What is Regions Bank App?

Regions Bank App is a mobile app that allows customers to access their account information and manage their finances on the go. The app offers a wide range of features, including the ability to view account balances, transaction history, and account activity.

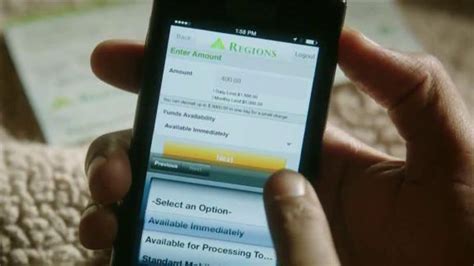

One of the most popular features of the Regions Bank App is mobile check deposit. With this feature, customers can simply snap a photo of their check with their mobile device's camera and deposit it into their account without ever having to visit a branch.

In addition to mobile check deposits, the app also offers bill pay, funds transfers, and the ability to set up custom alerts for account activity. Customers can also use the app to locate ATMs or branches near them.

The Regions Bank App also offers advanced security features to help protect customers' accounts. Customers can set up mobile biometric authentication, such as fingerprint or facial recognition, as an added layer of security.

Overall, the Regions Bank App is a powerful tool for managing finances on the go. Its robust features and advanced security make it a popular option for Regions Bank customers who want to stay connected to their accounts and take control of their finances from anywhere.

Frequently Asked Questions about regions bank app

Our app provides you a fast, secure, and convenient way to manage your Regions accounts directly from your Android.

Basic Banking Functions

The whole point of having a mobile app is to be able to access your money so it can do what you need it to do. That includes the ability to deposit checks, pay bills, make loan payments and transfer money between accounts from anywhere you are.

Regions Now Checking. As a nationally certified Bank On account, Regions Now Checking® is a simple way to bank without the concern of overdraft fees at a low, flat monthly fee. Bank how you want – pay bills with Online Banking Bill Pay, enjoy unlimited check writing and send and receive money with Zelle®.

What is a Mobile Banking App? Using a mobile banking application, you can easily access your banking account, check balance, transfer funds, pay bills, deposit checks, etc. Overall, you can access almost all products and services provided by your banking institution.

Limits: Most customers have a $6,000 daily and $10,000 monthly limit. Customers who qualify as a member of Preferred Banking programs have a $10,000 daily and $25,000 monthly limit.

Access Bank Mobile App: Access Bank's app allows customers to manage their accounts, transfer funds, pay bills, and access other banking services.

Characteristics of a Bank

- Managing Money. A bank is a financial entity that deals with other people's money, such as depositors' money.

- Individual/Firm/Enterprise.

- Deposit Acceptance.

- Advance Payments.

- Withdrawal and Payment.

- Utility and Agency Services.

- Connecting Link.

- Identifying your name.

The benefits of mobile banking for users include time efficiency, the possibility to manage funds, transfer money, and detect frauds quickly. Also with the help of digital banking users have 24/7 access to their accounts (including the possibility to check balance) and reminders about bills payments, loans, etc.

Regions Bank Review: A Great Place for All-in-One Banking. Regions Bank has a great reputation throughout its service area in the South and Midwest. Its strong relationship benefits and excellent customer service help it stand out, but it also offers a variety of flexible accounts for many types of people.

Regions Savings. Basic, low-fee savings account to build your nest egg for the future. Plus, you can avoid the monthly fee by maintaining a $300 minimum daily balance.

Types of Mobile Banking Services

- Mobile banking over mobile applications (for smartphone; SBI Yono and iMobile by ICICI Bank, etc.)

- Mobile banking over SMS (also known as SMS banking)

- Mobile banking over Unstructured Supplementary Service Data (USSD)

The biggest difference between the two is their functionality. Internet Banking allows you to conduct online transactions through your PC or laptop and an internet connection. On the other hand, mobile banking can be done with or without internet. Many banks nowadays have their mobile apps for mobile banking.

The minimum opening deposit amount for a Regions checking account is $50. The minimum opening deposit amount for opening a LifeGreen Savings Account is $50 (or $5 if you set up a monthly automatic savings transfer from a Regions checking account).

Yes, your daily ATM withdrawal limit is $808; you as the business owner can set the daily limit for each of your employees. The combined total of these limits should not exceed your account's $808 daily limit.

Summary: Best Mobile Banking Apps

| Account | Forbes Advisor Rating | LEARN MORE |

|---|

| Citi Mobile | 5.0 | Learn More |

| Bank of America Mobile Banking | 5.0 | Learn More |

| Chase Mobile | 5.0 | Learn More |

| Ally: Banking & Investing | 4.9 | Learn More |

FirstMobile is the official mobile banking smartphone application from FirstBank.