What is Credit One Bank Wander Card?

Credit One Bank launched their Wander Card as a new offering that caters specifically to travel enthusiasts and adventurers. This credit card is designed to address the unique needs of travelers, making it an excellent choice for those who frequently embark on journeys and vacation trips.

The Wander Card offers attractive rewards and perks for those who take advantage of its features. Customers who use the card are automatically enrolled in the Wander Cash program, where they earn cashback rewards for every purchase made on qualified travel bookings. They can earn up to 5% cashback on select purchases, such as lodging, airfare, and car rentals.

Moreover, the Wander Card comes with no annual fees, making it a practical and convenient option for frequent travelers who don't want to commit to additional costs. The card's benefits are also customizable, as customers can adjust their rewards programs as needed to suit their needs.

When it comes to safety, the Wander Card boasts top-of-the-line security features, including fraud detection and monitoring services, ensuring that customers can enjoy their travels worry-free. The card also provides access to 24/7 customer service and support, making it an ideal choice for those who need immediate assistance while on the go.

Overall, Credit One Bank's Wander Card is an excellent credit card option for travel enthusiasts seeking to maximize the benefits of their experiences and add more value to their trips. With its exceptional perks, competitive rewards program, and top-notch security features, this credit card is a must-have for those who want to travel with peace of mind and convenience.

Frequently Asked Questions about credit one bank wander card

The Credit One Bank Wander Card offers a variety of ways to earn rewards and to redeem those rewards: 10 points per $1 on hotels and car rentals booked through the Credit One Bank travel partner. 5 points per $1 on travel, dining and gas. 1 point per $1 on all other purchases.

Credit One Bank is an online-only bank that exclusively offers credit cards. It is a technology and data-driven financial services company that is based in Las Vegas. The bank offers American Express and Visa credit cards to millions of customers across the United States.

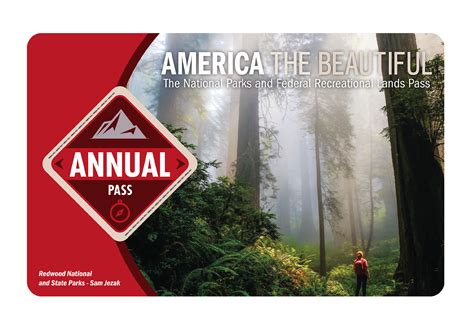

As to be expected in a travel card, the Wander Card offers its highest rewards rates on travel purchases. You'll earn: 10x points on eligible hotels and car rentals booked using the Credit One Bank travel platform, accessed via the link in the Credit One Bank mobile app or your online account.

Best for earning alternative rewards for travel purchases. The Wander Card from Credit One Bank is a rewarding travel card designed to earn you the most for your travel purchases.

This means Credit One Bank will add a surcharge of either 3% or $1, whichever is greater, anytime you use the Credit One Bank® Platinum Visa® outside of the United States. The fee of 3% or $1, whichever is greater, also applies to online purchases made through an internationally-based merchant.

Best Credit One Bank Cards of October 2023

- Credit One Bank® Platinum Rewards Visa:

- Credit One Bank® Visa® Cash Back Rewards:

- Credit One Bank® Platinum Rewards Visa with No Annual Fee:

- Credit One Bank American Express® Card:

As one of the largest credit card banks in the United States, Credit One Bank issues Visa®, Mastercard® and American Express® cards to millions of card members nationwide.

Credit One credit cards have a starting credit limit of at least $300 to $500. Credit One credit card applicants with the highest credit scores and the most income have the best chance of getting the highest starting credit limits.

Visa and Mastercard are usually accepted anywhere you can pay with a card. So if you want to use a Discover or Amex card abroad, you may want to bring a Visa or Mastercard along as well, just to be safe.

Platinum Visa Credit Card | Credit One Bank.

No, our experts don't recommend Credit One Bank because of its fees and predatory practices. The annual fees that Credit One Bank charges are expensive for what its cards offer. It tacks on fees for services that are free from reputable credit card companies, including express payments and credit limit increases.

Is Credit One Bank reputable? Credit One Bank is a credit card company with a poor reputation because of its fees and lack of basic services. It offers credit cards for consumers with bad credit. However, it charges so many fees that it arguably takes advantage of people who don't have many credit card options.

OneCard is a metal credit card that is offered in collaboration with several providers including SBM Bank, South Indian Bank, Federal Bank, BOB Financial and CSB Bank. It is a lifetime-free credit card that is best suited for people who are new to credit and want to earn reward points on their purchases.

Generally speaking, banks and lenders may grant credit limits based on a person's credit risk profile, history, and other factors. However, the maximum credit limit offered in India can be anywhere from Rs. 50,000 to even Rs. 10 Lakhs, depending on the lender.

Best Credit One Bank Cards of October 2023

- Credit One Bank® Platinum Rewards Visa:

- Credit One Bank® Visa® Cash Back Rewards:

- Credit One Bank® Platinum Rewards Visa with No Annual Fee:

- Credit One Bank American Express® Card:

Here we list two banks which offer debit cards that might be worth considering if you're travelling abroad.

- Chase current account. Best debit card to use abroad.

- First Direct current account.

- Starling Bank current account*

- Halifax Clarity.

- Barclaycard Rewards.

- Metro Bank Credit Card (in Europe)

- Zopa.

- Revolut*