Root Insurance App tv commercials

TV spots

TV commercials Root Insurance App

Advertisers

Advertisers of commercials featuring Root Insurance App

Root Insurance

Root Insurance is an innovative company that is revolutionizing the car insurance industry. With a fresh approach to coverage, Root Insurance is disrupting the traditional insurance model by providing...

Actors

Actors who starred in Root Insurance App commercials

What is Root Insurance App?

Title: Root Insurance App - Revolutionizing the World of Insurance

Introduction:Root Insurance has taken the insurance industry by storm with its innovative approach and user-friendly mobile application. With the Root Insurance App, customers can say goodbye to the hassles and complications typically associated with insurance, and experience a seamless and personalized insurance journey like never before. In this article, we will explore the features, benefits, and impact of the Root Insurance App.

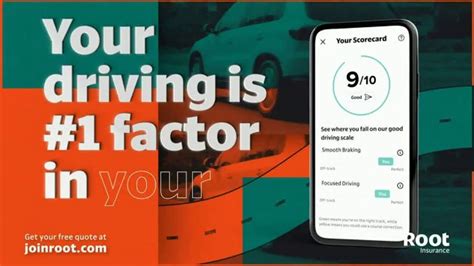

1. Simplified and Transparent Pricing:One of the standout features of the Root Insurance App is its unique algorithm that assesses user driving habits to determine insurance premiums. Using telematics and smartphone sensors, the app collects data on driving behavior such as speed, braking patterns, and turning angles. This enables Root to provide personalized rates that accurately reflect individual driving habits. By eliminating the need for complex forms and guesswork, Root Insurance App ensures that users have a transparent and fair pricing experience.

2. Seamless User Experience:Root Insurance App offers a seamless and user-friendly experience that makes managing insurance policies effortless. With just a few taps, customers can access policies, view coverage details, and make adjustments as needed. The app also provides real-time notifications to keep users updated on their driving behavior and policy changes. Additionally, filing claims has never been easier; all it takes is a few simple steps within the app to initiate the claims process.

3. Driving Rewards:Root Insurance App goes beyond traditional insurance policies by rewarding safe driving behavior. Through the app's gamification features, users can earn points based on their driving habits and redeem them for rewards or discounts. This unique incentive promotes safe driving practices and encourages users to become more responsible on the road.

4. Innovation and Disruption:Root Insurance App is disrupting the insurance industry by challenging conventional insurance models and embracing emerging technologies. By leveraging data analytics and smartphone technology, Root is able to provide fair and accurate insurance premiums, tailored to each customer's driving behavior. This data-driven approach paves the way for a more efficient and customer-centric insurance experience.

5. Customer Satisfaction and Trust:Root Insurance App has garnered a strong customer following, thanks to its commitment to delivering exceptional service and transparency. Customers appreciate the personalized rates, user-friendly interface, and the ability to have full control over their policies. The app has received positive reviews for its ease of use, quick claims process, and reliable customer support. Root Insurance's dedication to meeting customer needs has earned them trust and loyalty within the insurance industry.

Conclusion:The Root Insurance App has transformed the traditional insurance landscape by offering a simplified, transparent, and personalized insurance experience. Its innovative use of technology and user-friendly interface have set a new standard for the industry. With Root Insurance, customers can expect a seamless journey from quote to claim, ensuring peace of mind and satisfaction. Ultimately, the Root Insurance App represents a disruptive force that is shaping the future of insurance.