What is Augusta Precious Metals Physical Gold IRA?

Augusta Precious Metals is a well-known and reputable company that offers physical gold IRA services. The company aims to empower retirement savers to gain peace of mind by investing in gold IRAs, which can help to diversify their investment portfolios and protect against economic uncertainty.

The process of acquiring physical gold and silver from Augusta Precious Metals is simple and hassle-free , with a three-step process in place. Additionally, the company provides education and resources to help customers make informed decisions about their investments and understand the benefits of a gold IRA.

Augusta Precious Metals is a family-owned and operated company , and it has built its reputation on transparency, integrity, and respect. The company is highly rated by various consumer advocacy groups, including the Better Business Bureau and Consumer Affairs.

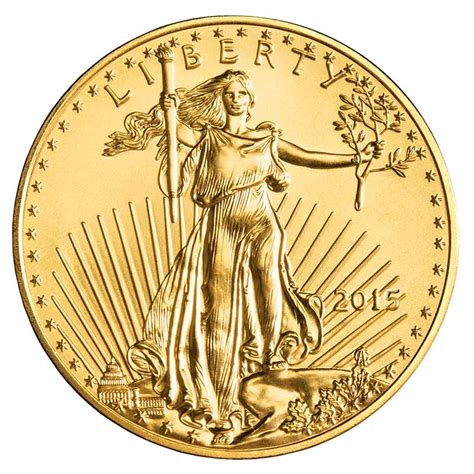

Investing in a physical gold IRA with Augusta Precious Metals can be a sound strategy for retirement savings. Gold has historically been a store of value and a hedge against inflation, making it a valuable addition to a diversified investment portfolio. With Augusta Precious Metals' expertise and guidance, customers can confidently navigate the process of investing in a physical gold IRA and potentially reap the benefits of investing in precious metals.

Frequently Asked Questions about augusta precious metals physical gold ira

A gold IRA allows you to buy, sell and hold gold within a tax-advantaged individual retirement account. You open a gold IRA with the company of your choice who works with a custodian that manages the storing and tracking of your physical gold, for a fee.

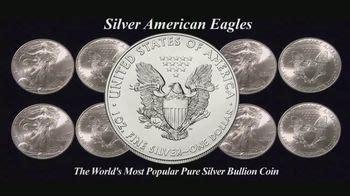

A gold IRA or precious metals IRA is an Individual Retirement Account in which physical gold or other approved precious metals are held in custody for the benefit of the IRA account owner. It functions the same as a regular IRA, only instead of holding paper assets, it holds physical bullion coins or bars.

Top Gold IRA Companies: Reviews & Comparison

- Augusta Precious Metals.

- Goldco.

- American Hartford Gold.

- Birch Gold Group.

- Noble Gold Investments.

Stellar reputation and accreditations: With a remarkable 4.95-star rating from over 930 reviews and an A+ rating on the Better Business Bureau (BBB), Augusta Precious Metals has earned the trust and respect of its clients.

Gold IRAs appeal to investors who want a diversified retirement portfolio. “Because gold prices generally move in the opposite direction of paper assets, adding a gold IRA to a retirement portfolio provides an insurance policy against inflation,” says Moy.

An IRA, or individual retirement account, is an account for your retirement that enables you to delay paying taxes until the money is withdrawn. It's similar to a 401(k), but instead of the account being managed by your employer, this is an account you choose and manage yourself.

An individual retirement account (IRA) is a long-term savings account that individuals with earned income can use to save for the future while enjoying certain tax advantages.

Gold IRAs appeal to investors who want a diversified retirement portfolio. “Because gold prices generally move in the opposite direction of paper assets, adding a gold IRA to a retirement portfolio provides an insurance policy against inflation,” says Moy.

Benefits of a Gold IRA (or Other Self-Directed Precious Metals IRA)

- #1: Diversification. Diversification is rule number one when it comes to protecting and growing your wealth.

- #2: Insurance.

- #3: Hedge Against Inflation.

- #4: Control.

- #5: Growth Potential.

- #6: Tax Advantages.

While gold IRAs offer plenty of positives, they also have some potential negatives to keep in mind. Relatively low returns: The flip side of gold's stability is that its returns aren't as high as riskier assets can be. For this reason, you should include a variety of assets in your portfolio for the best outcome.

Augusta is one of the leading companies offering gold IRA accounts for over 10 years. Augusta's competitive prices on products backed by a track record of excellent customer service for the lifetime of the account make the company a trusted name in the gold IRA industry.

There are eight metals that are considered precious. They are gold, silver, platinum, palladium, rhodium, ruthenium, iridium, and osmium.

Since investing in a gold IRA allows you to purchase IRS-eligible physical gold that can be liquidated once you reach your retirement age, it is undoubtedly a secure way to store your funds.

Contribution limits for traditional, Roth and SEP gold IRAs

| Contribution limits in 2023 |

|---|

| Traditional gold IRA | $6,500 or $7,500 for 50 years or older. |

| Roth gold IRA | $6,500 or $7,500 for 50 years or older. |

| SEP gold IRA | 25% of employee compensation or $66,000 maximum. |

The three main types of IRAs are traditional IRAs, Roth IRAs and rollover IRAs. Traditional IRAs are funded with pretax dollars, while Roth IRA contributions are made after taxes. A rollover IRA is an IRA funded with money from a former employer-sponsored 401(k) that doesn't incur early withdrawal penalties.

A traditional IRA lets you defer taxes now and pay them when you withdraw the money for your retirement. If you suspect you'll be in a lower tax bracket in retirement, a traditional IRA can save you money in the long run. It includes some special penalty-free withdrawals for certain purchases.