American Advisors Group TV commercial - Reverse Mortgage Stabilization Act

Advertisers

Advertisers of the American Advisors Group TV Spot, 'Reverse Mortgage Stabilization Act'

American Advisors Group (AAG)

American Advisors Group (AAG) is a company that specializes in providing reverse mortgage loans and other home equity retirement solutions. With a focus on helping seniors build a more financially sec...

What the American Advisors Group TV commercial - Reverse Mortgage Stabilization Act is about.

American Advisors Group (AAG) is known for its innovative and impactful television commercials. One of their memorable TV spots is the 'Reverse Mortgage Stabilization Act' advertisement. It captivates viewers with its informative and engaging approach, while also shedding light on an important piece of legislation.

The commercial begins by introducing the viewers to the Reverse Mortgage Stabilization Act, a significant law aimed at protecting homeowners who opt for reverse mortgages. With a blend of compelling visuals and clear, concise narration, the ad highlights the benefits offered by the Act.

As the commercial unfolds, viewers are presented with a series of real-life scenarios where individuals have greatly benefited from the Reverse Mortgage Stabilization Act. The stories range from seniors who were struggling to meet their financial needs to those seeking to make improvements to their homes, such as much-needed repairs or accessibility modifications. The ad demonstrates how the Act played a vital role in providing them with a stable and secure financial future.

Throughout the TV spot, AAG showcases its expertise and commitment to helping seniors make informed decisions about their financial well-being. Their knowledgeable team members are depicted as compassionate guides, ready to assist homeowners in navigating the complexities of reverse mortgages and the new legislation.

The 'Reverse Mortgage Stabilization Act' advertisement ultimately leaves viewers with a sense of reassurance and empowerment. It emphasizes AAG's dedication to responsible lending practices and its mission to provide personalized solutions for seniors seeking financial stability in their retirement years.

By utilizing this commercial, AAG effectively educates the public about the Reverse Mortgage Stabilization Act, bringing awareness to the importance of legislation that safeguards seniors and provides them with peace of mind. With its informative content and engaging storytelling, this TV spot leaves a lasting impression, establishing AAG as a trusted resource for seniors considering reverse mortgages.

Overall, the 'Reverse Mortgage Stabilization Act' TV spot by American Advisors Group is a powerful and impactful advertisement that educates viewers about a significant piece of legislation while showcasing AAG's commitment to helping seniors secure a stable financial future.

American Advisors Group TV commercial - Reverse Mortgage Stabilization Act produced for American Advisors Group (AAG) was first shown on television on July 7, 2014.

Frequently Asked Questions about american advisors group tv spot, 'reverse mortgage stabilization act'

Videos

Watch American Advisors Group TV Commercial, 'Reverse Mortgage Stabilization Act'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

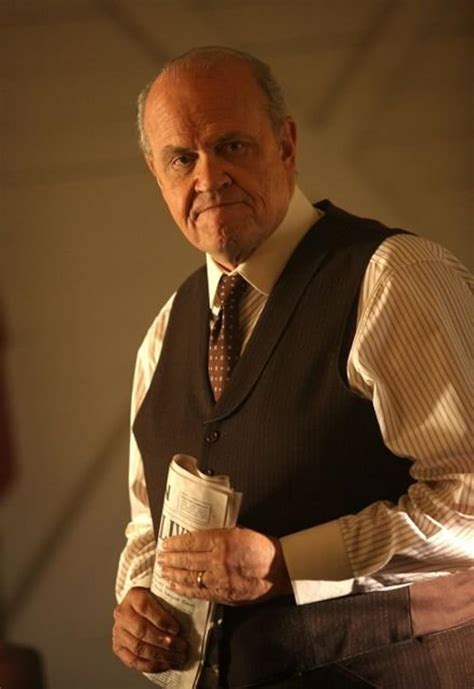

Actors

Actors who starred in American Advisors Group TV Spot, 'Reverse Mortgage Stabilization Act'

TV commercials

Similar commercials