Live Well Financial TV commercial - Reverse Mortgage Special Report

Advertisers

Advertisers of the Live Well Financial TV Spot, 'Reverse Mortgage Special Report'

LiveWell

LiveWell is an innovative and dynamic company that aims to revolutionize the way people approach health and wellness. With a mission to empower individuals to live their best lives, LiveWell offers a...

What the Live Well Financial TV commercial - Reverse Mortgage Special Report is about.

Title: Live Well Financial TV Spot: "Reverse Mortgage Special Report"

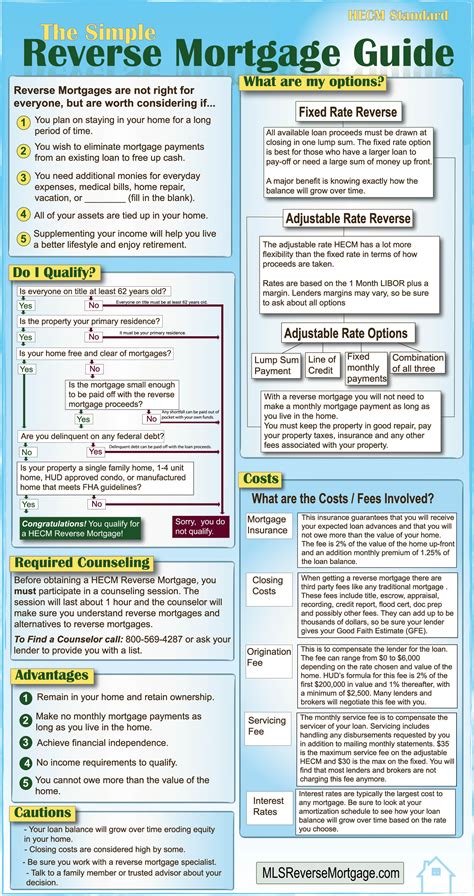

Introduction:In a world where financial security is of utmost importance, Live Well Financial has emerged as a trusted name in the reverse mortgage industry. With their latest TV spot titled "Reverse Mortgage Special Report," they aim to educate and empower viewers with essential knowledge about this unique financial product. This engaging and informative commercial sheds light on the advantages of reverse mortgages, dispelling common misconceptions and showcasing Live Well Financial as a reliable provider.

Engaging Visuals:The TV spot opens with a warm and inviting living room setting, where a couple in their golden years is seen happily conversing with a Live Well Financial specialist. The scene radiates comfort and trust, immediately establishing a connection with the audience. As the couple shares their positive experiences with reverse mortgages, the camera smoothly transitions to snapshots of other seniors enjoying their dream retirement lifestyles courtesy of Live Well Financial.

Informative Content:The narrator's voiceover is resolute yet reassuring, explaining the ins and outs of reverse mortgages. Key benefits are highlighted, such as the ability to supplement retirement income, eliminate monthly mortgage payments, and maintain homeownership. The commercial also emphasizes Live Well Financial's commitment to personalized service, expert guidance, and flexible lending options - factors that set them apart from other financial institutions.

Credibility and Expertise:To further establish their credibility, the TV spot features endorsements and testimonials from esteemed financial professionals and satisfied customers. Notable experts provide their stamp of approval, speaking highly of Live Well Financial's expertise, transparency, and ethical practices. These endorsements aim to instill confidence in viewers, assuring them that they are in capable hands with Live Well Financial.

Call to Action:The TV spot concludes with a compelling call to action, urging viewers to take the first step towards a financially secure retirement by contacting Live Well Financial. The commercial provides a toll-free number and website details, making it easy for interested individuals to seek further information or schedule a consultation. The viewer is left with a sense of empowerment and hope, knowing that Live Well Financial is ready to assist them in their journey towards a more secure future.

Conclusion:Live Well Financial's TV spot, "Reverse Mortgage Special Report," serves as a persuasive and informative tool for inspiring viewers to consider the advantages of reverse mortgages. Through engaging visuals, credible endorsements, and expert guidance, the commercial sets the stage for a confident retirement filled with financial stability. By dispelling misconceptions and offering personalized service, Live Well Financial has positioned itself as a trusted resource for seniors seeking a more comfortable and fulfilling retirement experience.

Live Well Financial TV commercial - Reverse Mortgage Special Report produced for LiveWell was first shown on television on October 3, 2019.

Frequently Asked Questions about live well financial tv spot, 'reverse mortgage special report'

Videos

Watch Live Well Financial TV Commercial, 'Reverse Mortgage Special Report'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Products

Products Advertised

TV commercials

Similar commercials