What is LiveWell Reverse Mortgages: Reverse Mortgage Guide?

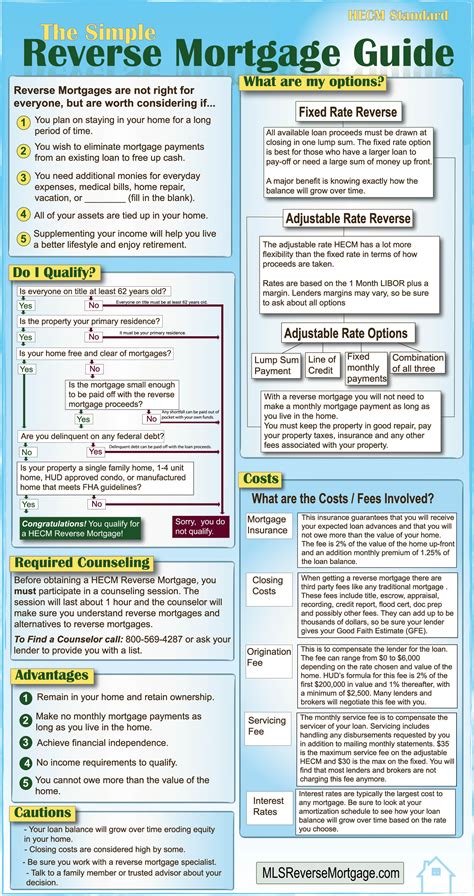

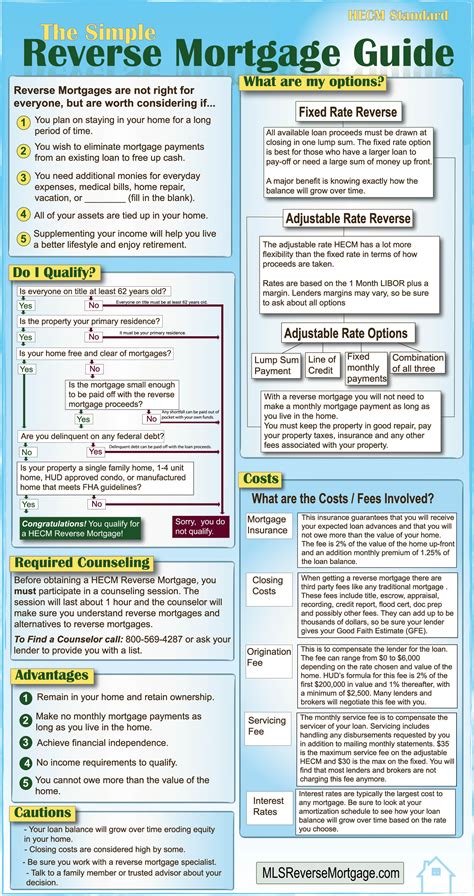

LiveWell Reverse Mortgages is a company that provides reverse mortgage services to homeowners who are 62 years of age or older. A reverse mortgage is a type of home equity loan that allows homeowners to convert a portion of their home’s equity into cash. The loan is only repaid when the borrower moves out of the home, sells it, or passes away.

The LiveWell Reverse Mortgage Guide is a comprehensive resource that helps homeowners understand the advantages and disadvantages of reverse mortgages. It includes information on how to qualify for a reverse mortgage, how it works, and how to manage the loan.

One of the primary benefits of a reverse mortgage is that it allows homeowners to tap into their home equity without having to sell their property. This can be an attractive option for seniors who want to supplement their retirement income or pay for unexpected expenses.

However, there are also some potential drawbacks to consider. For example, the loan must be repaid with interest, which can decrease the amount of equity that the homeowner has in their property. Additionally, there are fees associated with obtaining a reverse mortgage, and these can be significant.

The LiveWell Reverse Mortgage Guide covers these topics in detail, providing homeowners with the information they need to make an informed decision about whether a reverse mortgage is right for them. It includes tips on how to work with a reverse mortgage lender, how to manage the loan, and how to avoid common pitfalls.

Overall, the LiveWell Reverse Mortgage Guide is an essential resource for any homeowner who is considering a reverse mortgage. By providing accurate and unbiased information, it empowers seniors to make the best decisions for themselves and their families.

Frequently Asked Questions about livewell reverse mortgages: reverse mortgage guide

A reverse mortgage is a loan that allows you to get money from your home equity without having to sell your home. This is sometimes called “equity release”. You can borrow up to 55% of the current value of your home.

A reverse mortgage is a home loan that you do not have to pay back for as long as you live in your home. It can be paid to you in one lump sum, as a regular monthly income, or at the times and in the amounts you want. The loan and interest are repaid only when you sell your home, permanently move away, or die.

A reverse mortgage initial principal limit is the total amount that a borrower can access on their reverse mortgage. It can be paid as part of a lump sum, as ongoing payments, as a line of credit, or as a combination of the three depending on the terms of the reverse mortgage.

First, the loan amount is based on the “maximum claim amount,” which is defined as the lesser of the appraised value of the house. Second, the age of the borrower affects the borrower's loan amount - the older the borrower, the higher the loan amount.

For example, if your purchase price is $200,000 and your reverse mortgage is $120,000, you would bring in $80,000 plus any closing costs, the loan would supply $120,000 at closing, and the purchase would close.

It is called a “reverse” mortgage because, instead of making payments to the lender, the borrower receives money from the lender. The money the borrower receives, and the interest charged on the loan, increases the balance of the borrower's loan each month. Over time, the loan amount grows.

The suits relating to mortgages stand for the principle "once a mortgage, always a mortgage", meaning a borrower cannot contract to give up his automatic right to redeem title to his property once the debt is paid. The Transfer of Property Act, 1882 deals with the mortgage of immovable property in our country.

$1,089,300

Reverse Mortgage Loan Limits

For the government-insured Home Equity Conversion Mortgage (HECM), the maximum reverse mortgage limit you can borrow against is $1,089,300 (updated January 1st, 2023), even if your home is appraised at a higher value than that.

The value of your home is one of the biggest factors in how much you can borrow with a reverse mortgage. Generally speaking, you can usually get somewhere between 40% to 60% of your home's appraised value. And the higher your home value is, the more money you can potentially access.

You can better manage expenses in retirement

Many seniors experience a significant income reduction when they retire, and monthly mortgage payments can be their biggest expense. With a reverse mortgage, you can supplement a diminished income and continue to pay your bills.

Homeowners aged 62 and older with a significant amount of equity in their homes can fund their retirement by taking out a reverse mortgage, meaning a loan that converts a portion of their home equity into cash.

MORTGAGES - THREE KEY ELEMENTS: CREDIT, DOWN PAYMENT, & INCOME. If you're new to the mortgage loan process, or if it's been a while, you may be experiencing a variety of emotions if you're thinking about getting a new home.

Principal, Interest, Taxes, and Insurance, known as PITI, are the four basic elements of a monthly mortgage payment.

Reverse Mortgage Loan Rates

| Updated: April 12, 2023 | HECM Fixed Rate | Jumbo Fixed (Proprietary) |

|---|

| Current Rates | 6.18% - 6.99% | 8.99% - 9.99% |

| APR | 7.94% - 8.48%* | 9.696% - 10.542%** |

| Index | N/A | N/A |

| Margin | N/A | N/A |

Simply put, the principal limit is the maximum amount of money that you can borrow using a reverse mortgage. This maximum amount does not change if you pay off your reverse mortgage and then apply for a second one – rather, it's a lifetime maximum that is calculated per-borrower.

Home Equity Conversion Mortgage (HECM)

A Home Equity Conversion Mortgage (HECM), the most common type of reverse mortgage, is a special type of home loan only for homeowners who are 62 and older.