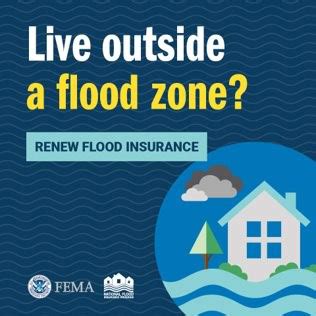

What is FEMA Preferred Risk Policy?

The FEMA Preferred Risk Policy (PRP) is a type of flood insurance policy that is offered to property owners who reside in low-to-moderate-risk flood zones. The PRP provides flood insurance protection at a lower cost than standard flood insurance policies, making it a more affordable option for those who live in areas with low-to-moderate flood risk.

The PRP policy provides coverage for both residential and commercial properties, offering protection for up to $250,000 for physical damage caused by flooding to the building and its contents. This policy is also renewable on an annual basis, with the option to increase or decrease coverage levels based on the property owner's needs.

To be eligible for the PRP policy, the property must be located in a low-to-moderate-risk flood zone, as determined by FEMA and its flood maps. Property owners in high-risk flood zones are not eligible for the PRP policy and must purchase a standard flood insurance policy instead.

The PRP policy is an excellent option for property owners who reside in areas with low-to-moderate flood risk but still want peace of mind when it comes to flood protection. By having this policy in place, property owners can protect their investment from the costly damages and devastation that can result from flooding events.

Frequently Asked Questions about fema preferred risk policy

noun. : an insured that an insurer deems has a lower than average chance of loss and that usually may pay a lower premium.

You can also call the National Flood Insurance Program (NFIP) at 877-336-2627. For residential properties, you can secure coverage up to $250,000 for the building and $100,000 for the building contents.

Definition of preferred risk

insured, or an applicant for insurance, with lower expectation of incurring a loss than the standard applicant. For example, an applicant for life insurance who does not smoke can usually obtain a reduced premium rate to reflect greater life expectancy.

An applicant who receives a preferred risk classification qualifies for: Lower premiums than a person who receives a standard risk. The preferred risk category is reserved for those persons with a superior physical condition, lifestyle, and habits.

Moderate- to low-risk flood areas are designated with the letters B, C, and X on FEMA flood maps. In these areas, the risk of being flooded is reduced, but not completely removed.

The most expensive state for flood insurance is Connecticut with an average cost of $1,491 a year.

- Connecticut.

- Hawaii.

- Massachusetts.

- Rhode Island.

- New Jersey.

Risk-specific insurance policies provide protection for businesses and individuals against certain identified exposures that might not be covered by a traditional insurance policy. Traditional insurance policies often cover all risks unless the risk is specifically excluded by the policy.

Most pure risks can be divided into three categories: personal risks that affect the income-earning power of the insured person, property risks, and liability risks that cover losses resulting from social interactions. Not all pure risks are covered by private insurers.

Criteria for selecting variables may be summarized into the following categories: actuarial, operational, social, and legal.

There are four main risk classes: preferred plus, preferred, standard plus, and standard. Your risk class is determined by factors like your age, health, occupation, and lifestyle. If you're in a higher risk class, you may have to pay more for life insurance.

The Netherlands

The Netherlands has one of the best flood control systems in the world, notably through its construction of dykes. The country faces high flooding risk due to the country's low-lying landscapes.

The Southeast Asia region alone makes up more than two-thirds of the global population exposed to flooding risk at 1.24 billion people. China and India account for 395 million and 390 million people, respectively, with both nations at the top in terms of the absolute number of people at risk of rising water levels.

approximately $700 annually

According to FEMA, the average flood insurance cost for a policy from the National Flood Insurance Program (NFIP) is approximately $700 annually. However, your price will vary based on your location, type of home, and other factors.

Widespread Floods

most costly and covers the largest area. Widespread flooding is often referred to as the “slow and leisurely disaster” because floods of this magnitude often take weeks or months to develop.

Examples of Product Risks are:

- Complex features affecting multiple areas of the existing product, like an upgrade/migration of the system.

- New Technologies used in the product; for example a new DB server, a new programming language, a new integration, etc.

Market risks – Success of a new product can come down to several external factors, including customer sentiment, economic conditions, and unforeseen circumstances (a certain pandemic comes to mind). Often, timing is critical when introducing an innovative product into the market.