What is Dave App Debit Card?

Dave App is a personal finance management platform that offers various tools to help users budget, save, and manage their money. One of the key features of the app is the Dave debit card, which allows users to access their funds quickly and easily.

The Dave debit card is linked to the user's Dave account and can be used for transactions anywhere that accepts Visa. The card offers a range of benefits to users, including no overdraft fees, no minimum balance requirement, and no ATM fees at over 32,000 ATMs across the United States.

In addition to these benefits, the Dave debit card also offers cashback rewards on purchases made at select merchants. Users can earn up to 10% cashback on purchases made at restaurants, retailers, and other businesses.

One of the standout features of the Dave debit card is the instant advance feature, which allows users to access a small cash advance up to $100 to cover unexpected expenses. This can be a lifesaver for those who find themselves in a tight spot and need a little extra cash.

Overall, the Dave debit card is a powerful tool for those looking to take control of their finances and manage their money more effectively. Whether you're trying to save for a big purchase or just looking to stay on top of your finances, the Dave app and debit card offer a range of features to help you achieve your goals.

Frequently Asked Questions about dave app debit card

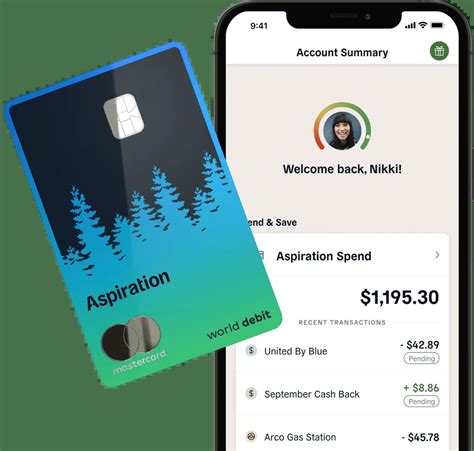

Using Your Dave Debit Mastercard. You must request a Dave Debit Card for your Dave Spending Account; one will not be sent out automatically upon account opening. The Dave Debit Card is a debit card that allows you to access funds in your Dave Spending Account up to your Available Balance.

If you request a physical Dave debit card after opening your account, or if you replace your Dave debit card, it can take up to 10 business days (Monday - Friday) to receive. If you have not received your Dave debit card after 10 business days, you can request a replacement card in the app.

Dave is a mobile fintech platform, not a bank. The Dave Spending Account is FDIC-insured through Evolve Bank & Trust.

Outside of the $1 monthly fee, it doesn't charge anything else for its services. You cannot overdraft the account, so you won't pay overdraft fees and the cash advances it offers are free of charge. Even using another bank's ATMs won't incur fees from Dave, though you may have to pay fees to the ATM's owner.

You can also earn up to 15% cash back on select offers when you use the Dave Debit Mastercard® 3, Round Up your purchases for savings, and earn interest.

5 Best Debit Cards in India in October 2023

| ATM/Debit Cards | Daily ATM Limit | Daily Shopping Limit |

|---|

| SBI Platinum Debit Card | Rs. 1 Lakh | Rs. 2 Lakh |

| HDFC Millennia Debit Card | Rs. 50,000 | Rs. 3.5 Lakh |

| ICICI Coral Debit Card | Rs. 1 Lakh | Rs. 5 Lakh |

| Axis Bank Burgundy Debit Card | Rs. 3 Lakh | Rs. 6 Lakh |

You can easily find over 37,000 ATM locations to use with no withdrawal or processing fees all from within the app! You will see the full details and directions to the ATM. Please note, there are no withdrawal or processing fees when using an ATM within the MoneyPass® network.

Dave (also known as Dave.com) is a digital banking service. The service' main focus is on cash advances.

Here are some pros of debit cards:

- They're highly convenient. They're faster than writing a check and are widely accepted by retailers.

- They typically don't have any annual fees.

- They can help with budgeting by discouraging excess spending.

- They don't charge interest.

When you sign up for Dave Banking, you'll receive a Visa debit card and get a cash management account. The account has no overdraft fees whatsoever, plus no required minimum deposit to open the account. Plus, the entire point of the Dave app is to protect you from overdraft fees.

Evolve Bank & Trust

Every account is FDIC-insured up to $250K through our partner bank, Evolve Bank & Trust, Member FDIC.

5 Best Debit Cards in India in October 2023

| ATM/Debit Cards | Daily ATM Limit | Daily Shopping Limit |

|---|

| SBI Platinum Debit Card | Rs. 1 Lakh | Rs. 2 Lakh |

| HDFC Millennia Debit Card | Rs. 50,000 | Rs. 3.5 Lakh |

| ICICI Coral Debit Card | Rs. 1 Lakh | Rs. 5 Lakh |

| Axis Bank Burgundy Debit Card | Rs. 3 Lakh | Rs. 6 Lakh |

Visa Debit Card

Visa Debit Card: One of the most popular debit cards in India, Visa offers the Verified by Visa platform for enhanced security during online transactions.

Dave is part of the MoneyPass ATM network, which gives account holders access to over 32,000 ATMs nationwide. You can use non-network ATMs for free, but you may be subject to service-provider charges.

You can also earn up to 15% cash back on select offers when you use the Dave Debit Mastercard® 3, Round Up your purchases for savings, and earn interest.

Jason Wilk

Jason Wilk is an American entrepreneur and the founder and CEO of Dave, a publicly traded financial services company on NASDAQ.