What is State Street Global Advisors DIA SPDR Dow Jones Industrial Average ETF Trust?

State Street Global Advisors (SSGA) is a division of State Street Bank and Trust Company , which offers various investment products, including exchange-traded funds (ETFs). One of its popular ETF offerings is the SPDR Dow Jones Industrial Average ETF Trust (DIA).

DIA seeks to provide investment results that correspond generally to the price and yield performance of the Dow Jones Industrial Average (DJIA). The DJIA is a price-weighted index that tracks the performance of 30 large-cap American companies across various industries.

Investing in DIA allows investors to gain exposure to the performance of the DJIA and its constituent companies , which include well-known names such as Apple, Microsoft, and Coca-Cola. The ETF offers diversification across multiple companies and industries, which can help reduce risk.

DIA is the only ETF that is focused solely on tracking the DJIA, and it has remained a popular choice for investors seeking exposure to the index. In addition, SSGA offers various other ETFs that cover different indices and asset classes.

Overall, State Street Global Advisors DIA SPDR Dow Jones Industrial Average ETF Trust is a popular investment product that provides investors with exposure to the DJIA and its constituent companies.

Frequently Asked Questions about state street global advisors dia spdr dow jones industrial average etf trust

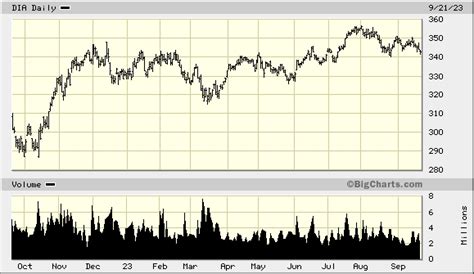

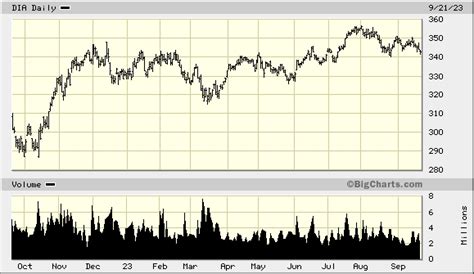

DIA

DIA - SPDR Dow Jones Industrial Average ETF Trust.

DIA tracks a price-weighted index of 30 large-cap US stocks, selected by the editors of the Wall Street Journal. Despite the name recognition that comes from tracking the Dow and its own popularity, DIA is not the ideal ETF for investors who want broad-based exposure to US large-caps.

Top 10 Holdings

- UnitedHealth Group Inc. 10.32%

- Microsoft Corp. 6.43%

- The Goldman Sachs Group Inc. 6.14%

- The Home Depot Inc. 5.76%

- Amgen Inc. 5.26%

- Caterpillar Inc. 5.23%

- McDonald's Corp. 4.88%

- Visa Inc Class A. 4.62%

DIA Holdings List

| No. | Symbol | Weight |

|---|

| 1 | UNH | 10.17% |

| 2 | MSFT | 6.26% |

| 3 | GS | 6.11% |

| 4 | HD | 5.83% |

stock index

The DJIA is a stock index that tracks the share prices of 30 of the largest U.S. companies. Like the S&P 500, the DJIA is often used to describe the overall performance of the stock market.

Direct investing

The first option is to make US stock investment from India by opening an overseas trading account with an Indian broker. Your other option is to open an overseas trading account with a foreign broker. Domestic brokers who offer this facility have tie-ups with US stockbrokers.

ETFs or "exchange-traded funds" are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. When you invest in an ETF, you get a bundle of assets you can buy and sell during market hours - potentially lowering your risk and exposure, while helping to diversify your portfolio.

SPDR Dow Jones Industrial Average ETF holds a Zacks ETF Rank of 1 (Strong Buy), which is based on expected asset class return, expense ratio, and momentum, among other factors. Because of this, DIA is an excellent option for investors seeking exposure to the Style Box - Large Cap Value segment of the market.

As of January 16, 2023, State Street's SPDR S&P 500 ETF Trust was the highest valued exchange traded fund (ETF) globally, with a market capitalization of over 365 billion U.S. dollars.

The SPDR S&P 500 ETF Trust (SPY) seeks to track the performance of the S&P 500 index, which is a cap-weighted basket of the largest publicly traded companies in the U.S. SPY is the oldest ETF listed on a U.S. exchange and is the largest ETF as measured by AUM.

The creation of the Agency was the result of recommendations contained in a 1960 report prepared by the Joint Study Group on Foreign Intelligence Activities of the United States Government, and from Secretary of Defense Robert McNamara's own desire to achieve unity of effort in the production of military intelligence ...

The Defence Intelligence Agency (DIA) is an intelligence agency responsible for providing and coordinating defence and military intelligence to the Indian Armed Forces.

The DJIA is one of the oldest U.S. indexes, having been created in 1896. In its modern form, the Dow tracks the prices of 30 blue-chip stocks. These stocks are from large companies with long histories of strong performance.

The first option is to make US stock investment from India by opening an overseas trading account with an Indian broker. Your other option is to open an overseas trading account with a foreign broker. Domestic brokers who offer this facility have tie-ups with US stockbrokers.

Investing in US stocks or ETFs by Indian investors is permissible under the RBI's Liberalized Remittance Scheme (LRS), by using purpose code S0001 (fun fact: you can also open US bank accounts under this purpose code).

Yes, Indians can invest in the US stock market. There is more than one way to buy and hold US stocks in your portfolio. Direct equities, ETFs, and mutual funds are just one of the few popular options. You can invest in US stocks in two ways from India – indirect and direct.