Root Insurance TV commercial - Control Your Rates: Better Price

Advertisers

Advertisers of the Root Insurance TV Spot, 'Control Your Rates: Better Price'

Root Insurance

Root Insurance is an innovative company that is revolutionizing the car insurance industry. With a fresh approach to coverage, Root Insurance is disrupting the traditional insurance model by providing...

What the Root Insurance TV commercial - Control Your Rates: Better Price is about.

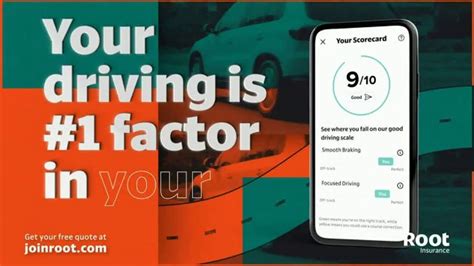

Root Insurance aired a TV spot in which they showcased their innovative approach to car insurance. The commercial titled "Control Your Rates: Better Price" emphasized Root's unique selling point, which is using technology to offer personalized quotes based on driving behavior.

The ad starts with an actor sitting behind the wheel of a car and introducing himself as a safe driver. He then goes on to explain that unlike traditional insurance companies that use demographic data to determine car insurance rates, Root Insurance takes a different approach by using a mobile app to monitor driving behavior.

Throughout the spot, we see the actor using the app while driving, which tracks various metrics such as speed, braking, and turning. The app then analyzes this data to generate a personalized quote for the driver, which is often significantly lower than that of traditional insurance companies.

The ad ends with the actor being surprised by how much he saved and encouraging viewers to take control of their rates with Root Insurance. The commercial effectively emphasizes Root's differentiating factor and positions them as a modern and innovative insurance provider.

Overall, the Root Insurance TV spot is an effective marketing tactic that showcases their unique selling proposition in an engaging and approachable way. By using a relatable and enthusiastic actor, the ad helps to demystify the complex process of calculating insurance rates, making it easier for viewers to understand and appreciate Root's technology-based approach.

Root Insurance TV commercial - Control Your Rates: Better Price produced for Root Insurance was first shown on television on July 14, 2021.

Frequently Asked Questions about root insurance tv spot, 'control your rates: better price'

Videos

Watch Root Insurance TV Commercial, 'Control Your Rates: Better Price'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Products

Products Advertised

TV commercials

Similar commercials