Silver & Partners tv commercials

TV spots

TV commercials with the participation of Silver & Partners

Advertisers

Advertisers of commercials featuring Silver & Partners

CarMax

What is CarMax?CarMax is a company that specializes in buying and selling used cars. They are the largest used-car retailer in the United States and have been in business for over 25 years. The compan...

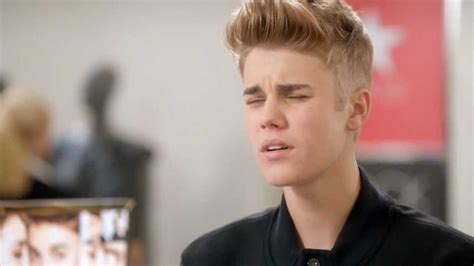

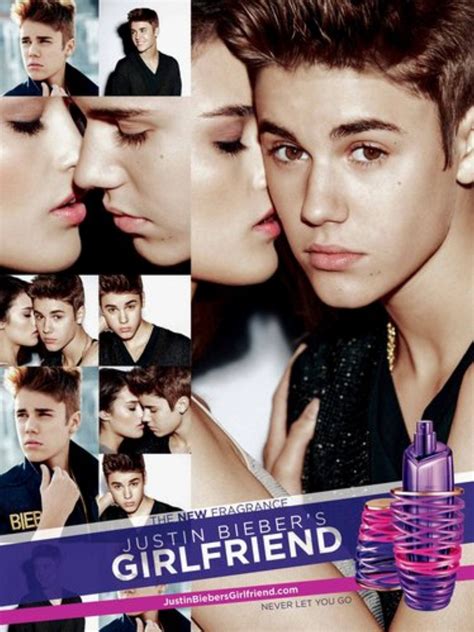

Justin Bieber

Title: Revolutionizing the Music Industry: The Phenomenon of Company Justin BieberIntroduction:In the world of music, there are few names as recognizable as Justin Bieber. From humble beginnings as a...

Actors

Actors who starred in Silver & Partners commercials

What kind of company is Silver & Partners?

Silver & Partners is a full-service creative advertising agency with a long-standing reputation for delivering unparalleled creative solutions. This New York-based company was founded in 2013 and has been making waves in the industry ever since.

At Silver & Partners, the team prides itself on their ability to break through the noise to deliver powerful messaging and compelling campaigns that connect with audiences in meaningful ways. They provide a wide range of services including brand strategy, creative development, production, media planning and buying, and analytics and measurement.

Some of the notable clients that Silver & Partners has worked with include Heineken, Amazon, and Burger King. Their work has also been recognized with numerous awards and accolades across a range of categories, including the Cannes Lions, Adweek Media Plan of the Year, and the Effie Awards.

The team at Silver & Partners is made up of a diverse group of creatives, strategists, producers, and account managers who are passionate about their work and dedicated to delivering the best possible outcomes for their clients. Their approach to every project is highly collaborative, with an emphasis on communication, transparency, and creatively solving problems together.

Overall, Silver & Partners is a dynamic and innovative agency that pushes the boundaries of what is possible in the world of advertising. With their exceptional creativity, strategic mindset, and deep commitment to client success, they are a force to be reckoned with in the industry and a top choice for organizations seeking cutting-edge marketing solutions.

Social media links

Frequently Asked Questions about silver & partners

Products

Products advertised with participation of Silver & Partners

Def Jam Recordings is an American record label specializing in hip hop and urban music genres. One o...

Justin Bieber has had several high-profile relationships over the years, including with famous names...