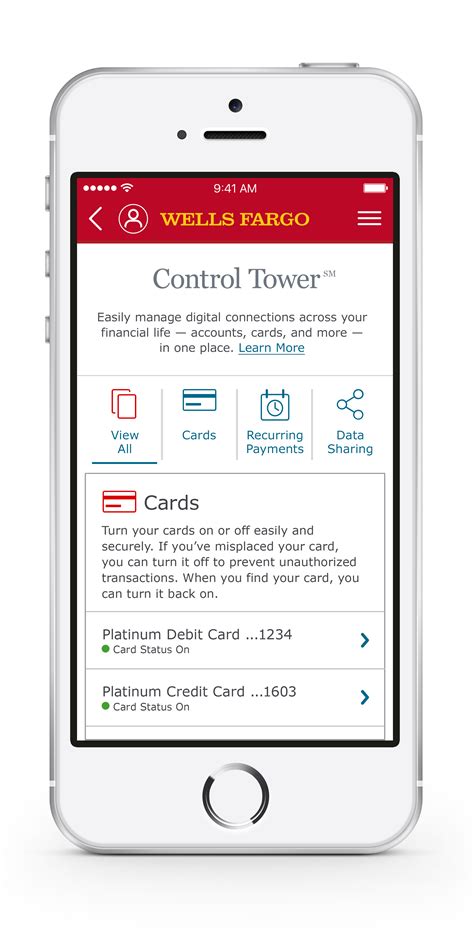

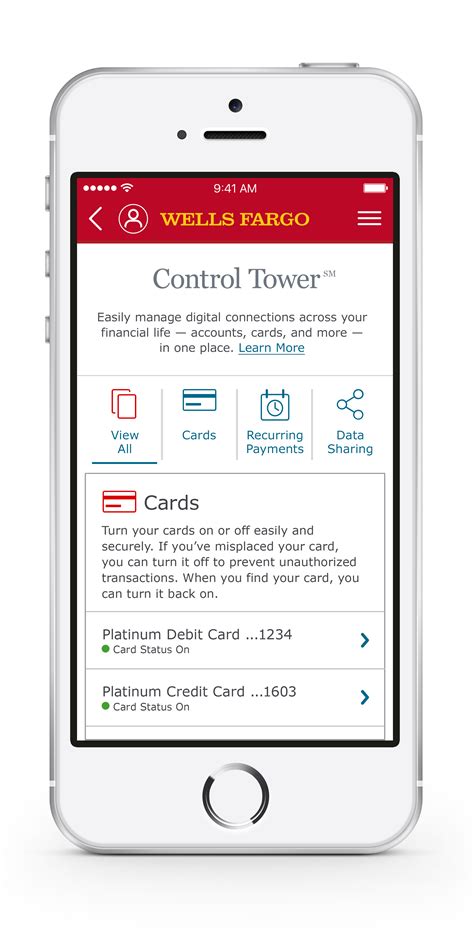

What is Wells Fargo Control Tower?

Wells Fargo Control Tower is a centralized hub for managing customer service and operations across various Wells Fargo business units. It provides a real-time overview of customer interactions, process efficiencies and performance metrics, enabling Wells Fargo to optimize its operations and improve customer satisfaction.

The Control Tower is powered by advanced technologies such as artificial intelligence, machine learning, and robotic process automation, which helps in automating routine tasks, identifying patterns, and detecting issues that require immediate attention. The platform enables Wells Fargo to monitor customer experience in real time and identify potential problems before they escalate.

The Control Tower is an essential part of Wells Fargo's digital transformation journey, aimed at streamlining its operations and creating a more efficient and customer-centric organization. The platform has helped the bank to improve its customer service, reduce costs, and increase operational efficiency. It has also helped the bank to identify new opportunities and make strategic decisions based on data-driven insights.

The Control Tower collects data from various sources, including customer interactions, business operations, and market trends. It then analyzes this data to create actionable insights, which can be used to improve business processes, customer experience, and operational efficiencies.

In conclusion, Wells Fargo Control Tower is a powerful platform that enables the bank to manage customer service and operations in a centralized and efficient manner. Through the use of advanced technologies, Wells Fargo is able to create a more streamlined, customer-centric organization that can better meet the needs of its customers in today's rapidly changing business landscape.

Frequently Asked Questions about wells fargo control tower

Control Tower will give users a single view of their payments and the spread of their sensitive financial data - including automated bill payments, third party and mobile wallets holding debit or credit card information, and the different physical devices that have signed into their banking account ー and lets them turn ...

Popular FAQs

- Checking.

- Savings & CDs.

- Credit Cards.

- Home Loans.

- Personal Loans.

- Auto Loans.

- Premier.

- Education & Tools.

Wells Fargo & Company, a diversified financial services company, provides banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

The main competitors of Wells Fargo are three of the other big four major U.S. banks - JPMorgan Chase, Bank of America, and Citigroup. Combined, these four banks together hold between 40% to 45% of all bank deposits in the country and serve the majority of personal and commercial accounts in the United States.

A supply chain control tower is traditionally defined as a connected, personalized dashboard of data, key business metrics and events across the supply chain. A supply chain control tower enables organizations to understand, prioritize and resolve critical issues in real time more fully.

Their primary purpose worldwide is to prevent collisions, organize and expedite the flow of air traffic, and provide information and other support for pilots. It is ultimately a safety measure– skies do not have traffic lights!

Overview. Wells Fargo may be a good fit for those who want access to a large network of branches and ATMs as well as a full-featured mobile banking app. Those seeking out high savings rates may want to consider other options.

Plus all the features of a Wells Fargo checking account

- Online banking with the banking tools you need.

- Contactless debit card for fast, secure payments and Wells Fargo ATM access.

- More than 12,000 Wells Fargo ATMs to help you bank locally and on the go.

- 24/7 fraud monitoring plus Zero Liability protection 20

Wells Fargo is among the top five banks in the United States. The bank makes money by lending out at a higher rate than it borrows. Wells Fargo operates four segments including Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management.

Specifically, account holders also enjoy the following: Fee-free Wells Fargo Personal Wallet checks, cashier's checks, and money orders. One overdraft Protection fee from an eligible, linked savings account is waived per fee period. Discounts on interest rates on select new loans and lines of credit.

JPMorgan Chase & Co's brand is ranked #72 in the list of Global Top 100 Brands, as rated by customers of JPMorgan Chase & Co. Their current market cap is $451.20B. Wells Fargo's brand is ranked #139 in the list of Global Top 1000 Brands, as rated by customers of Wells Fargo. Their current market cap is $156.41B.

The areas of responsibility for tower controllers fall into three general operational disciplines: local control or air control, ground control, and flight data/clearance delivery - other categories, such as airport apron control or ground movement planner, may exist at extremely busy airports.

Typical benefits of control towers

- Save on logistics costs.

- Reduce inventory.

- Improve service levels such as total cycle time and on-time delivery.

Wells Fargo has a significantly lower daily minimum balance requirement than Bank of America. It also makes it easy to waive monthly services fees if you're a college student or minor. If you qualify for Wells Fargo's bonus, you'll earn more than you would with Bank of America.

Wells Fargo's competitive advantage stems from cost advantages and customer switching costs in its core banking operations--which provide a vast majority of profits--and switching costs and intangible assets in wealth management. Wells Fargo's funding costs are its key source of advantage.

It's easy to see what made the audience fall in love with this movie: Fargo features a very, very dark story set in the cold and dark Minnesota, the authors' homeland. It's a story of murder, blackmail, kidnapping; a bloody account of deceit, lying, cheating and amorality.