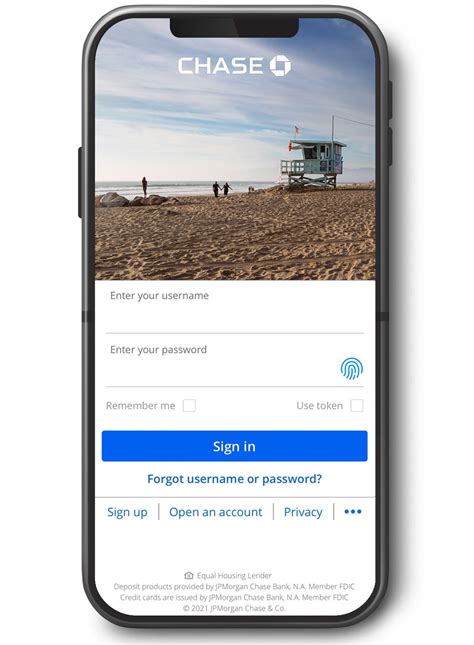

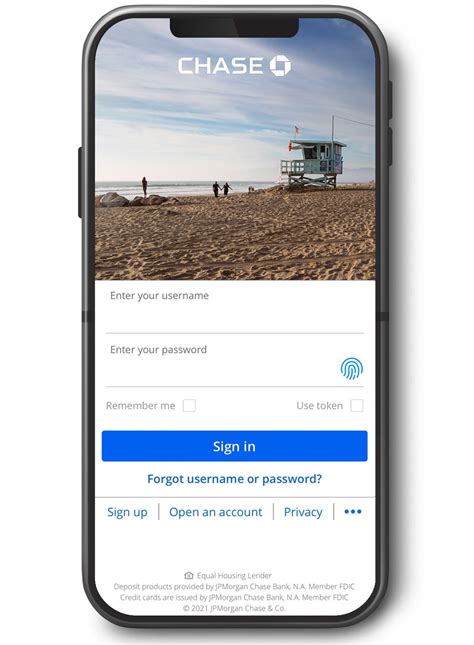

What is JPMorgan Chase (Banking) Freedom Mobile App?

JPMorgan Chase is one of the largest banking institutions in the world, with a strong focus on delivering top-notch financial services to its customers. One of the ways it has achieved this goal is through the development of its innovative Freedom Mobile App.

The Freedom Mobile App is an essential tool that helps Chase banking customers manage their accounts and transactions on the go. It is available to both iOS and Android users and can be downloaded for free from their respective mobile app stores.

The app offers many features that allow customers to manage their finances effectively. Users can view their account balances, transaction history, monitor their bills, and transfer funds between accounts. The app also allows customers to deposit checks on the go, which significantly reduces the need to visit a physical bank.

One of the unique features of Chase Freedom Mobile App is the ability to control debit card usage. Customers can turn on or off their debit card, set spending limits, or restrict transactions to specific areas. This feature adds an additional layer of security and control for customers.

In addition to these features, the app provides a range of personalized alerts, allowing customers to monitor their account activity in real-time. For example, customers can set up alerts for low balance notifications, deposit alerts, or unauthorized transactions. This feature gives customers complete control over their accounts and helps them avoid any unpleasant surprises.

Overall, the JPMorgan Chase Freedom Mobile App provides customers with an efficient and convenient way to manage their banking needs, wherever they are. By embracing technology and choosing to invest in the latest mobile banking solutions, JPMorgan Chase has further cemented its position as a leader in the banking industry.

Frequently Asked Questions about jpmorgan chase (banking) freedom mobile app

Bank securely with the Chase Mobile® app. Manage your investments with J.P. Morgan and your Chase accounts: monitor your credit score, budget and track monthly spending, send and receive money with Zelle® and deposit checks. Some features are available for eligible customers and accounts only.

The Chase Freedom Unlimited® credit card awards 1.5% cash back for every $1 spent on all purchases. You also earn 5% cash back on travel purchases made through Chase Ultimate Rewards® and 3% cash back on dining purchases at restaurants, including takeout and eligible delivery services, and drugstores.

It's an app for all your Chase accounts: credit, savings, and checking. You can do everything from viewing your balances to paying bills. The app is available for both Android and Apple devices, and it's highly rated: 4.4/5 on Google Play and 4.8/5 on App Store.

With the Chase Mobile app, you can:

Pay bills or schedule when you want to pay bills 4. Transfer money across the country. Manage alerts 5 and paperless statements. Add Chase Offers to your debit card and earn cash back on eligible purchases.

Chase maintains a strong digital footprint with its popular mobile app and online banking platform. Yet, it still offers an extensive local presence for individuals who prefer in-person banking services. If you can avoid the monthly fees, Chase is a solid option for your personal banking needs.

Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. To learn more, visit the Banking Education Center. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback.

To recap, good credit (a FICO® Score of 670 or higher) is recommended to get the Chase Freedom Unlimited® or the Chase Freedom Flex℠, as those are some of Chase's best credit cards. You'll also need to pass Chase's 5/24 rule, and it helps if you've been using credit for at least a year, too.

Also, the Chase Freedom® is a Visa, while the Chase Freedom Flex℠ is a Mastercard. Does the Chase Freedom® earn cash back or points? Freedom-branded cards technically earn Chase Ultimate Rewards® points, which you can redeem for 1 cent apiece as cash back.

Freedom works by blocking content locally on your devices.

Pros: The Chase app is convenient and allows users to keep track of charges, balances, make payments, credit score and more all from their tablet or smart phone.

Basic Banking Functions

The whole point of having a mobile app is to be able to access your money so it can do what you need it to do. That includes the ability to deposit checks, pay bills, make loan payments and transfer money between accounts from anywhere you are.

What is a Mobile Banking App? Using a mobile banking application, you can easily access your banking account, check balance, transfer funds, pay bills, deposit checks, etc. Overall, you can access almost all products and services provided by your banking institution.

Chase Bank may be best for consumers who prefer in-person banking and ATM access, since it offers more than 4,900 branches and 15,000 ATMs nationwide.

9 best mobile banking apps

- Chime. Visit Chime.

- CIT Bank. Visit CIT Bank.

- Ally Bank. Ally Bank review.

- Capital One. Capital One 360 review.

- Discover Bank. Visit Discover Bank.

- Novo. Visit Novo.

- Bluevine. Visit BlueVine.

- Juno. Juno review.

Here's why you should use mobile banking in 2023

- Accessing the bank 24/7.

- Making it easier to save.

- Paying IOUs.

- Strengthening security.

- Offering clarity about where your financial data is going.

- Tracking expenses.

- Giving you tailored options.

The biggest difference between the two is their functionality. Internet Banking allows you to conduct online transactions through your PC or laptop and an internet connection. On the other hand, mobile banking can be done with or without internet. Many banks nowadays have their mobile apps for mobile banking.