American Advisors Group Reverse Mortgage Loan TV commercial - Reverse Your Thinking

Advertisers

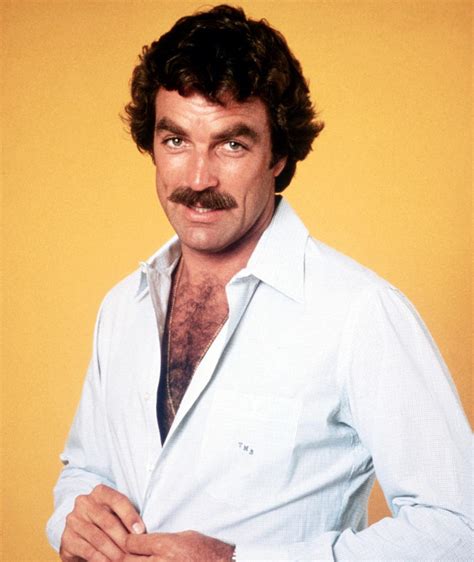

Advertisers of the American Advisors Group Reverse Mortgage Loan TV Spot, 'Reverse Your Thinking' Featuring Tom Selleck

American Advisors Group (AAG)

American Advisors Group (AAG) is a company that specializes in providing reverse mortgage loans and other home equity retirement solutions. With a focus on helping seniors build a more financially sec...

What the American Advisors Group Reverse Mortgage Loan TV commercial - Reverse Your Thinking is about.

The American Advisors Group has recently launched a new TV spot for their Reverse Mortgage Loan program, which features popular actor Tom Selleck. The ad, titled 'Reverse Your Thinking,' aims to educate viewers about the benefits of reverse mortgage loans and how they can help senior citizens live a better and more financially stable life.

The ad opens with Selleck sitting in a living room, speaking directly to viewers about the many challenges that seniors face when it comes to retirement and finances. He acknowledges that many traditional retirement investments, like 401(k)s and Social Security payments, may not be enough to cover the high costs of healthcare, housing, and other expenses.

To combat this issue, Selleck introduces the American Advisors Group's Reverse Mortgage Loan program, which he states can provide seniors with the financial freedom and stability they need to live confidently in their golden years. The ad goes on to explain how the program works, using simple and easy-to-understand language that makes it accessible to all viewers.

The overall message of the ad is that it's never too late for seniors to take control of their finances and secure a better future for themselves and their loved ones. By choosing the reverse mortgage loan program offered by American Advisors Group, seniors can unlock the equity in their homes and use it to cover their expenses and live a better life.

Overall, the American Advisors Group Reverse Mortgage Loan TV Spot, 'Reverse Your Thinking' Featuring Tom Selleck, is a powerful and effective marketing tool that not only educates viewers about the benefits of reverse mortgage loans but also encourages them to take control of their financial future. With its engaging visuals, clear messaging, and compelling narration, this ad is sure to be a hit with seniors across the country.

American Advisors Group Reverse Mortgage Loan TV commercial - Reverse Your Thinking produced for American Advisors Group (AAG) was first shown on television on July 15, 2019.

Frequently Asked Questions about american advisors group reverse mortgage loan tv spot, 'reverse your thinking' featuring tom selleck

Videos

Watch American Advisors Group Reverse Mortgage Loan TV Commercial, 'Reverse Your Thinking'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Actors

Actors who starred in American Advisors Group Reverse Mortgage Loan TV Spot, 'Reverse Your Thinking' Featuring Tom Selleck

Products

Products Advertised

TV commercials

Similar commercials

![Jaguar TV Spot, 'Ultimate Joyride' [T1] Jaguar TV Spot, 'Ultimate Joyride' [T1]](https://connect4productions.com/image/Jaguar%20TV%20Spot,%20%27Ultimate%20Joyride%27%20%5BT1%5D/tv)

![Lexus Special July 4th Offer TV Spot, 'To Err Is Human' [T2] Lexus Special July 4th Offer TV Spot, 'To Err Is Human' [T2]](https://connect4productions.com/image/Lexus%20Special%20July%204th%20Offer%20TV%20Spot,%20%27To%20Err%20Is%20Human%27%20%5BT2%5D/tv)

![Jeep Labor Day Sales Event TV Spot, 'Traffic Jams' [T2] Jeep Labor Day Sales Event TV Spot, 'Traffic Jams' [T2]](https://connect4productions.com/image/Jeep%20Labor%20Day%20Sales%20Event%20TV%20Spot,%20%27Traffic%20Jams%27%20%5BT2%5D/tv)