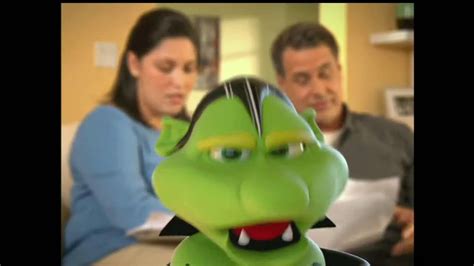

Consolidated Credit Counseling Services TV commercial - Presentación

Advertisers

Advertisers of the Consolidated Credit Counseling Services TV Spot, 'Presentación'

Consolidated Credit Counseling Services

Consolidated Credit Counseling Services is a non-profit organization that aims to help people manage their finances and get out of debt. The company was founded in 1993 and has since helped thousands...

What the Consolidated Credit Counseling Services TV commercial - Presentación is about.

Title: "Presentación: Consolidated Credit Counseling Services' Empowering TV Spot"

¡Hola a todos! ¿Saben qué? ¡Hoy es el día en el que ustedes pueden tomar el control de sus finanzas y construir un futuro más sólido! Bienvenidos a Consolidated Credit Counseling Services.

Sabemos que a veces es difícil enfrentar los desafíos financieros. Pero no están solos, Consolidated Credit está aquí para ayudarlos.

Entendemos lo estresante que pueden ser las deudas y los altos intereses que parecen nunca terminar. Pero ¡no hay problema demasiado grande que no podamos enfrentar juntos!

Cuando ustedes deciden trabajar con Consolidated Credit, se unen a una comunidad de personas que han tomado el control de sus finanzas ¡y han alcanzado la libertad económica!

Nuestro equipo de asesores financieros expertos está aquí para escucharlos, entender su situación y crear un plan personalizado para que puedan tomar medidas efectivas para eliminar sus deudas y mejorar su situación financiera.

¡Imaginen las posibilidades! ¡Un futuro sin deudas agobiantes, sin llamadas de cobranza y sin noches sin dormir!

Queremos que vivan una vida llena de oportunidades y estabilidad financiera. Consolidated Credit Counseling Services les da las herramientas necesarias para lograrlo.

[Scene:

Consolidated Credit Counseling Services TV commercial - Presentación produced for Consolidated Credit Counseling Services was first shown on television on March 11, 2019.

Frequently Asked Questions about consolidated credit counseling services tv spot, 'presentación'

Videos

Watch Consolidated Credit Counseling Services TV Commercial, 'Presentación'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Agenices

Agenices of the Consolidated Credit Counseling Services TV Spot, 'Presentación'

Zimmerman Advertising

Zimmerman Advertising is a full-service advertising agency that is located in Fort Lauderdale, Florida. The company was founded in 1984 by Jordan Zimmerman and has grown to become one of the largest a...

TV commercials

Similar commercials