Security 1 Lending Reverse Mortgages TV commercial - Life Changing

Advertisers

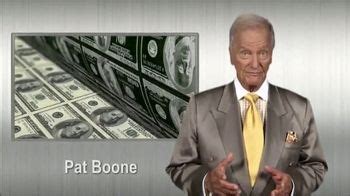

Advertisers of the Security 1 Lending Reverse Mortgages TV Spot, 'Life Changing'

Security 1 Lending

Security 1 Lending is a financial company that specializes in reverse mortgages. It was founded in 2006, and since then, it has been providing excellent services to its clients. The company is headqua...

What the Security 1 Lending Reverse Mortgages TV commercial - Life Changing is about.

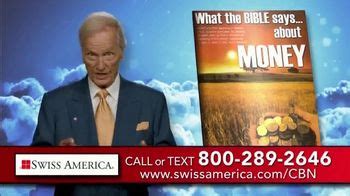

Security 1 Lending's TV spot for their reverse mortgages is titled 'Life Changing' and focuses on the positive impact a reverse mortgage can have on seniors' lives. The spot features real-life testimonials from senior citizens who have used Security 1 Lending's services and are now living a more comfortable and worry-free life.

The commercial begins with a woman sharing her anxieties about retirement and the lack of funds available to support her. However, her worries are put to rest when she discovered Security 1 Lending. The next testimonial is from a couple who express their delight with the financial flexibility that their new reverse mortgage has given them.

The ad then shifts its focus to the specific features of Security 1 Lending's reverse mortgage, highlighting its low interest rates, flexible payment options, and the ability to stay in the home without making a mortgage payment.

The TV spot ends with an invitation to viewers to call Security 1 Lending's offices and learn more about how their reverse mortgage program can positively change their lives.

In short, Security 1 Lending's reverse mortgages TV spot is a powerful and heartwarming ad that showcases the transformative impact of their services on seniors' lives. Through real-life testimonials and a focus on the financial flexibility and security offered by their program, Security 1 Lending's commercial aims to inspire viewers to take control of their financial future with their reverse mortgage options.

Security 1 Lending Reverse Mortgages TV commercial - Life Changing produced for Security 1 Lending was first shown on television on May 11, 2015.

Frequently Asked Questions about security 1 lending reverse mortgages tv spot, 'life changing'

Videos

Watch Security 1 Lending Reverse Mortgages TV Commercial, 'Life Changing'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Actors

Actors who starred in Security 1 Lending Reverse Mortgages TV Spot, 'Life Changing'

TV commercials

Similar commercials