Regions Mobile Banking TV commercial - Helping You Give Life the Green Light

Advertisers

Advertisers of the Regions Mobile Banking TV Spot, 'Helping You Give Life the Green Light'

Regions Bank

Regions Bank is a full-service financial institution that caters to clients across the United States. Established in 1971, the bank has grown over the years to become one of the largest regional banks...

What the Regions Mobile Banking TV commercial - Helping You Give Life the Green Light is about.

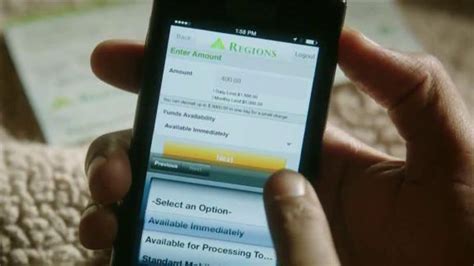

Regions Mobile Banking TV Spot is an advertisement meant to showcase how Regions Mobile Banking can help you take control of your finances. In the commercial, viewers are introduced to a variety of individuals from all walks of life who are all seeking to take control of their finances. The ad begins with a young girl making a purchase with her phone and then transitions to a young couple purchasing a new home using the Regions Mobile Banking app.

The ad then moves into a montage of individuals utilizing the Regions Mobile Banking app in a variety of ways. One person pays their bills, another checks their account balance, and yet another deposits a check using their phone. Throughout the commercial, the message is clear: Regions Mobile Banking can help you take control of your finances.

The commercial concludes with the tagline, "Helping You Give Life the Green Light," a nod to the idea that managing your finances effectively can help you achieve your goals and lead a more fulfilling life. The overall tone of the ad is friendly, upbeat, and optimistic, and it effectively communicates the many benefits of using Regions Mobile Banking to manage your finances.

Regions Mobile Banking TV commercial - Helping You Give Life the Green Light produced for Regions Bank was first shown on television on May 1, 2014.

Frequently Asked Questions about regions mobile banking tv spot, 'helping you give life the green light'

Videos

Watch Regions Mobile Banking TV Commercial, 'Helping You Give Life the Green Light'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Actors

Actors who starred in Regions Mobile Banking TV Spot, 'Helping You Give Life the Green Light'

Agenices

Agenices of the Regions Mobile Banking TV Spot, 'Helping You Give Life the Green Light'

Luckie & Company

Luckie & Company is a full-service advertising agency, with headquarters in Birmingham, Alabama. The firm was founded in 1953 by Tom Luckie, and since then, it has been providing advertising services...

m/SIX

M/SIX is a global media agency that is known for its innovative approach and data-driven strategies. The company was established in 2015 as a joint venture between The&Partnership and WPP, two giant a...

Products

Products Advertised

TV commercials

Similar commercials