What is TurboTax Tax Preparation App?

TurboTax is a popular tax preparation app that is widely used by millions of taxpayers worldwide. The app was created by Intuit, a financial software company, to help people prepare and file their income tax returns quickly and easily. With TurboTax, you can prepare, file, and track your tax returns without any hassle.

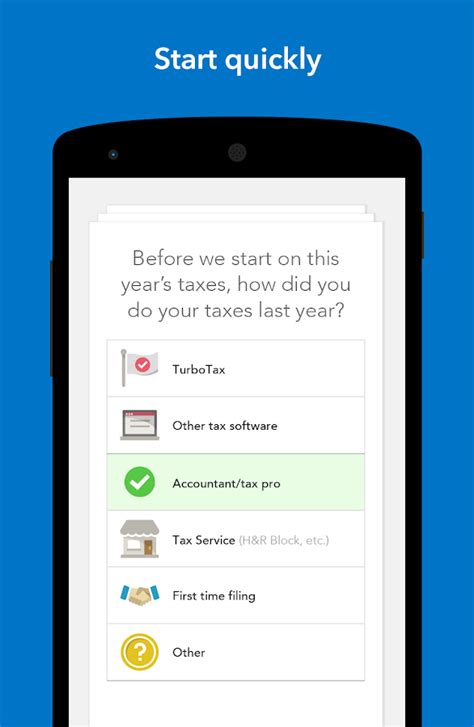

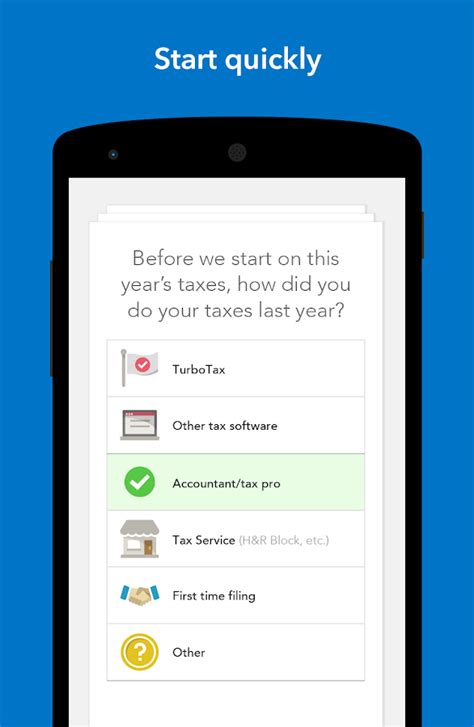

One of the most appealing features of TurboTax is its user-friendly interface. The app is designed to guide you through every step of the tax preparation process, ensuring that you don't miss any important information. The app offers a range of tax preparation options, including free federal and state tax returns for simple tax situations. The paid versions offer more features for complex returns, such as itemized deductions, business expenses, rental property income, and investments.

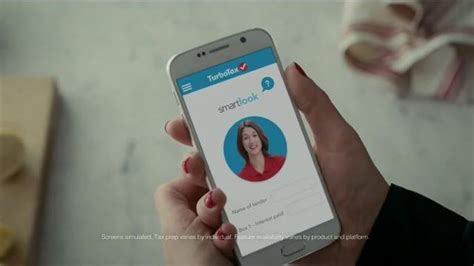

TurboTax also features a "SmartLook" option, which allows you to connect with a certified tax professional via live video chat or phone call. This feature provides personalized advice and support from a professional tax expert, helping you to maximize your deductions and avoid errors.

The TurboTax app also offers many other useful features, such as a personalized dashboard, personalized analysis of your tax return, and access to previous tax returns. You can also upload your W-2 directly from your employer, and the app will automatically fill in the necessary information.

Overall, TurboTax is a reliable and convenient tax preparation app that has helped millions of taxpayers file their taxes easily and efficiently. Whether you're a first-time filer or a seasoned taxpayer, TurboTax is an excellent choice for anyone who wants to simplify their tax preparation process.

Frequently Asked Questions about turbotax tax preparation app

With the TurboTax mobile app, filing your return using your iPhone, Android phone, iPad, or Android tablet is fast, easy, and secure. You can use the app to file or switch back and forth between TurboTax Online and the app. Everything is synced.

Tax preparation software is a computer program designed to help you prepare and file your taxes. The software typically asks you a series of questions and then automatically chooses the right forms for you, fills them out, and then e-files for you.

- Open TurboTax.

- Sign In. Join the Community Sign in to Support or Sign in to TurboTax and start working on your taxes.

There's a free version of the software available, but it only works for the simplest tax returns, and not all taxpayers qualify. The most popular version is TurboTax Deluxe, for $69 plus $59 per state.

Summary: Best Tax Software Ratings Of 2023

- TaxSlayer Premium – Best Tax Software for Customer Support.

- Cash App Taxes – Best Free Tax Software.

- Jackson Hewitt Online – Best Tax Software for Value.

- TurboTax Deluxe – Best Tax Software for Ease of Use.

- TaxSlayer Self-Employed – Best Tax Software for the Self-Employed.

Yes. You can use TurboTax Online on any PC or Mac with a current web browser. You can also use the TurboTax mobile app for iOS and Android devices to do your taxes on your smartphone or tablet.

Some free plans also include the earned income tax credit (TurboTax, H&R Block, Cash App Taxes, and TaxAct), child tax credits (TurboTax, H&R Block, Cash App and TaxAct) and student loan interest tax deductions (H&R Block, Cash App, TaxAct and TaxSlayer).

State Filing Fee

| Company | Forbes Advisor Rating | Best For |

|---|

| TaxSlayer Premium | 5.0 | Best Tax Software for Customer Support |

| Cash App Taxes | 5.0 | Best Free Tax Software |

| Jackson Hewitt Online | 5.0 | Best Tax Software for Value |

| TurboTax Deluxe | 4.8 | Best Tax Software for Ease of Use |

To find Tools: Sign in to TurboTax and open or continue your return. Select Tax Tools in the left menu.

If you purchased TurboTax Online

You've purchased the online edition of TurboTax and there's nothing to download or install. You'll find your activation code and instructions on the card that came inside the box. If you didn't receive a card, contact TurboTax Support.

If you have a simple tax return, you can file for free yourself with TurboTax Free Edition, or you can file with TurboTax Live Assisted Basic or TurboTax Live Full Service Basic at the listed price.

Simple tax returns: If you have a simple tax return, you can file with TurboTax Free Edition, TurboTax Live Basic, or TurboTax Live Full Service Basic. A simple tax return is one that's filed using IRS Form 1040 only, without having to attach any forms or schedules.

Though TurboTax and similar software are set up to analyze your life changes, tax professionals do so with a personal touch. A professional understands the nuances and ever-changing tax codes that impact people with complex tax situations.

TurboTax is a good fit if you're looking for access to live expert assistance and an easy-to-follow interface and don't mind paying to make your experience better. Below, CNBC Select breaks down TurboTax's tax software and services to help you decide if it's the right service to help you do your taxes this year.

Security is built into everything

Securely access your account by entering your password and a unique, single-use code we'll send your trusted device or email address, or answer a series of questions. Your one-of-a-kind fingerprint password gives you access to your account on your smartphone via the TurboTax app.

TurboTax is only licensed for personal use, and it is not compliant with IRS regulations for paid preparers. Intuit offers ProSeries, ProConnect, and Lacerte Tax software, which are IRS-compliant for tax professionals who are filing multiple returns.