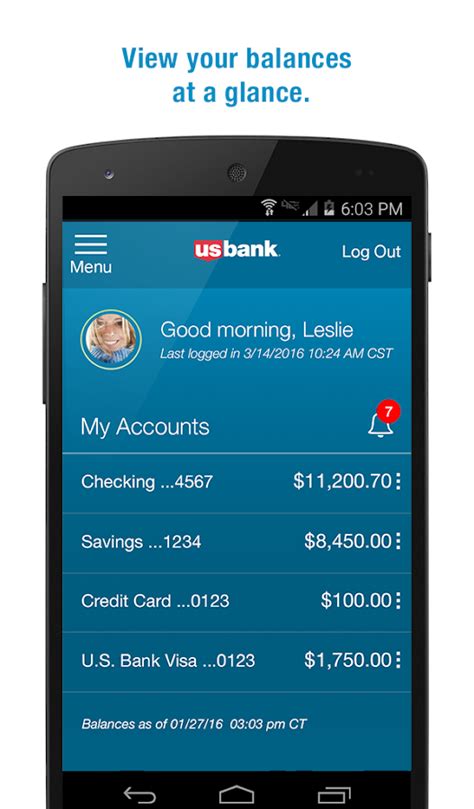

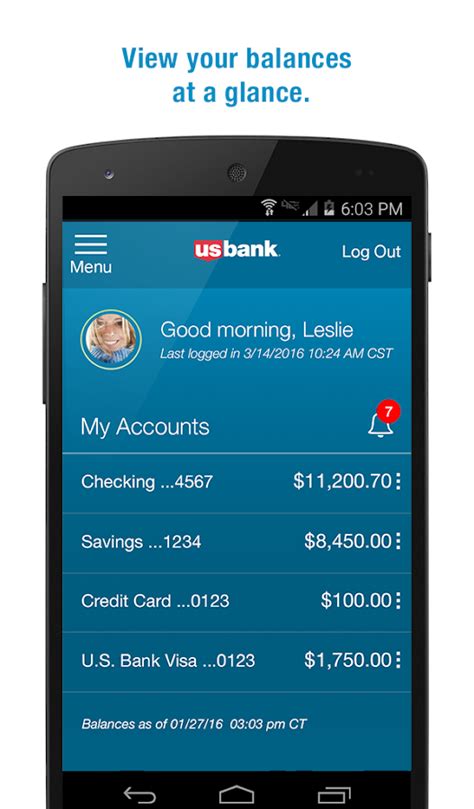

What is U.S. Bank App?

The U.S. Bank App is a mobile application that allows U.S. Bank customers to access their accounts and manage their finances from their smartphones or tablets. The app offers a wide range of features, making it easy for users to check their account balances, pay bills, transfer funds, deposit checks, and much more.

One of the most popular features of the U.S. Bank App is the ability to deposit checks remotely. Users can simply take a picture of their check using the camera on their device and submit it for deposit. This eliminates the need to go to a physical bank location to deposit checks, making it more convenient for busy customers.

The app also allows users to set up alerts for account activity, such as when a deposit has been made or when a payment is due. This feature helps to ensure that users stay on top of their finances, avoid overdraft fees, and minimize the risk of fraudulent activity.

In addition to these features, the U.S. Bank App also provides users with detailed transaction histories, customizable budgeting tools, and the ability to add and manage their debit and credit cards. Overall, the app is easy to use, reliable, and provides U.S. Bank customers with a seamless mobile banking experience.

Frequently Asked Questions about u.s. bank app

The company provides banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial institutions. It has 3,106 branches and 4,842 automated teller machines, primarily in the Western and Midwestern United States.

No matter what you choose, you'll get:

- Top-rated digital tools. Enjoy mobile check deposit, account alerts, financial insights and more.

- Fraud protection. You're protected with the industry's strongest available encryption.

- National ATM network. Avoid ATM fees 1 with one of the largest ATM networks in America.

Industry benchmarking firm Keynova Group ranked U.S. Bank #1 for mobile app in its Q3 2021 Mobile Banker Scorecard.

Let's explore how to download the U.S. Bank Mobile App on your Android device.

full-service bank

U.S. Bank is a full-service bank that provides a wide range of financial services and products, including credit cards, home mortgages, personal loans, lines of credit, vehicle loans and more.

Avoid Transaction and Conversion Fees

Exchange rates are unpredictable as well. This is where having a U.S. dollar bank account is especially handy. Foreign transactions fees can come with international transfers and expensive conversion fees.

The Federal Reserve System is the central banking system of the United States. The Fed uses the system and the tools it has to set interest rates and regulate the money supply to accomplish its mandate of price stability and maximum employment.

Log in to the U.S. Bank Mobile App. Don't have the app? Get it free for your iOS or AndroidTM mobile device.

One mobile bank app for all your money needs

Bring digital banking with you wherever you go with the U.S. Bank Mobile App. Complete simple everyday tasks. Have quick access to money management tools. Securely connect your accounts from other financial institutions for a full view of your money.

* The U.S. Bank Mobile App awards include: No. 1 in Insider Intelligence's 2022 Mobile Banking scorecard.

Ranked #1 by a consensus of benchmarking firms, the app just keeps getting better – and extending its lead. When U.S. Bank launched its new mobile app in 2019, the bank wanted to give its customers the best tools possible to manage their money.

U.S. Bancorp

Is U.S. Bank part of U.S. Bancorp? Yes, U.S. Bancorp [NYSE: USB] is the publicly traded parent company of U.S. Bank. While we often use U.S. Bancorp in formal documents and corporate filings, U.S. Bank is what you'll see on branch doorways, app stores, national television commercials and much more.

A U.S. dollar bank account is an account that holds U.S. dollars (USD) for you at your Canadian bank - no conversion to Canadian dollars (CAD) necessary. You might want to keep your USD in its native currency for the following reasons: You have U.S. clients that want to pay you in USD.

Standard Savings Account

Maintain a $300 minimum daily balance. Keep a $1,000 average monthly collected balance. Hold the account jointly with an individual age 17 and under.

Board of Governors of the

Board of Governors of the Federal Reserve System

The Board of Governors--located in Washington, D.C.--is the governing body of the Federal Reserve System. It is run by seven members, or "governors," who are nominated by the President of the United States and confirmed in their positions by the U.S. Senate.

The banking sector is vital to the U.S. and world economies. Its primary function is to safeguard depositors' assets and make loans to individuals and businesses. Banks are regulated by the federal government, and sometimes state governments, to try to keep them from taking on too much risk and imperiling the economy.