive fees and high variable purchase APR of 29.24%* Variable - these can quickly eat into anything you might earn.

Browse and compare Credit One Bank Visa credit cards. Comparing interest rates, annual fees, rewards and benefits of Visa cards from Credit One Bank is easy.

A Visa Platinum debit card offers higher credit limit and exceptional features like extended warranty coverage, price protection, advanced fraud protection measures, and more! Additionally, you get top-quality customer assistance, reward points, complimentary travel insurance, and access to airport lounges.

The Capital One Platinum card charges as few fees as possible, making it a great choice for cardholders who want to avoid costs that can build up over time. Although you'll still pay for cash advances and late payments, you aren't charged foreign transaction fees or an annual fee.

50,000 per day from ATM. Purchase limit of Rs. 2,00,000 per day (POS). Card can be used for domestic as well as international transactions.

As one of the largest credit card banks in the United States, Credit One Bank issues Visa®, Mastercard® and American Express® cards to millions of card members nationwide.

Platinum credit cards are usually the crème de la crème of the credit card world. Generally, they're a step up from a gold credit card and are reserved for those with a good credit score providing you with access to a range of offers and perks, as well as a higher credit limit than standard options.

High or uncapped credit limit: Platinum cards have a higher credit limit than regular or gold cards which gives you much more flexibility in spending. More rewards points per rupees spent: These cards will give you more reward points than other credit cards for the same amount of money.

While it's not the best balance transfer card offer available, the U.S. Bank Visa Platinum card carries one of the better intro periods for both purchases and balance transfers. But like most balance transfer cards, its lack of rewards hinders its ongoing value after you've settled your balance.