What is American Advisors Group (AAG) Reverse Mortgage?

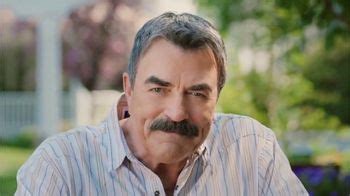

American Advisors Group (AAG) is the nation's largest provider of reverse mortgages , a financial product designed to allow seniors 62 and older to borrow against the equity in their homes to supplement their retirement income. The company was founded in 2004 and is based in Irvine, California.

AAG offers a range of reverse mortgage options, including federally-insured Home Equity Conversion Mortgages (HECMs), jumbo reverse mortgages, and Proprietary Reverse Mortgage products. These products differ in terms of how much can be borrowed, the interest rates, and the requirements for the borrower's credit score and income.

In October 2021, the Consumer Financial Protection Bureau (CFPB) took action against AAG, alleging that the company engaged in deceptive marketing practices and charged customers hidden fees. AAG agreed to a consent order that required it to pay $400,000 in civil penalties and take steps to prevent future violations.

In more recent news, as of October 2022, AAG has paused new loan submissions and suspended existing applications for its proprietary reverse mortgage product. Additionally, the company announced a layoff that cut 204 jobs, including 43 loan officers, in October 2022.

Despite these recent developments, AAG remains a top option for seniors looking to supplement their retirement income with a reverse mortgage. The company has professional customer service and offers several mortgage-type options to suit different financial needs.

Frequently Asked Questions about american advisors group (aag) reverse mortgage

AAG offers different home equity solutions - Home Equity Conversion Mortgages and proprietary reverse mortgages, that are designed to give seniors a better financial outcome in retirement.

A reverse mortgage is a loan that allows you to get money from your home equity without having to sell your home. This is sometimes called “equity release”. You can borrow up to 55% of the current value of your home.

It is called a “reverse” mortgage because, instead of making payments to the lender, the borrower receives money from the lender. The money the borrower receives, and the interest charged on the loan, increases the balance of the borrower's loan each month. Over time, the loan amount grows.

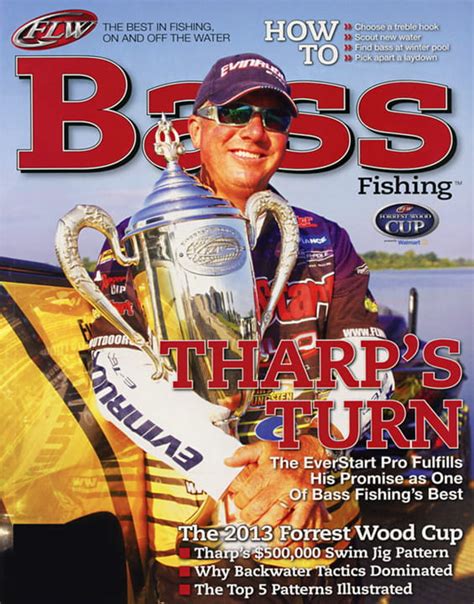

Finance of America Companies Inc.

Plano, Texas-based Finance of America Companies Inc. (FOA) said Monday it closed March 31 on its previously announced deal to acquire the assets of American Advisors Group (AAG), a direct-to-consumer reverse mortgage lender.

If you decide to cancel the loan after the rescission period, you can do so by paying back any proceeds you received plus the accrued interest. About American Advisors Group.

A Home Equity Conversion Mortgage (HECM), the most common type of reverse mortgage, is a special type of home loan only for homeowners who are 62 and older.

A reverse mortgage is a loan for homeowners aged 62 and older who want to borrow against their home equity without having to make monthly payments. 1 This mortgage product can help seniors who are short on funds for living expenses.

For example, if your purchase price is $200,000 and your reverse mortgage is $120,000, you would bring in $80,000 plus any closing costs, the loan would supply $120,000 at closing, and the purchase would close.

A Home Equity Conversion Mortgage (HECM), the most common type of reverse mortgage, is a special type of home loan only for homeowners who are 62 and older.

Starwood Capital Group

RMF is a wholly owned subsidiary of Reverse Mortgage Investment Trust Inc. (RMIT), a specialty finance company in the reverse mortgage sector. RMIT is an affiliate of Starwood Capital Group, a global private investment firm and an innovator in non-agency mortgages.

AAG - American Advisors Group | Reverse Mortgage Lender.

Reverse mortgages allow seniors to tap their home equity and turn it into cash. They can offer lump-sum payments, a line of credit (like a credit card) or even monthly payments - whichever suits your lifestyle and retirement goals best.

The amount of money you can borrow depends on how much home equity you have available. You typically cannot use more than 80% of your home's equity based on its appraised value. In 2023, the maximum amount anyone can be paid from a HECM reverse mortgage is $1,089,300. However, most people will be paid much less.

The value of your home is one of the biggest factors in how much you can borrow with a reverse mortgage. Generally speaking, you can usually get somewhere between 40% to 60% of your home's appraised value.

American Advisors Group (AAG)

American Advisors Group (AAG)

AAG is by far the largest reverse mortgage lender in the U.S. It's a division of Finance of America Reverse, another major reverse mortgage lender.

Administrative and general expenses are a sub-category of expenses incurred in the normal day-to-day operations of a business. Utility expenses typically included in this category include: Employee salaries. Employee benefits. Office supplies.