What is J.P. Morgan Asset Management Income ETF?

J.P. Morgan Asset Management offers a variety of ETF products, including fixed income ETFs. One of their specific ETFs in this category is the JPMorgan Income ETF (JPIE), which was launched in November 2021. This is an actively managed ETF that seeks to provide investors with income by investing in a variety of fixed income securities, including bonds, institutional loans, and other income-producing securities.

The JPMorgan Income ETF is designed to offer a diversified portfolio of high-quality, short-duration fixed income securities. The fund's investment strategy is to seek to generate a level of income that is higher than the average yield of the Bloomberg Barclays U.S. Aggregate Bond Index, while striving to maintain low volatility in the portfolio.

With JPMorgan Asset Management's experienced portfolio managers and their research capabilities, the JPMorgan Income ETF aims to provide investors with access to the competitive advantages of an actively managed strategy. Additionally, the fund seeks to deliver this strategy in a cost-effective manner using the structure of an ETF.

Investors seeking yield and income may find the JPMorgan Income ETF to be an attractive investment option. As with any investment, it's important to consider your individual financial situation, investment goals, and risk tolerance before investing.

Frequently Asked Questions about j.p. morgan asset management income etf

About JPMorgan Income ETF

(JPMIM or the adviser) believes have high potential to produce income and have low correlations to each other in order to manage risk. It has broad flexibility to invest in a wide variety of debt securities and instruments of any maturity.

JEPI is a conservative equity solution comprised of two fundamental building blocks: a defensive equity portfolio of U.S. large cap stocks and a disciplined options overlay.

J.P. Morgan Global Liquidity draws on rigorous proprietary credit and risk management, paired with the resources and expertise of our global investment platform, to deliver effective short-term fixed income strategies designed to help clients navigate shifting markets and evolving regulatory regimes.

JEPI is an actively-managed fund that invests in large-cap US stocks and equity-linked notes (ELNs). It seeks to provide similar returns as the S&P 500 Index with lower volatility and monthly income.

Summary. If you love income and hate volatility, JEPI is hard to ignore. But if you want to maximize long-term income and total returns, JEPI should be totally avoided. We review JEPI's strategy and offer our opinion on who should (and who should NOT) consider investing.

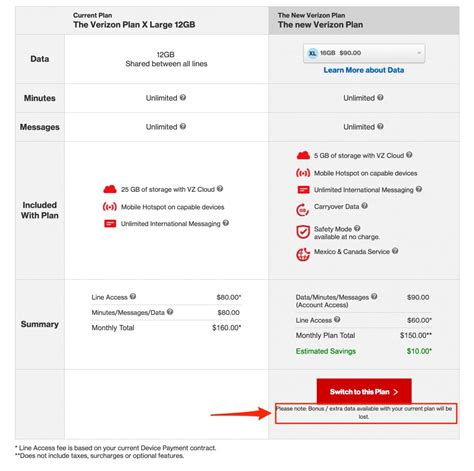

JEPI vs JEPQ: Differences

JEPI actively selects stocks from the S&P 500, while JEPQ does so from the Nasdaq 100. The former is a broad-market index of 500 large and mid-cap equities, while the latter is a narrower index composed of 100 of the largest non-financial stocks traded on the Nasdaq exchange.

The JPMorgan Equity Premium Income ETF (JEPI) is an actively managed fund that generates income by selling options on U.S. large cap stocks.

J.P. Morgan Alternative Asset Management (JPMAAM) is a dedicated, global provider of niche hedge fund strategies. Since its inception in 1995, JPMAAM has focused on developing customized solutions across the liquidity spectrum to help investors achieve their strategic investment objectives.

I am drawn to JPMorgan Chase because of its reputation as one of the world's leading financial institutions and its commitment to providing innovative solutions to its clients. Additionally, I am impressed with the company's strong leadership and track record of success.

A conservative equity ETF seeking income as the outcome, balanced with an attractive total return. JEPI is a highly liquid ETF offering daily transparency and tax efficiency at a low cost. The strategy combines equities with options to strike a balance among yield, capital growth and risk.

As a covered call ETF, JEPI can use a covered call writing strategy on a portion of its portfolio to generate additional income for investors while still providing exposure to the underlying stocks in the portfolio.

JEPI produces high income

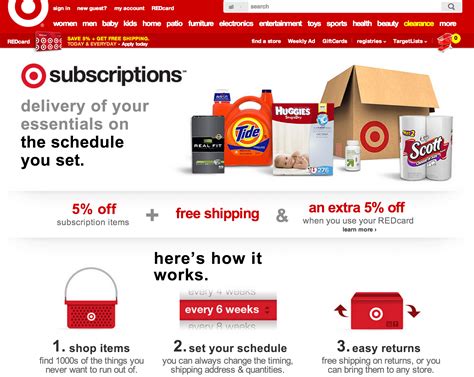

Instead of focusing on total returns (which are capped with a covered call strategy), they love looking at high distribution yields. Bonus if the distribution is paid on a monthly basis.

Is JEPI a Buy, According to Analysts? Turning to Wall Street, JEPI has a Moderate Buy consensus rating, as 68.32% of analyst ratings are Buys, 29.01% are Holds, and 2.67% are Sells. At $60.52, the average JEPI stock price target implies ~11% upside potential.

Overall, JEPQ can be an excellent investment for the right person. Those approaching retirement, seeking sustainable income, or having a strong belief in the tech sector's long-term growth potential while wanting to limit risk might find JEPQ suitable for their portfolio.

JEPQ also takes more risk than other income based funds that use similar strategies focused on selling options to generate income such as RYLD and QYLD, since those funds are more diversified.

JEPI offers a hedge-fund like strategy in an ETF wrapper, and investors and advisers should consider whether JEPI is suitable for their objectives. It is quite reasonably priced for what it offers.