Greenlight Financial Technology TV commercial - Drive: Greenlight Infinity

Advertisers

Advertisers of the Greenlight Financial Technology TV Spot, 'Drive: Greenlight Infinity'

Greenlight Financial Technology

Greenlight Financial Technology is a financial technology company that offers a financial platform designed for families. The company was founded in 2014 with the aim of providing a platform that woul...

What the Greenlight Financial Technology TV commercial - Drive: Greenlight Infinity is about.

Greenlight Financial Technology is a fintech company founded in 2014 that offers debit cards for kids and teenagers, with parental controls and monitoring features. Recently, the company produced a new TV spot titled 'Drive: Greenlight Infinity,' which showcases the benefits and features of the Greenlight debit card.

The TV spot opens with a young girl driving a go-kart on a race track, as the voiceover says, "At Greenlight, we believe in giving kids the chance to dream big." The girl is then shown driving in a car, and the voiceover continues, "With Greenlight, they can start living those dreams today. Our card grows with your kids and gives them the freedom to explore, learn, and be themselves."

The commercial goes on to highlight the parental control features of the Greenlight card, such as setting spending limits, monitoring spending activity, and even blocking certain merchants or categories of spending. The voiceover emphasizes that parents need not worry about their child overspending or making unwise purchases, saying, "You stay in complete control, and your kids get a head start on financial responsibility."

The commercial ends with the girl driving a slick sports car, with a voiceover asking, "What will your kids aspire to?" before the Greenlight logo appears on the screen.

Overall, the Greenlight 'Drive: Greenlight Infinity' TV spot effectively showcases the benefits and features of the Greenlight debit card, emphasizing its role in helping kids and teenagers learn financial responsibility early on while still enjoying the freedom to dream big and explore their interests.

Greenlight Financial Technology TV commercial - Drive: Greenlight Infinity produced for Greenlight Financial Technology was first shown on television on November 7, 2022.

Frequently Asked Questions about greenlight financial technology tv spot, 'drive: greenlight infinity'

Videos

Watch Greenlight Financial Technology TV Commercial, 'Drive: Greenlight Infinity'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

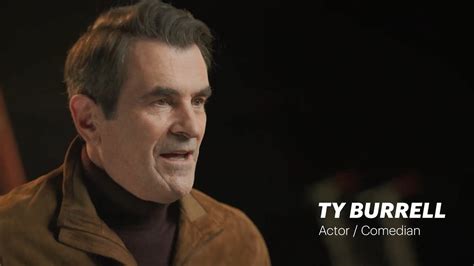

Actors

Actors who starred in Greenlight Financial Technology TV Spot, 'Drive: Greenlight Infinity'

Products

Products Advertised

TV commercials

Similar commercials