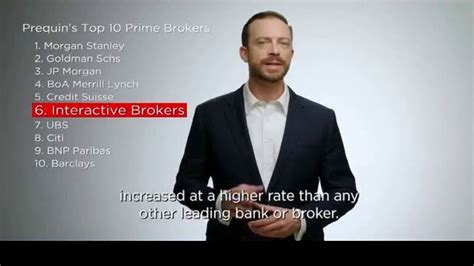

What is Interactive Brokers Margin Loan?

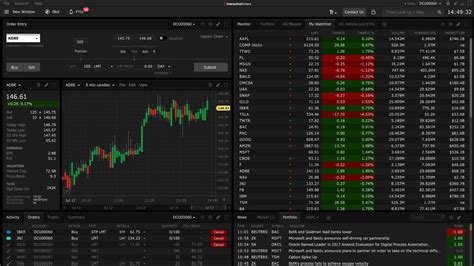

Interactive Brokers Margin Loan is a popular credit option for traders who want to invest in the stock market. It is a loan that is granted to the trader to increase their purchasing power by leveraging their investments. This loan enables them to borrow money using their investments as collateral, thus giving them the ability to buy more stocks or other financial instruments.

The Interactive Brokers Margin Loan is accessible to traders who have a minimum initial deposit of $2,000. Once an account is opened, traders can borrow up to 50% of the value of their stock investments. The interest rate for this loan is comparatively lower than other financial products such as credit cards.

Interactive Brokers Margin Loan is a type of revolving credit loan, which means that traders can borrow and repay the loan as frequently as they want to within the approved credit limit. The process of borrowing is straightforward, with funds being available immediately; thus, allowing traders to make trades without delay.

Margin loans always come with a level of risk, and it is important that traders understand the risks before deciding to take advantage of this option. The Interactive Brokers Margin Loan provides leverage to traders by borrowing money from the brokerage firm using their current investments as collateral. If market conditions are unfavorable and the value of the investments falls, the collateral provided may no longer be sufficient to cover the outstanding loan balance, and the trader may be called upon to repay the loan immediately or face liquidation of the investment.

In conclusion, Interactive Brokers Margin Loan is an excellent credit option for traders looking to invest in the stock market. However, traders should be aware of the risks associated with margin loans and should ensure that they have a solid trading strategy in place and are fully aware of the risks involved before availing themselves of this service.

Frequently Asked Questions about interactive brokers margin loan

For rules-based, the Federal Reserve sets initial margin rules for RegT accounts, under which investors can borrow 50% of the value of stocks held and may borrow the remaining 50% from their broker.

Margin lending is a flexible line of credit that allows you to borrow against the securities you already hold in your brokerage account. When used correctly, margin loans can help you execute investment strategies by increasing your borrowing power to purchase more securities.

Margin rates represent the cost of borrowing for an investor for an outstanding margin loan. Each brokerage can set the margin rate differently, it typically reflects the current broker call rate or call money rate. This is the rate that the bank charges the broker for the money used to fund investors' margin loans.

Long Position

| Margin |

|---|

| Initial Margin | 25% 1 * Stock Value (minimum of $2,000 or 100% of the purchase price, whichever is less) |

|---|

| Maintenance Margin | 25% * Stock Value |

| Reg T End of Day Initial Margin | 50% * Stock Value |

| Cash or IRA Cash | 100% * Stock Value |

An investor with a margin account can usually borrow up to half of the total purchase price of marginable investments. The percentage amount may vary between different investments.

You can repay the loan by depositing cash or selling securities. Buying on a margin allows you to pay back the loan by either adding more money into your account or selling some of your marginable investments.

While margin loans can be useful and convenient, they are by no means risk free. Margin borrowing comes with all the hazards that accompany any type of debt - including interest payments and reduced flexibility for future income. The primary dangers of trading on margin are leverage risk and margin call risk.

As with any loan, when you buy securities on margin you have to pay back the money you borrow plus interest, which varies by brokerage firm and the amount of the loan. Margin interest rates are typically lower than those on credit cards and unsecured personal loans.

While margin loans can be useful and convenient, they are by no means risk free. Margin borrowing comes with all the hazards that accompany any type of debt - including interest payments and reduced flexibility for future income. The primary dangers of trading on margin are leverage risk and margin call risk.

Important risks of margin.

Leveraging exposes you to greater downside risk than cash purchases because you must repay your margin loan, regardless of the underlying value of the securities you purchased.

IBKR has a low margin rate because they make money on a number of other services they provide. These include monthly fees on IBKR Pro, subscription to market data, inactivity fees and others. This allows them to cut costs on other parts of their service, like providing loans for margin trading.

Borrow against your account from USD 5.83% to 6.83%,1 which is lower than average rates on home equity lines of credit (HELOCs), personal loans, or credit cards. Plus, there are no monthly minimum payments or late fees, so you have the flexibility to pay back loans at your own pace.

When investors borrow money, or buy on margin, they're going for these types of gains. But the strategy is extremely risky because, while it magnifies your gains, it also magnifies losses.

By investing with a margin loan, you can buy more assets than you could on your own. With the standard limit of 50%, for example, you can literally double your underlying investment. If you have $1,000 to invest, by using a margin loan you can purchase $2,000 worth of assets and collect the commensurate returns.

When this happens, the investor must add more money in order to satisfy the loan terms from the broker or regulators. If the investor is unable to bring their investment up to the minimum requirements, the broker has the right to sell off their positions to recoup what it's owed.

While margin loans can be useful and convenient, they are by no means risk free. Margin borrowing comes with all the hazards that accompany any type of debt - including interest payments and reduced flexibility for future income. The primary dangers of trading on margin are leverage risk and margin call risk.