What is Mastercard Credit Touch Card?

The Mastercard Credit Touch Card is a revolutionary new credit card that allows for secure and contactless payments through the use of touch technology. This card features a built-in fingerprint sensor that enables cardholders to quickly and easily complete transactions without the need for a PIN or signature.

Using this card is incredibly simple: when making a payment, all the cardholder needs to do is place their finger on the sensor located on the card's front-facing side. The sensor quickly and securely identifies the cardholder and validates the transaction, allowing for a seamless payment experience.

Not only is the Mastercard Credit Touch Card incredibly convenient and easy to use, but it's also highly secure. The use of biometric technology ensures that only the cardholder themselves can authorize payments, making fraud and theft virtually impossible. Additionally, since there is no need for a PIN or signature, the risk of forgetfulness or theft of these pieces of information is eliminated.

Another great feature of the Mastercard Credit Touch Card is its compatibility with many popular mobile wallets, including Apple Pay, Google Pay, and Samsung Pay. This means that cardholders can make payments using their mobile device with ease, further simplifying the payment process.

In conclusion, the Mastercard Credit Touch Card is a cutting-edge credit card that offers security, convenience, and ease of use all in one. With its touch technology and biometric authentication, this card is sure to make the payment process smoother and more secure for cardholders everywhere.

Frequently Asked Questions about mastercard credit touch card

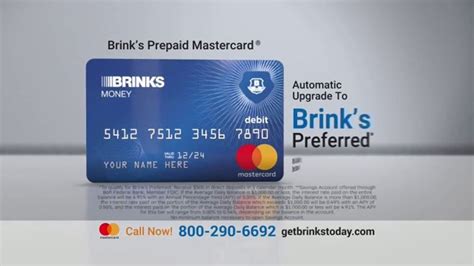

Standard credit card. World Mastercard® World Elite Mastercard® Prepaid and digital banking. Priceless® Mastercard® gift cards.

A credit card is a type of credit facility, provided by banks that allow customers to borrow funds within a pre-approved credit limit. It enables customers to make purchase transactions on goods and services.

touch Visa Card offers you the convenience of a payment card in fresh $, that can be used locally & internationally, and that will instantly grant you FREE MBs on your touch line.

Use your Mastercard® credit card for everyday purchases - at stores, online and even places that don't accept cash or checks, like hotels. Your Mastercard gives you the freedom to support the lifestyle you choose.

Visa and Mastercard: Key differences

The only real differences between Visa and Mastercard are the features and rewards individual cards offer. Both payment networks extend three different tiers of credit cards that are geared to users with different credit profiles.

Both Visa and Mastercard provide a very similar service. They basically process your credit card payments on a payment network. Naturally, Visa credit card payment cannot be processed on Mastercard networks and vice versa. In terms of functionality, there's virtually no difference between the two.

What are the 4 types of credit cards? The types of credit cards are categorised as per their used cases. Four types of credit cards include travel credit cards, business credit cards, reward credit cards, and shopping credit cards among others.

Fortunately, most cards can be classified into three major categories based on the features they offer: rewards credit cards, low interest and balance transfer cards, and credit-building cards.

Contactless cards use radio-frequency identification (RFID) technology. This allows the card to communicate with the card reader when the card is held near the reader during a transaction.

Yes, contactless credit cards are secure because they use the same security standards for transactions as EMV chip credit cards. Whether you're using a contactless credit card and tapping to pay or inserting your EMV chip card into a card reader, the sensitive information sent to the card reader is encrypted.

The key difference is that debit cards are linked to a bank account and draw directly from those funds (similar to a check). A credit card, on the other hand, does not draw any money immediately and must be paid back in the future, subject to any interest charges accrued.

The tier you receive varies by credit card, but you'll typically need to pay a higher annual fee to benefit from a higher tier. Beyond tiers, Mastercard holders can earn competitive rewards, benefit from no annual fees and even pay off debt with an intro 0% APR depending on which card you have.

Greater security features, including the ability to confirm online purchases via your banking app, or mobile phone. With VISA, if I want to confirm an online purchase I have to enter a password - with Mastercard it's 'log into app' or 'receive one-time code via text.

For you as a consumer, there is no real discernible difference between Visa or Mastercard®. Both are simply forms of payments. Their real strength for consumers lies in that they are accepted by the overwhelming majority of merchants in the UK and in over 200 countries around the world.

Benefits comparison: Visa vs. Mastercard. On entry level cards, there is very little difference between Visa and Mastercard, as both provide a similar suite of basic features. However, Mastercard includes impressive special luxury offers on its World and World Elite level cards, which can be attractive for big spenders ...

The four major credit card networks in the United States are Visa, Mastercard, American Express and Discover. All four are widely accepted within the U.S. Abroad, your best bet may be Visa or Mastercard, because Amex and Discover acceptance lags in some countries.