VISA Prepaid tv commercials

TV spots

TV commercials VISA Prepaid

Advertisers

Advertisers of commercials featuring VISA Prepaid

Fios by Verizon

Fios by Verizon is an innovative telecommunications company that has revolutionized the way people experience and interact with their digital world. With a focus on high-quality internet, television,...

Firestone Complete Auto Care

Firestone Complete Auto Care is a well-renowned company that offers comprehensive automobile services to its clients. Established in 1926, Firestone Complete Auto Care has been offering quality auto c...

Sprint

IntroductionSprint is an American telecommunications company that is known for providing wireless services, internet services, and more. The company was founded in 1899 as the Brown Telephone Company,...

TireRack.com

TireRack.com: Revolutionizing the Way We Shop for TiresIn a world where convenience and efficiency are paramount, TireRack.com has emerged as a pioneer in the tire industry, revolutionizing the way pe...

Verizon

What is Verizon? Verizon is an American telecommunications company that provides wireless services, internet services, and TV services to millions of customers across the United States. It was establi...

VISA

A company visa, also known as a business visa, is a type of visa that allows individuals to travel to another country for business-related purposes. This visa is typically issued to individuals who ne...

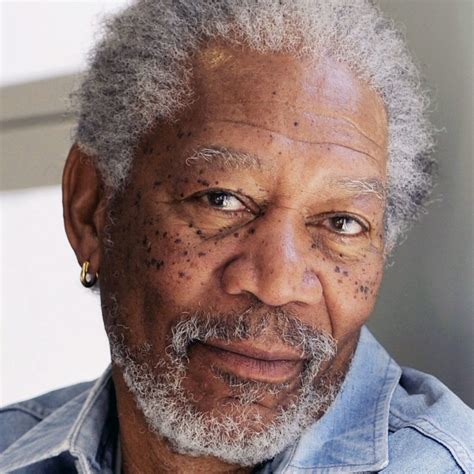

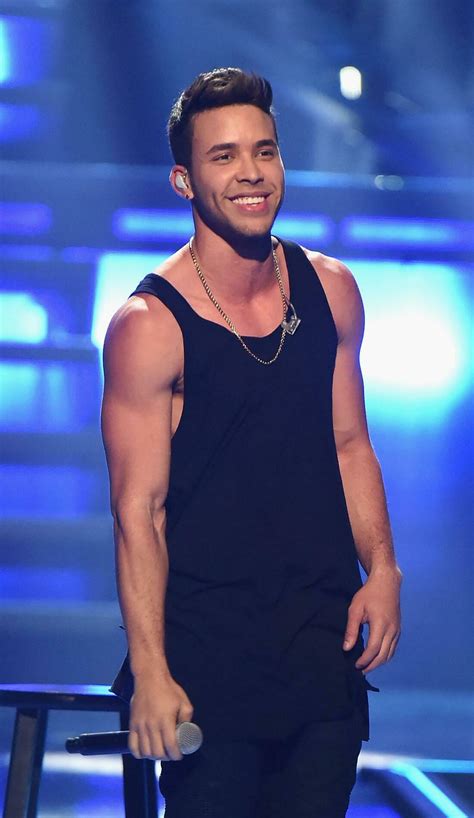

Actors

Actors who starred in VISA Prepaid commercials

Agenices

Agencies worked with VISA Prepaid

AKQA

Horizon Media, Inc.

Laughlin Constable Inc.

Leo Burnett

McGarry Bowen LLC

Starcom

TBWAChiatDay

TRG

Wieden+Kennedy

Zenith

What is VISA Prepaid?

A Visa prepaid card is a type of debit card that is pre-loaded with a certain amount of funds. This allows the cardholder to make purchases up to the amount of funds on the card, but they cannot spend more than that amount as the card is not linked to a bank account or line of credit. Visa prepaid cards can be used to make purchases online, in stores, and even internationally, just like any other Visa debit card.

One of the advantages of using a Visa prepaid card is that there is no need for a credit check or bank account to obtain one. They can be purchased at most major retailers or banks and can be loaded with funds either online or in-person. Another benefit is that they can be used to help control spending and budgeting as the cardholder can only spend what is loaded onto the card.

Visa prepaid cards are also a popular option for giving gifts or as a method of payment for individuals who do not have a bank account or may have limited access to banking services. They are often used as an alternative to traditional gift cards as they can be used for a wider range of purchases.

However, it is important to note that Visa prepaid cards may come with fees, such as activation fees, monthly maintenance fees, or transaction fees. The specific fees and terms can vary depending on the issuer of the card. Additionally, prepaid cards may not offer the same level of protection as a traditional credit or debit card in the event of fraudulent purchases or disputes.

Overall, Visa prepaid cards can be a useful tool for managing spending, making purchases, and giving gifts, but it's important to carefully review the terms and fees associated with them before obtaining one.