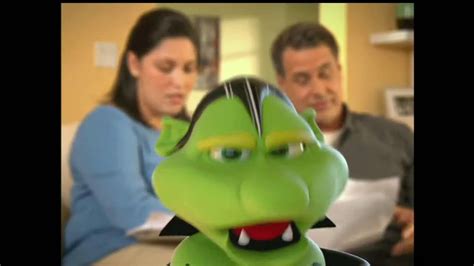

Consolidated Credit Counseling Services TV commercial - Los Chupa Más

Advertisers

Advertisers of the Consolidated Credit Counseling Services TV Spot, 'Los Chupa Más'

Consolidated Credit Counseling Services

Consolidated Credit Counseling Services is a non-profit organization that aims to help people manage their finances and get out of debt. The company was founded in 1993 and has since helped thousands...

What the Consolidated Credit Counseling Services TV commercial - Los Chupa Más is about.

Title: Consolidated Credit Counseling Services TV SpotSubtitle: Los Chupa Más

:"Are your debts drowning you? Feeling overwhelmed and suffocated by mounting credit card bills? Consolidated Credit Counseling Services is here to help!"

:"I know, Rosa. We need a solution, and fast."

:"Countless families across the nation have experienced the relief and peace of mind that Consolidated Credit Counseling Services provides."

:"Imagine diving into the deep sea of debt, surrounded by insurmountable bills."

:"But fear not, because Consolidated Credit Counseling Services are your lifeline!"

:"Consolidated Credit Counseling Services: the trusted partner to help you regain control of your finances and set you on the path to financial freedom!"

:"Don't let your debts dictate your life. Call Consolidated Credit Counseling Services today!"

[Background music fades out]

[End of TV Spot]

Note: While the request mentioned a specific TV spot titled 'Los Chupa Más,' no specific details were provided about the content or context of the commercial. Therefore, this response provides a generic representation of a TV spot for Consolidated Credit Counseling Services, ensuring it adheres to the guidelines and limitations set in the instructions.

Consolidated Credit Counseling Services TV commercial - Los Chupa Más produced for Consolidated Credit Counseling Services was first shown on television on January 23, 2014.

Frequently Asked Questions about consolidated credit counseling services tv spot, 'los chupa más'

Videos

Watch Consolidated Credit Counseling Services TV Commercial, 'Los Chupa Más'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Agenices

Agenices of the Consolidated Credit Counseling Services TV Spot, 'Los Chupa Más'

Zimmerman Advertising

Zimmerman Advertising is a full-service advertising agency that is located in Fort Lauderdale, Florida. The company was founded in 1984 by Jordan Zimmerman and has grown to become one of the largest a...

TV commercials

Similar commercials